Tech investors, and consumers for that matter, are likely tiring of hearing about the global semiconductor shortage, but there’s a silver lining.

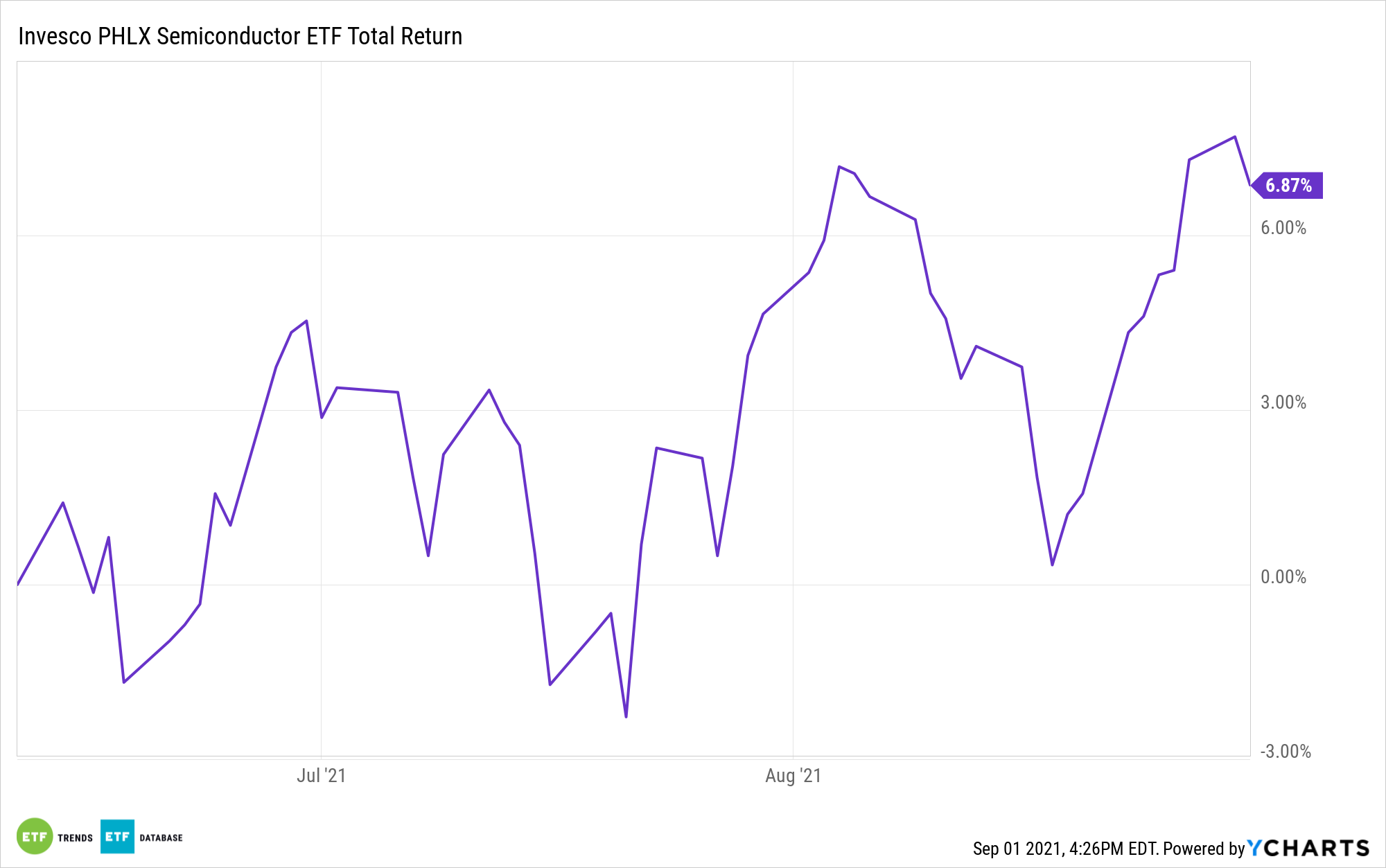

Companies in exchange traded funds, such as the Invesco PHLX Semiconductor ETF (SOXQ), are bolstering free cash flow during the supply shortfall. SOXQ, which debuted in June, tracks the widely followed PHLX SOX Semiconductor Sector Index (SOX). The ETF and its benchmark are home to some companies that are thriving even as chip supplies are crimped.

“Better demand visibility, lower cyclicality, as deeper partnerships with customers improves alignment of supply and demand, increased bargaining power, and customer prepayments will result in reduced working capital requirements that will benefit industry FCF over the intermediate term,” says Fitch Ratings. “Increased FCF leading to lower leverage could result in positive rating actions for some companies.”

The research firm sees ample runway for foundries and component designers, such as Broadcomm (NASDAQ:AVGO) and Taiwan Semiconductor (NYSE:TSM), to expand free cash flow. Those stocks combine for about 12.6% of SOXQ’s weight, according to issuer data.

Also part of that group are United Microelectronics (UMC), Microchip Technology (NASDAQ:MCHP), and NXP Semiconductor (NASDAQ:NXPI). NXP and Microchip Technology combine for about 7.6% of the SOXQ roster.

Rapidly evolving buying behavior, prompted in large part by the supply shortage, is helping chip producers gain revenue visibility and boost cash flow.

“However, the scramble to secure supply caused purchasers of semiconductors to rethink supply chain strategies to avoid future interruptions. Purchasing behavior is rapidly changing as chip consumers take measures to ensure sustained production levels,” adds Fitch.

The supply shortfall is working in favor of some SOXQ components, which are gaining bargaining power while implementing non-cancellable order provisions.

“We expect the reliability of chip suppliers’ backlog to structurally improve, account receivables burdens to ease and risk of future oversupply to decline with deeper customer relationships, and other behavior shifts by chip consumers in order to navigate the protracted shortage,” concludes Fitch.

Another SOXQ benefit is that its 0.19% annual fee is being waived through at least Dec. 17, 2021. Even if that fee is deployed, the Invesco ETF will be the cheapest in the category. That could be one reason that the fund is off to a solid start with $63.2 million in assets under management since coming to market.

For more news, information, and strategy, visit the Nasdaq Portfolio Solutions Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.