Nasdaq 100 investors witnessed much volatility in the first quarter of 2022. But it brings opportunities for risk mitigation from some exchange-traded funds (ETFs).

“So far, this has been a year like nothing in recent memory and it is only 25% done,” a Nasdaq article says. “It is doubtful many market participants expected inflation to push double digits along with the threat of a major conflict brewing in Europe. In reaction to world events, the Nasdaq-100 (NDX) gave up just over 9% in the first quarter, the worst performance since the first quarter of 2020, which coincided with the early days of the pandemic.”

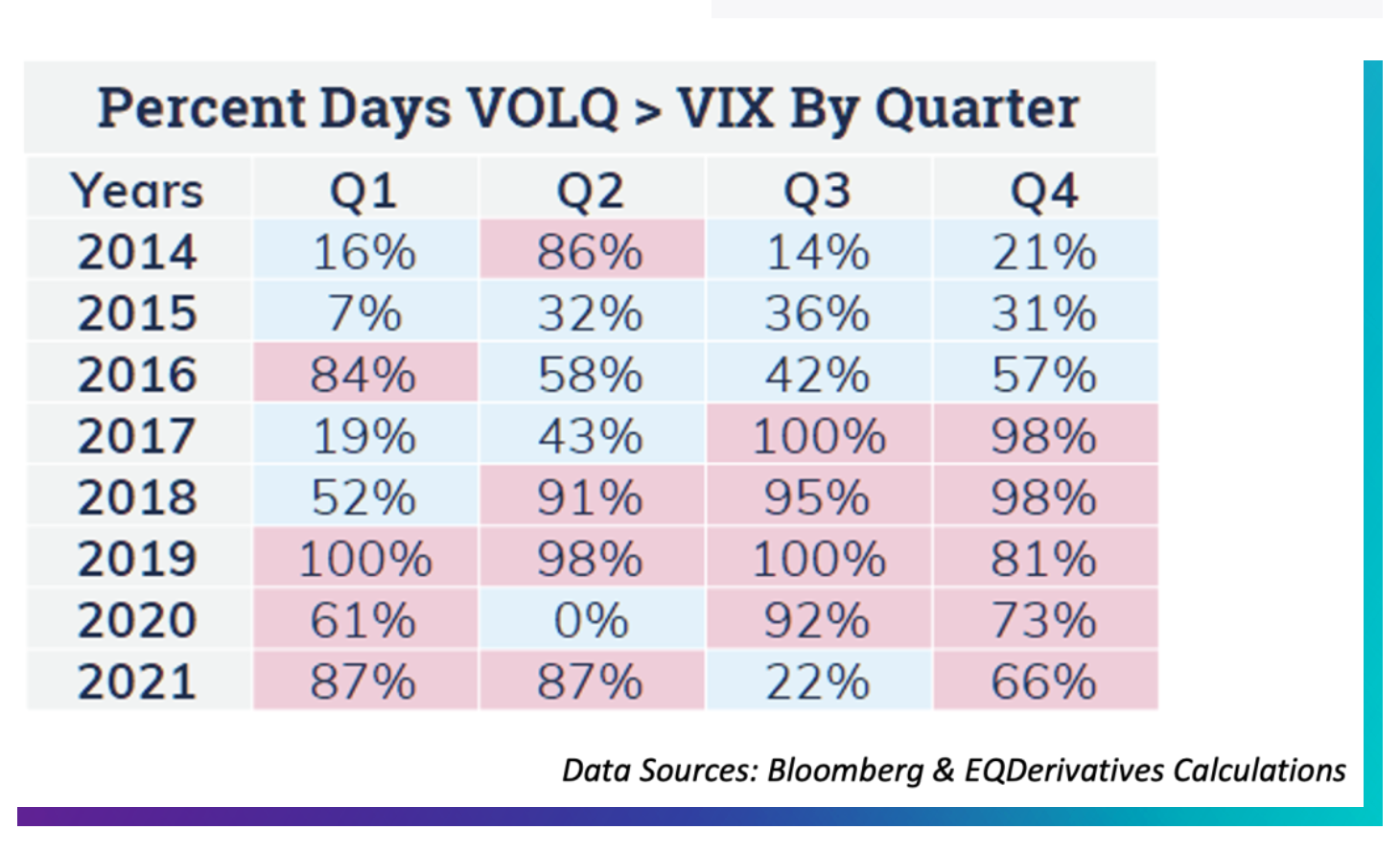

As it mentions, volatility has literally been off the charts. That’s evident when comparing the historical volatility of the Nasdaq 100 relative to the CBOE Volatility Index (VIX).

“Historical data for the Nasdaq-100 Volatility Index (VOLQ) stretches back to 2014 and the relationship between VIX and VOLQ over this time period has been interesting,” Nasdaq notes. “Between 2014 and 2021 VOLQ closed at a premium to VIX about 60% of trading days. This past quarter VOLQ closed at a premium to VIX 94% of trading days, likely as a function of NDX underperformance.”

Built-In Risk Protection

To trade the Nasdaq 100, one of the most common ways is to use the Invesco QQQ Trust (QQQ). However, with the Innovator Growth-100 Power Buffer ETF (NOCT), investors can still get QQQ exposure, but with built-in risk protection.

The fund seeks to track the return of the Invesco QQQ Trust (QQQ), up to a predetermined cap, while buffering investors against the first 15% of losses over the outcome period. The ETF can be held indefinitely, resetting at the end of each outcome period, approximately annually.

For more news, information, and strategy, visit the Nasdaq Investment Intelligence Channel.