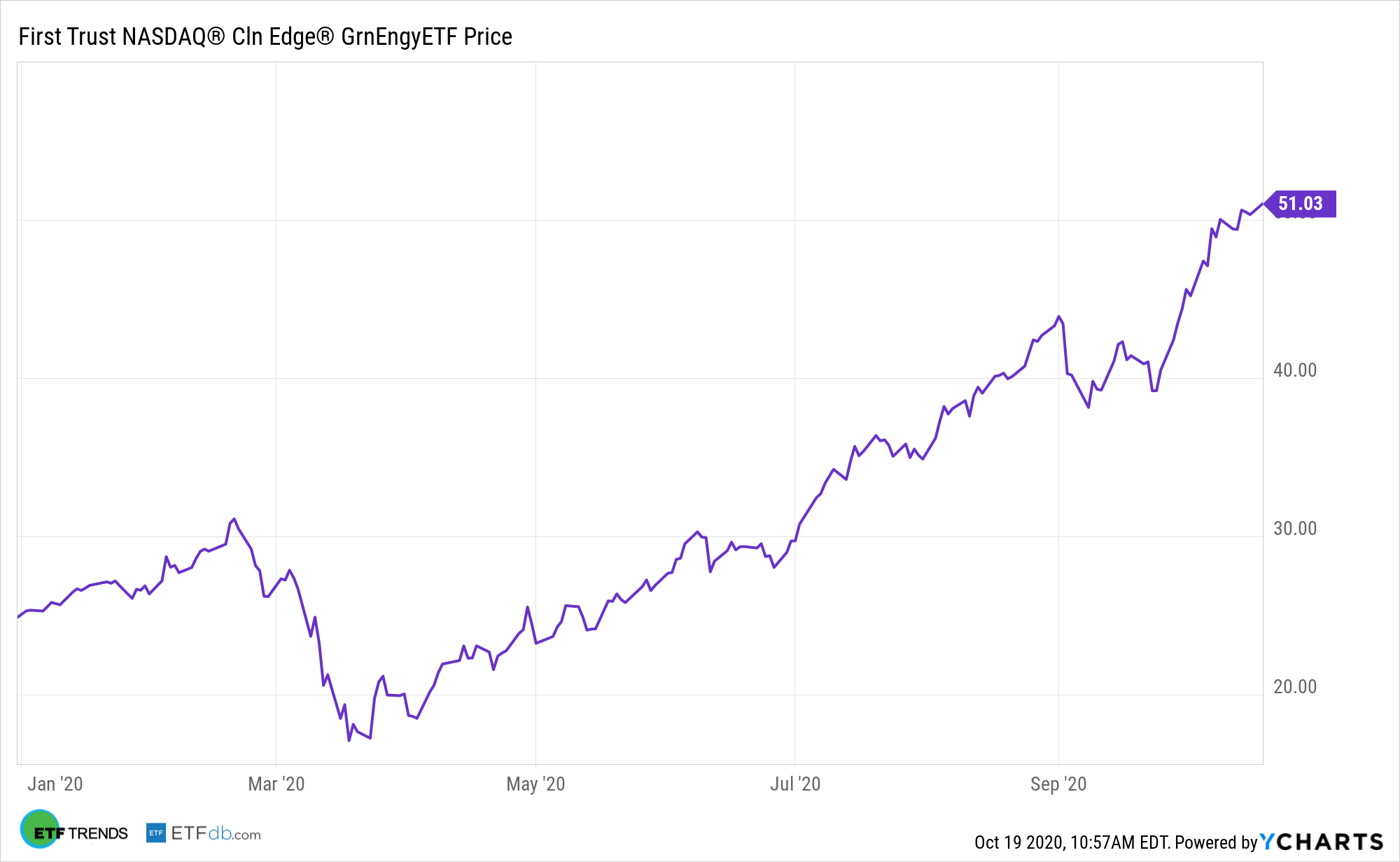

Renewable energy exchange traded funds are among the most exciting, impressive industry-level ideas this year, a theme some market observers expect is just getting started. That means a long runway for upside could be available with the First Trust NASDAQ Clean Edge Green Energy Index Fund (NasdaqGM: QCLN).

QCLN seeks investment results that correspond generally to the equity index called the NASDAQ® Clean Edge® Green Energy Index. The index is designed to track the performance of small, mid, and large capitalization clean energy companies that are publicly traded in the United States.

“Green and renewable energy ETFs have performed exceptionally well so far this year, with the majority of outperformance coming after May,” according to First Trust research. “At a base case level, we believe that investor sentiment toward this investment theme may be reflecting the shifting outlook (a Biden win) for the upcoming US elections, which could have a significant impact on the industry.”

QCLN’s Post-Election Merit

There’s plenty of speculation regarding how the upcoming presidential election will affect the energy sector – both fossil fuels producers and renewables providers. Currently, consensus wisdom dictates that QCLN and rival ETFs, although already soaring, will get big lifts if former Vice President Joe Biden wins the presidency. Fortunately, QCLN has post-election potential.

“Beyond November’s election results, we expect the US—along with other countries—to enact sizeable fiscal stimulus that targets green energy projects,” notes First Trust. “Over the long-term, we believe favorable changes in public opinion and economic fundamentals are likely to benefit the industry, as costs relative to traditional energy sources have declined dramatically. In our view, these developments may help fuel robust performance for the green and renewable energy theme in the years ahead.”

As has been widely noted, a victory by Biden has positive implications for assets such as QCLN.

The Democratic nominee “supports reducing US emissions through substantial investments in green initiatives, outlined in a $2 trillion climate plan unveiled earlier this summer,” said First Trust. “While performance of green and renewable energy ETFs may be driven by election expectations in the near-term, we believe two important factors may drive long-term growth for this theme: public-sector investments—accelerated by COVID-19 stimulus—and improving affordability.”

QCLN more than doubled year-to-date and is higher by almost 20% over the past month, indicating it has some positive leverage to Biden’s poll numbers.

For more on innovative portfolio ideas, visit our Nasdaq Portfolio Solutions Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.