Renewable energy exchange traded funds are among the hottest industry funds this year and with Joe Biden’s election, that ebullience can continue.

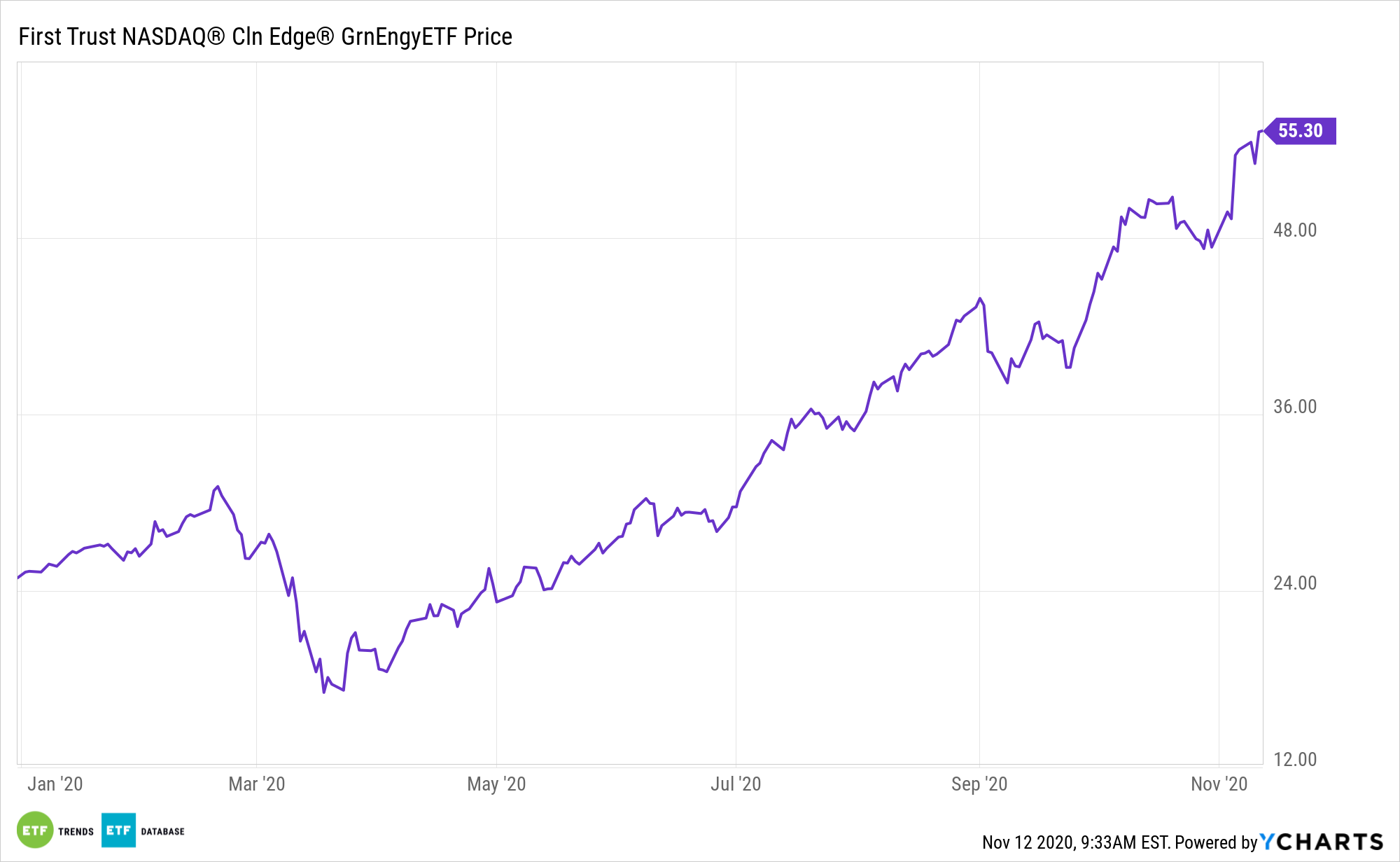

The First Trust NASDAQ Clean Edge Green Energy Index Fund (NasdaqGM: QCLN) is an example of a clean energy ETF investors are embracing this year on Democrat speculation. As it stands, QCLN has more than doubled over the past six months, indicating there’s plenty of momentum here.

QCLN seeks investment results that correspond generally to the equity index called the NASDAQ® Clean Edge® Green Energy Index. The index is designed to track the performance of small, mid, and large capitalization clean energy companies that are publicly traded in the United States.

“QCLN’s methodology delivers a broad, diversified approach to the theme, and has captured several clean energy trends as the industry has grown and evolved,” according to First Trust. “For example, at the beginning of 2011, consumer discretionary and materials stocks combined accounted for less than 4% of the portfolio. As the electric vehicle and advanced battery market has grown, the combined weight of the two sectors has increased to 24.5% as of 9/30/2020.”

QCLN on the Move

Another reasons QCLN is relevant for strategic investors today is the sheer number of tailwinds at the back of the alternative energy industry, many of which are international in nature. Wind power is one just one example of that trend.

One of the compelling elements about QCLN is its depth. It doesn’t solely focus on solar or wind stocks as some other funds in this category do. Rather, QCLN features exposure to traditional renewable energy as well as electrical vehicle manufacturers, semiconductor makers and more. The depth is notable at a time when data confirm the growth of the alternative energy space.

“Semiconductors play a key role in clean energy by enabling clean, renewable energy sources and improving energy efficiency,” notes First Trust. “Semiconductor materials are the basis for solar electric energy systems. Solar power companies, which are also classified as semiconductor stocks, made up most of QCLN’s exposure to the industry as of 9/30/20. In our opinion, QCLN provides investors with exposure to these technologies and innovations behind the clean energy transition.”

For more on innovative portfolio ideas, visit our Nasdaq Portfolio Solutions Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.