The financial services sector is on a path redemption after flailing for much of 2020 on the back of low interest rates and several other headwinds. Investors looking to capitalize on that trend can ratchet up gains with the Invesco DWA Financial Momentum Portfolio (PFI).

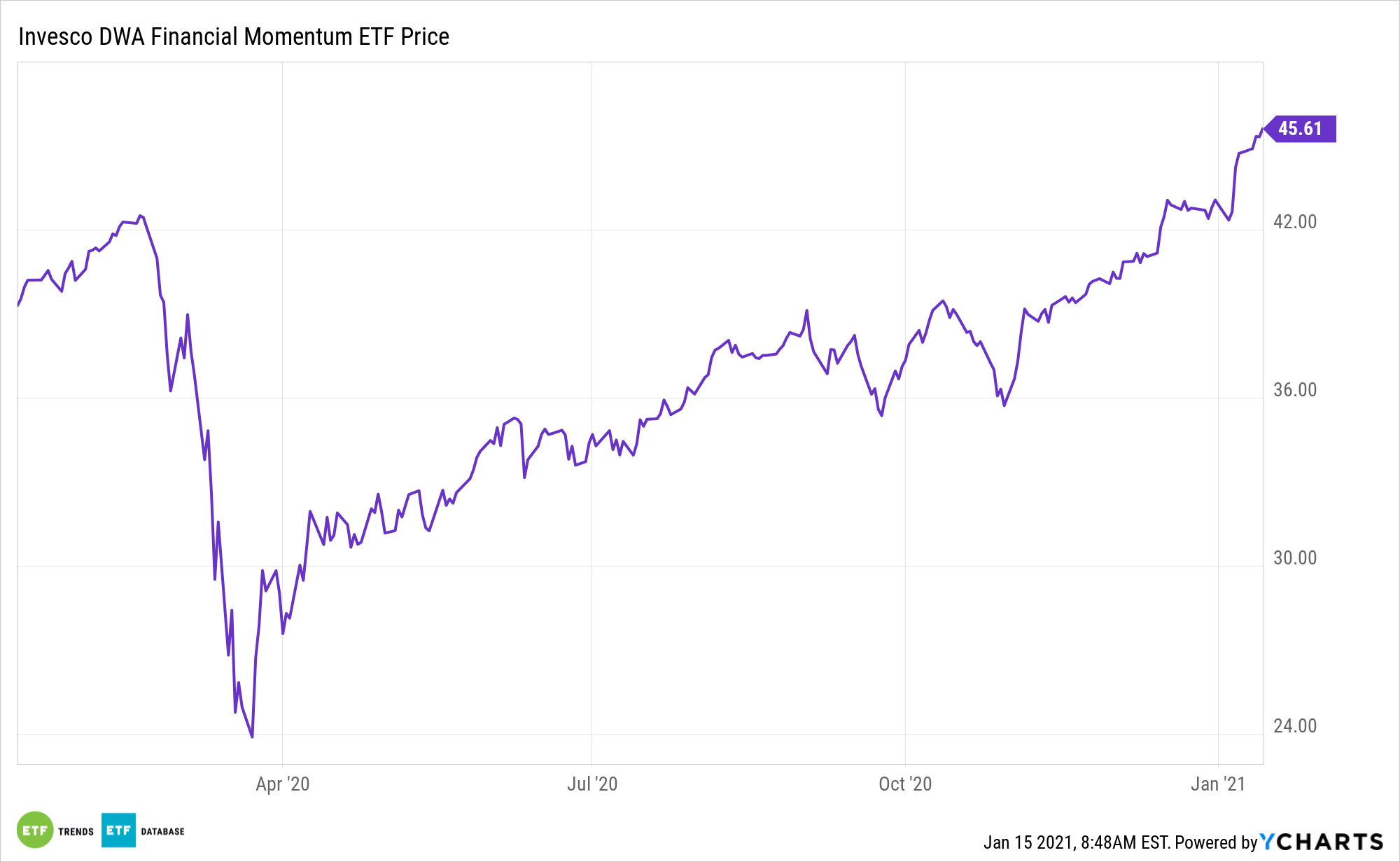

Up 6% to start 2021, PFI tracks the Dorsey Wright Financials Technical Leaders Index, which is rooted in Dorsey Wright’s notorious relative strength methodology.

“The Index is designed to identify companies that are showing relative strength (momentum), and is composed of at least 30 securities from the NASDAQ US Benchmark Index. Relative strength is the measurement of a security’s performance in a given universe over time as compared to the performance of all other securities in that universe,” according to Invesco.

Banking on the Banks: Why PFI Will Thrive

Vaccine rollouts are now fueling bets of an economy recovery in the second half of 2021. Additionally, the recent Georgia runoff election resulted in a Democratic party win. Wall Street believes that the Democrat-controlled Congress will be a good outcome for bank stocks.

A Democratic-controlled government has historically been associated with tougher regulations and higher tax rates. Yet many are focusing on the greater likelihood of Congress passing through a big fiscal spending measure to further bolster a flagging economy. Additionally, many observers believe President-elect Joe Biden will not focus on hiking up corporate taxes right as the country tries to shake off the coronavirus pandemic.

The bond markets are also seeing the yield curve steepen with rising long-term rates. Banks can enjoy a larger gap between short term deposit rates and long term loan rates.

The problem with banks setting aside large chunks of cash to cover bad loans is that the strategy weighs on earnings. Those reserves come directly out of profits, but if the economy improves, PFI holdings may not need to cover as many bad loans as expected, meaning those reserves could eventually be turned into profits.

Other near-term catalysts for PFI include solid credit quality.

For more on innovative portfolio ideas, visit our Nasdaq Portfolio Solutions Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.