In what’s becoming an all-too-regular occurrence this year, another cyber breach – this time on security software provider Kaseya – is putting cybersecurity stocks and their related exchange traded funds in the spotlight.

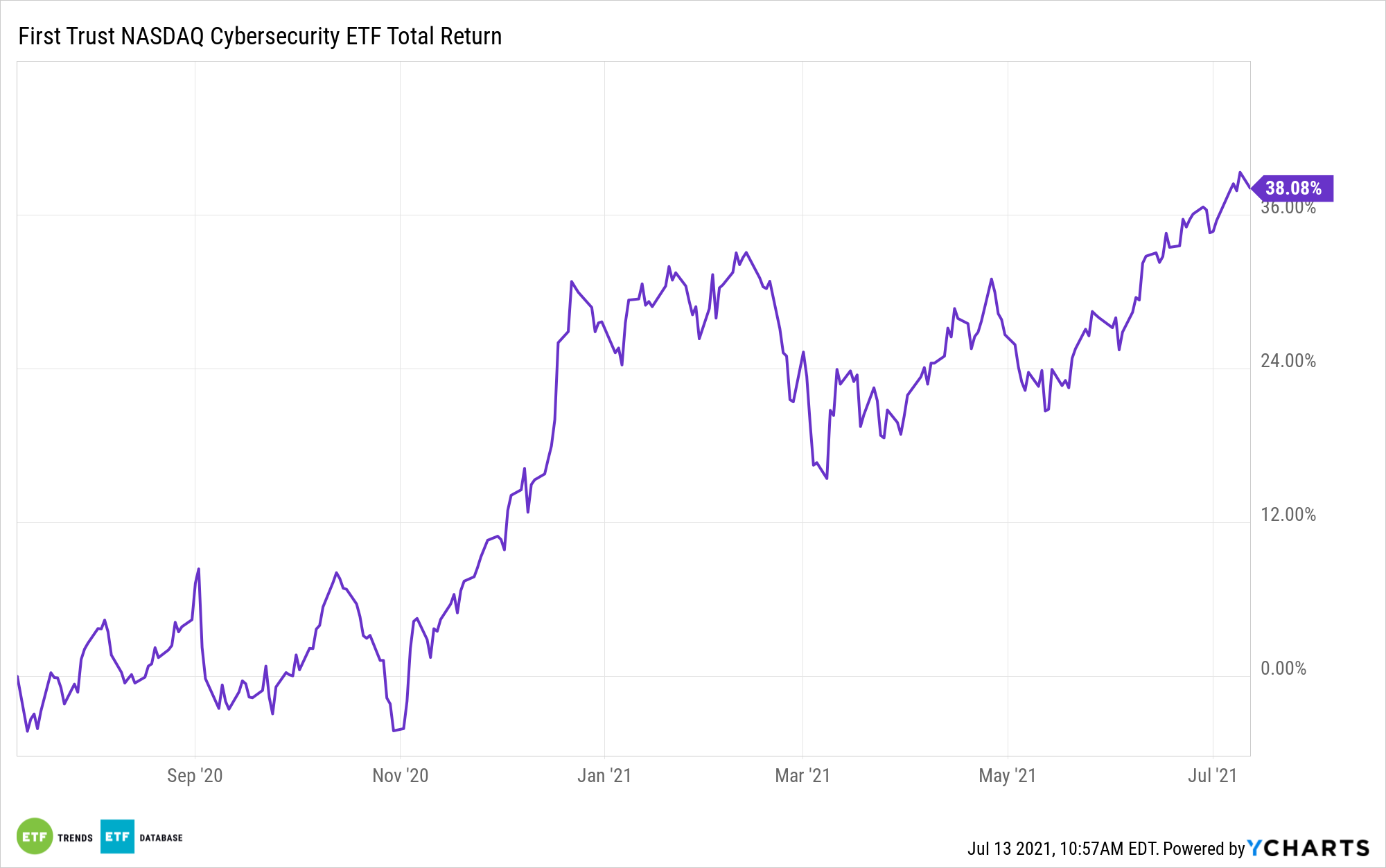

Given the frequency of high-profile cyberattacks this year, it may be fair to say that cybersecurity stocks and ETFs like the First Trust NASDAQ Cybersecurity ETF (NASDAQ: CIBR) never left the spotlight. On the heels of the Kaseya attack last week, CIBR hit an all-time high on Monday before settling modestly lower.

The $4.24 billion ETF, which tracks the Nasdaq CTA Cybersecurity Index, is higher by 10.4% over the past 90 days. More upside could be in store for the First Trust ETF.

“Increasingly, cybercrime is trending toward targeting service providers and supply chains, since hackers know they can affect a large group of people with a single attack. The $70 million ransomware attack last weekend, which struck between 800 to 1,500 businesses that used Kaseya’s services, is the latest sophisticated cyberattack following the Colonial Pipeline hack attack last month,” reports Lydia You for Barron’s.

CIBR: A Durable Tech Idea

For investors seeking exposure to a disruptive corner of the technology sector, cybersecurity and CIBR might make a lot of sense. Cyber breaches are becoming increasingly common, prompting companies and governments to up spending on the software and services provided by CIBR components.

Additionally, CIBR is a play on other fast-growing themes, such as cloud computing and hybrid work. Cloud computing and elevated levels of remote work require enhanced tech security, providing a lengthy runway for CIBR’s 40 components to grow and diversify revenue.

“Spending on information security and risk management technology is expected to grow 12.4% in 2021 to $150.4 billion, according to research firm Gartner. In general, however, only a small portion of companies’ IT budget is allocated toward security spending. Raymond James research, for instance, shows that security spending accounts for only 4% of IT budgets across all industries,” according to Barron’s.

Among the cybersecurity stocks Raymond James is bullish on are, in order of weight in the CIBR lineup, Okta (OKTA), Fortinet (FTNT), Palo Alto Networks (PANW), and Rapid7 (RPD). That quartet combines for over 15% of CIBR’s roster, according to First Trust data.

The Nasdaq CTA Cybersecurity Index mandates that member firms have a minimum market value of $250 million and applies caps to individual components. No member of CIBR’s roster exceeds a weight of 6.53%.

For more news, information, and strategy, visit the Nasdaq Portfolio Solutions Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.