With inflation at the forefront of so many economic and financial market conversations these days, an easy way for investors to get over fears of a rising Consumer Price Index (CPI) reading is with a strategy many are already deploying: dividend growth.

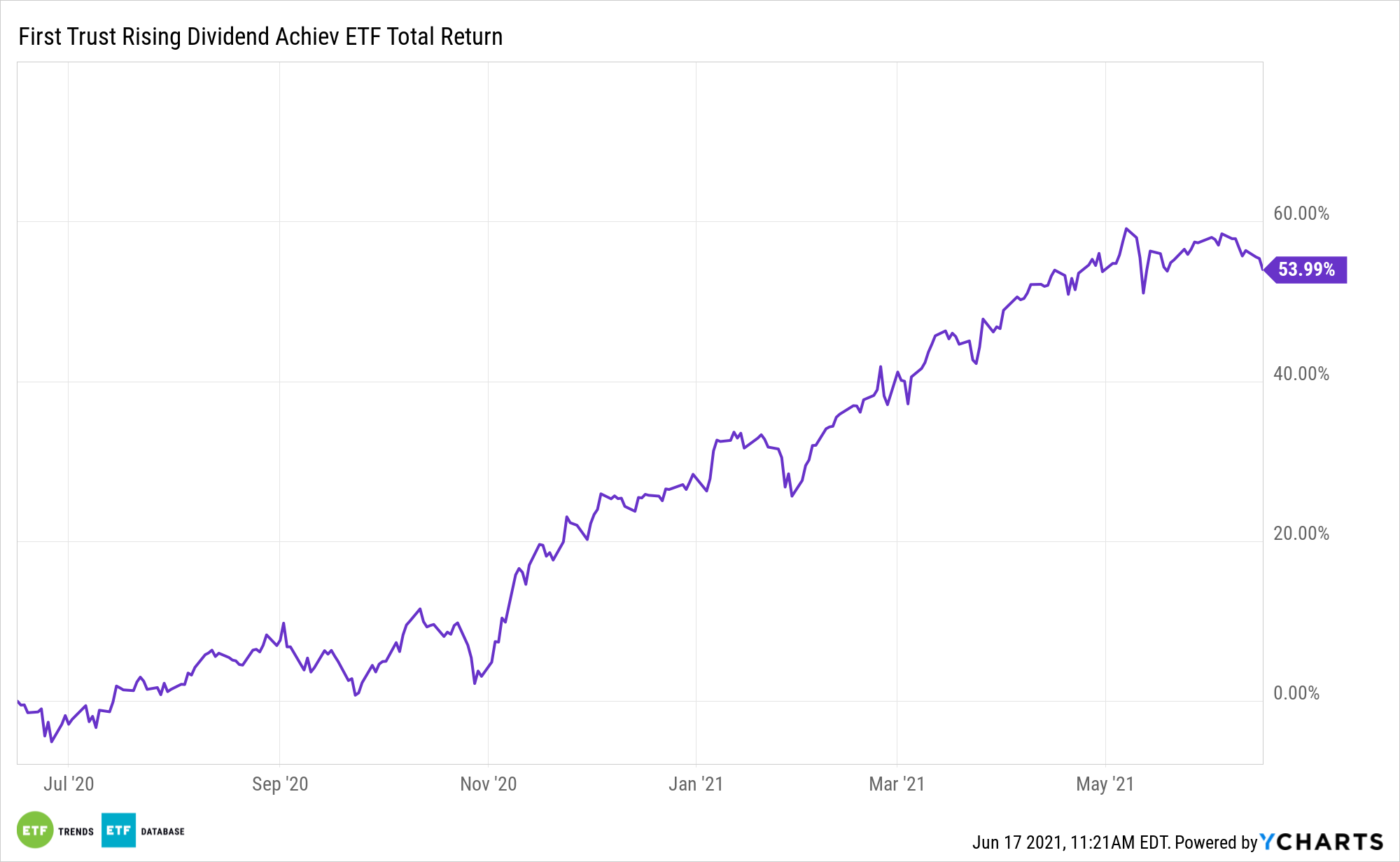

For those seeking access to companies with enviable track records of hiking payouts while eliminating the stock-picking burden, the First Trust Rising Dividend Achievers ETF (NasdaqGS: RDVY) is an exchange traded fund to consider.

The $4.59 billion RDVY follows the NASDAQ US Rising Dividend Achievers Index. That index doesn’t just let any dividend-paying company in. Rather, it’s home to companies with impressive dividend track records that are sporting traits suggesting dividend growth will materialize.

“Dividend strategies have gained a foothold with market participants seeking potential outperformance and attractive yields, especially in the low-rate environment since the 2008 financial crisis and the even lower-rate environment we’ve seen since early 2020 as the world deals with the economic fallout from COVID-19,” according to S&P Dow Jones Indices.

RDVY: A Smarter Dividend Growth Strategy

While some dividend growth exchange traded emphasize stocks’ payout growth track records, RDVY takes a different tact by focusing on metrics that can assess a companies ability to continue boosting dividends.

For example, the NASDAQ US Rising Dividend Achievers Index requires that member firms’ most recent fiscal years exceed those of the three prior fiscal years. Additionally, companies in the benchmark must have a cash-to-debt ratio north of 50%, while trailing 12-month payout ratios cannot exceed 65%. That methodology is important at a time when many investors are embracing high-dividend stocks, not all of which are cut out to sustain those big dividends.

“With the volatile economic situation that emerged in 2020, and market uncertainties putting pressure on corporate earnings, high-yielding companies without strong financial strength and discipline may not be able to sustain future payout and could be prone to dividend cuts and suspensions,” notes S&P.

RDVY eschews traditional high-dividend sectors and features no exposure to energy, real estate, and utilities names. Conversely, the fund allocates nearly 57% of its combined weight to the financial services and technology sectors. The former could soon unleash massive dividend growth, pending Federal Reserve approval, while tech enhances RDVY’s quality appeal because that sector is chock-full of cash-rich companies with the resources to steadily boost payouts.

Speaking of room for growth, RDVY’s trailing 12-month distribution rate is just 1.27%.

For more news, information, and strategy, visit the Nasdaq Portfolio Solutions Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.