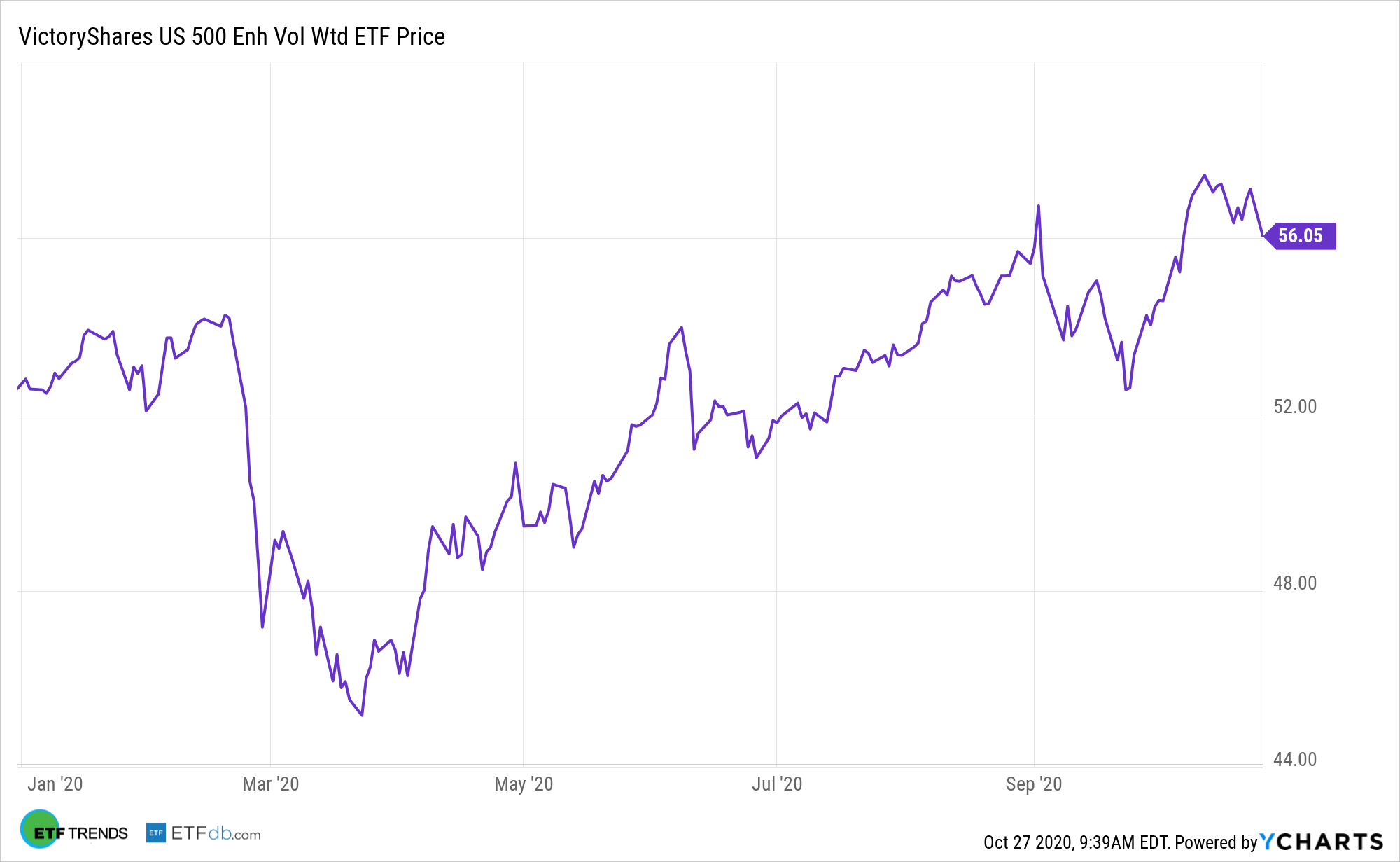

Low volatility is still a favored investment factor, but some of the exchange traded funds addressing it can leave investors thirsting for more. Enter the VictoryShares US 500 Enhanced Volatility Wtd ETF (CFO).

CFO tracks the Nasdaq Victory US Large Cap 500 Long/Cash Volatility Weighted Index. CFO can be seen as a quality meets low volatility play because its components must be earnings positive for at least four straight quarters.

Some of the highest flying stocks have also been among the worst off during the recent market pullback. Instead of relying on traditional market cap-weighting indices that may tilt toward these at risk high flyers, investors can look to exchange traded fund strategies with an alternative approach.

Some of the highest flying stocks have also been among the worst off during the recent market pullback. Instead of relying on traditional market cap-weighting indices that may tilt toward these at risk high flyers, investors can look to exchange traded fund strategies with an alternative approach.

As an alternative to traditional cap-weighted index funds, investors may considered a risk-weighted approach to better diversify their market exposure. Victory Capital offers its own suite of smart beta ETFs that focus on volatility-based weighting methodology to potentially help investors generate improved risk-adjusted returns, including CFO.

One way to combat volatility is to simply choose stocks that aren’t prone to heavy fluctuations.

“The simplest approach is to basically target stocks that have exhibited low volatility in the recent past, based on the assumption that stocks with low past volatility will likely continue to exhibit low risk going forward,” said Alex Bryan, Morningstar’s Director of Passive Strategies in North America said in an interview. “So if you think about this, this tends to tilt toward stocks like utilities, consumer defensive names, in some cases, healthcare names. These types of stocks tend to be a little bit less cyclical than most. So, in times when the economy is not doing so well, they tend to have better earnings than the more cyclical stocks.”

More on CFO

CFO components are weighted based on their standard deviation over the past 180 trading days. Stocks with lower volatility are given higher weightings and stocks with greater volatility are given lower weightings. Ultimately, all securities that pass the earnings criteria are present, just at different weights.

An interesting trait about CFO is that, unlike some rival low volatility strategies, is that the fund isn’t excessively allocated to any one sector. Nor is the fund heavily devoted to traditional low volatility groups such as consumer staples or utilities.

The proof of CFO’s efficacy is in the pudding as the fund is up 6.6% this year while the S&P 500 Low Volatility Index is off 7%.

When the going is good, passive market-cap weighted methodologies can help investors ride the markets higher and diversify across a broad market. This also creates an unforeseen risk since the largest components or largest companies by market capitalization are also those that have performed the best. Consequently, investors who are now overweight these big companies in a market cap-weighted fund are exposed to the downside risks when these high-flying stocks suddenly take a turn.

For more on innovative portfolio ideas, visit our Nasdaq Portfolio Solutions Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.