Share repurchase programs were among the investment victims of the coronavirus pandemic as companies looked for efficient avenues to rapidly conserve cash.

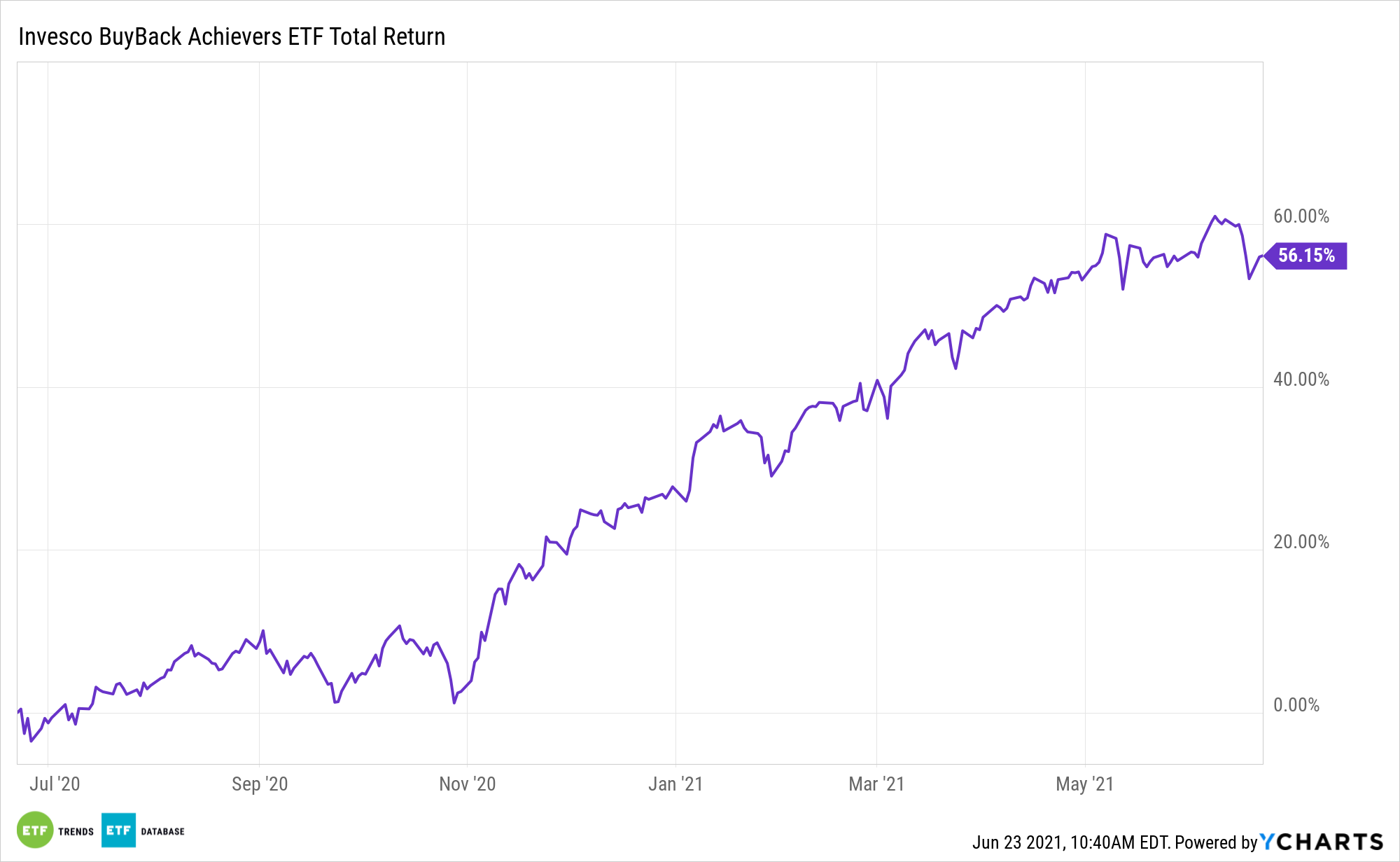

As has been widely noted, neither the COVID-19 bear market nor subsequent recession were as bad or as lengthy as were expected. Fast-forward to 2021 and the outlook for shareholder rewards – dividends and buybacks – is quite rosy. That’s good news for the Invesco BuyBack Achievers ETF (NASDAQ: PKW).

The $2.11 billion PKW is already up almost 20% year-to-date and data confirm buybacks are definitely on the mend.

In the first three months of 2021, buybacks “were $178.1 billion, a 36.5% increase from Q4 2020’s $130.5 billion, and 100.9% above the recent Q2 2020 low of $88.7 billion,” according to preliminary data recently released by S&P Dow Jones Indices.

A Strong Pulse for PKW

PKW, which tracks the NASDAQ US BuyBack Achievers™ Index, is home to 108 companies that have reduced their shares outstanding tallies by at least 5% over the trailing 12 months. The benchmark is rebalanced quarterly in January, April, July, and October, so it could soon get a makeover.

PKW’s 5% shares outstanding reduction mandate is relevant at a time when some companies are reentering the repurchase market in droves.

“Companies almost fully returned to the buyback market in Q1 2021 after their Q2 2020 COVID inspired departure, as 335 issues did significant open-market purchases, up from 244 last quarter and 170 in Q2 2020. Given the strong and expected record level cash-flow from Q1 2021, the full return to pre-COVID levels is expected later in the year,” said Howard Silverblatt, Senior Index Analyst at S&P Dow Jones Indices.

Although PKW is sector-agnostic, the methodology backstopping the NASDAQ US BuyBack Achievers™ Index gives investors a fair representation on sectors affecting big buybacks. For example, the fund allocates about 51% of its combined weight to financial services and technology stocks. In the first quarter, those sectors combined for over 51% of S&P 500 share repurchases, according to S&P data. Healthcare, PKW’s third-largest sector weight, was third in terms of first-quarter buybacks.

That’s indicative of some factor diversity, but the exchange traded fund leans toward value for the moment as about half its components are classified as value names. PKW also taps into another theme: buybacks aren’t limited to big companies. Large cap stocks represent just 36% of the fund’s weight.

For more news, information, and strategy, visit the Nasdaq Portfolio Solutions Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.