With 10-year Treasury yields still on the upswing, some market observers are talking about a resurgent U.S. dollar.

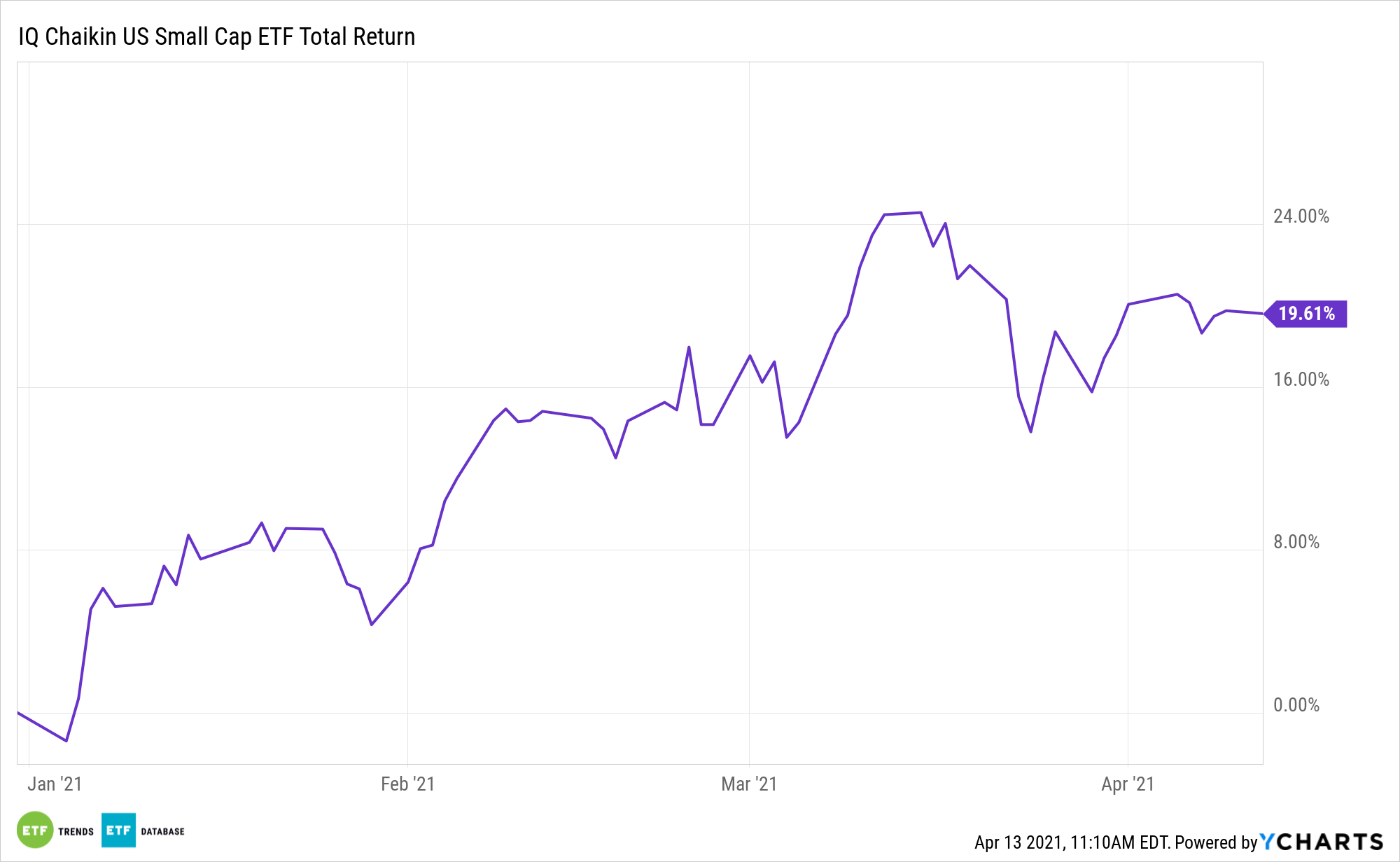

One way for investors to come out on top of that situation is with domestically focused small cap strategies such as the IQ Chaikin U.S. Small Cap ETF (NasdaqGM: CSML).

“Since the beginning of the year, the US dollar has appreciated against the euro and the Japanese yen, reflecting the view that the US economy will outperform those of its trading partners because of its fiscal stimulus measures and faster progress with vaccinations,” according to Moody’s Investors Service. “The dollar has also appreciated against several emerging market currencies since early 2020.”

The Future of the Dollar

Historically, the domestic focus of small caps favorably levers the asset class to a rising dollar. Export-oriented large caps tend to be pinched by a strong greenback.

“Over the next two years, cyclical factors and especially interest rate differentials versus major advanced economies will support capital flows into US dollar assets,” adds Moody’s. “We expect the US economy this year to outperform other developed markets, such as the euro area, because its economy will reopen earlier on account of its speedy vaccine roll-out and because of its massive fiscal response. The European Central Bank (ECB) and the Bank of Japan will likely maintain an accommodative policy stance for much longer than the Federal Reserve, giving the dollar the potential for additional appreciation.”

CSML tries to reflect the performance of the Nasdaq Chaikin Power US Small Cap Index.

The smart beta ETF’s underlying index will identify each security’s ability to outperform market-weighted products and active strategies. The Chaikin Power Gauge is a 20-multi-factor model that screens for value, growth, technical, and sentiment factors. Many of these factors have been utilized by institutional investors and money managers as a way to manage risk or potentially enhance a portfolio’s return.

“We expect global financial conditions to remain easy as major central banks including the Fed and the ECB, keep policy rates on hold and purchase assets. Stronger US growth should spill over to other economies, especially emerging market countries, but it will also inevitably drive a gradual increase in US interest rates,” concludes Moody’s.

For more news, information, and strategy, visit the Nasdaq Portfolio Solutions Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.