Expectations of slowing global growth, delta fears, and U.S. monetary policy tightening have led to hesitant markets and increased volatility. Investors remain less-than-confident about economic recovery and growth, as outlined by the Financial Times.

Concerns about a Fed pullback possibly beginning in September, while delta continues to force closures for the foreseeable future, has had many investors shifting to bonds. Central bankers have signaled their willingness to begin exiting the $120 billion monthly Fed support that has been in place since last year, as the labor market looks to be improving, along with inflation.

“There was this suggestion of tapering sooner and faster among some FOMC [Federal Open Market Committee] members,” said Derek Halpenny, head of research for global markets at MUFG, a financial services group. “I think that’s shaken up fragile sentiment.” An abrupt pullback could be a potentially crushing blow to the current market ecosystem that is contending with so many unknowns.

Markets are tremulous, coming off of an explosive earnings reporting season that are dampened by all of these compounding fears. It has created a lot of uncertainty and fears of decline as the global economy looks to be downshifting from the growth it has experienced since the beginning of the year.

“Investors worry that the best of the recovery and liquidity trade is behind us, and are turning more cautious on their allocation,” Emmanuel Cau, head of European equity strategy at Barclays said.

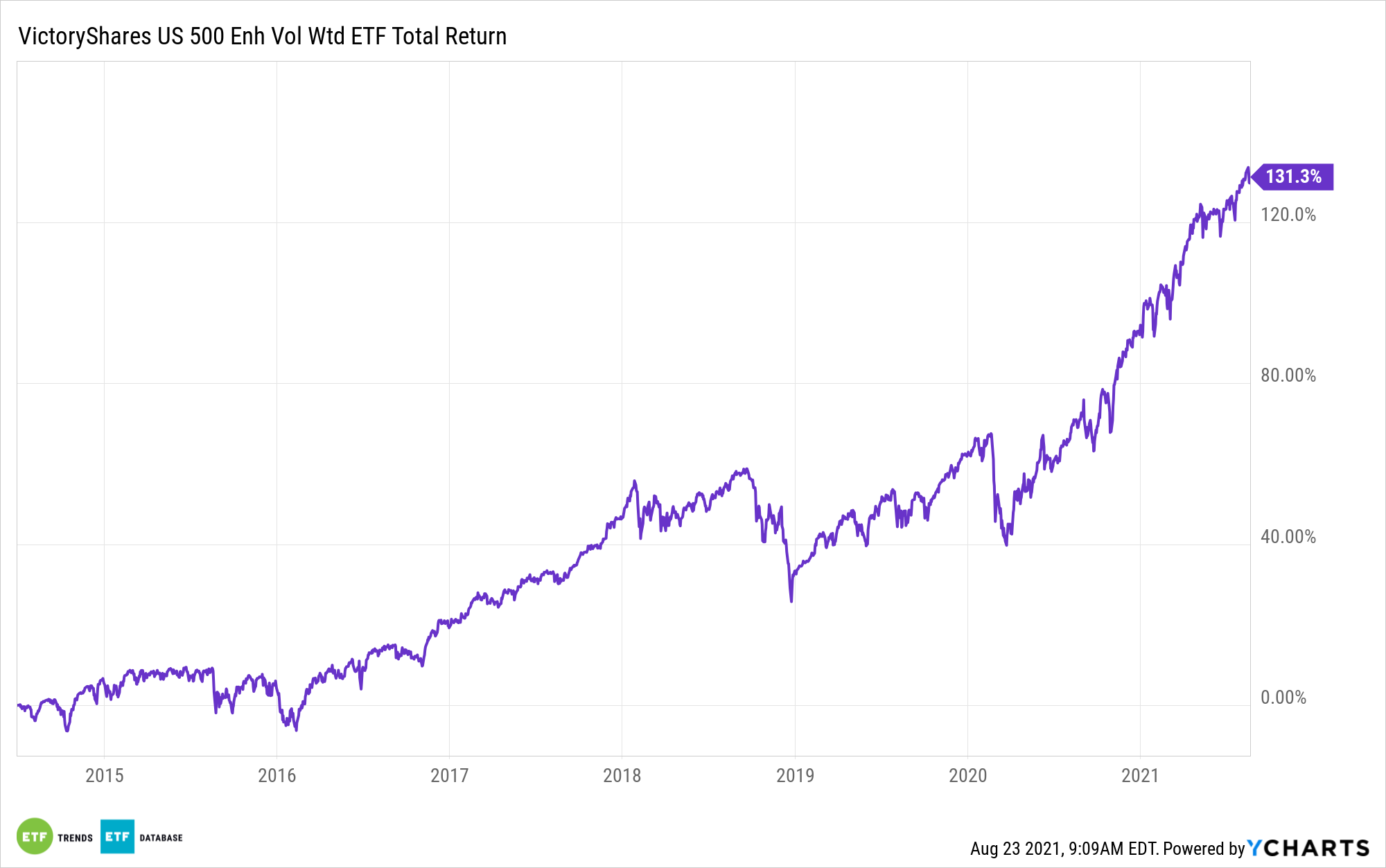

‘CFO’ Hedges Against Volatility and Sharp Declines

For cautious investors looking for a fund that manages risk by reducing exposure during significant drawdowns, the VictoryShares US 500 Enhanced Volatility Wtd ETF (CFO) is one solid option. The fund allows investors to gain balanced exposure to large cap U.S. equities with a unique volatility-weighted approach, while reducing its exposure to equity markets during significant decline.

CFO tracks the Nasdaq Victory US Large Cap 500 Long/Cash Volatility Weighted Index. The benchmark screens all publicly traded U.S. stocks and only includes those with positive earnings in the most recent 4 quarters.

From there, the benchmark takes the top 500 stocks by market cap and weights them based on the volatility of their price changes over the previous 180 days. Those with lowest volatility get the highest weighting, while those with the highest volatility have the lowest weighting.

During times of decline of 10% or more in daily closing value of the Nasdaq Victory US Large Cap 500 Volatility Weighted Index (the same as the benchmark but without cash allocations) compared to the most recent monthly closing value, the fund withdraws 75% from stocks and reallocates to cash. The cash is invested in 30-day U.S. Treasury bills or money market mutual funds that invest in short-term U.S. Treasury obligations.

The fund will reinvest in stocks when the decline becomes less than 10%; if the index declines 20%, then the fund allocates 25% back into stocks; if the index declines 30%, it allocates an additional 25% back into stocks; if the index declines 40%, the remaining 25% will be reallocated back to stocks.

The index limits exposure to any particular sector to 25%. CFO’s sector breakdown as of end of July includes a 17.68% allocation to industrials, a 16.17% allocation to information technology, 15.74% to financials, 14.59% to healthcare, 10.11% in consumer discretionary, and various smaller allocations.

The fund has an expense ratio of 0.38%.

For more news, information, and strategy, visit the Nasdaq Portfolio Solutions Channel.