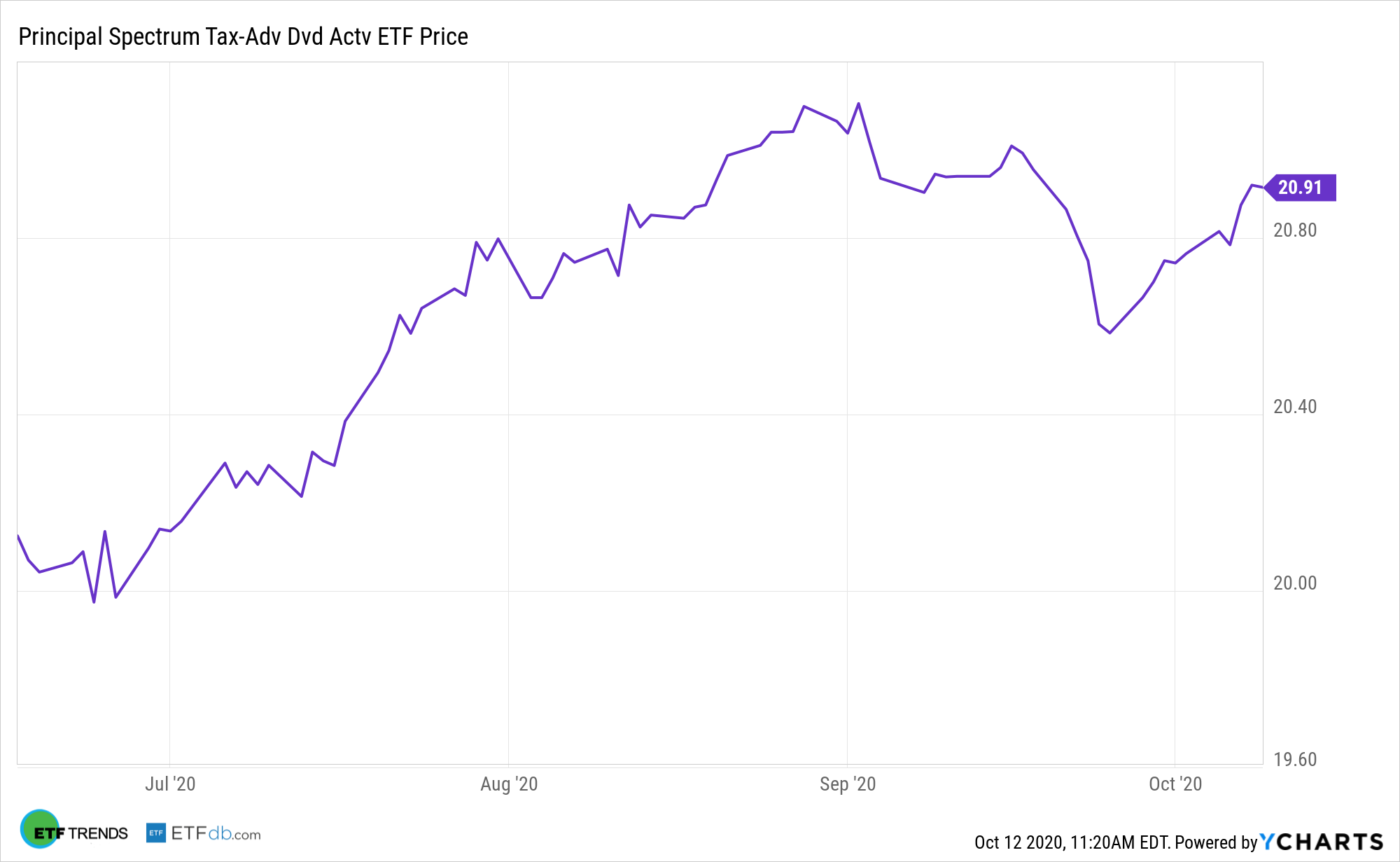

The Principal Spectrum Tax-Advantaged Dividend Active ETF (PQDI) is an example of exchange traded fund that’s taking on added importance because the aftermath of Election Day could bring a host of sweeping tax changes.

PQDI “seeks to provide current income. Under normal circumstances, the fund invests at least 80% of its net assets, plus any borrowings for investment purposes, in dividend-paying securities at the time of purchase,” according to Principal. “Such securities include, without limitation, preferred securities and capital securities of U.S. and non-U.S. issuers. The fund invests significantly in securities that, at the time of issuance, are eligible to pay dividends that qualify for favorable U.S. federal income tax treatment.”

PQDI is also relevant today because qualified dividends aren’t necessarily a hot-button political issue. However, a would be Biden Administration is likely to consider some tax code changes that could increase the allure of PQDI.

“A major component within the federal tax code is the preferential income tax rate for qualified dividends and long-term capital gains (that is, gains held for over one year),” according to the Tax Foundation. “Under current law, these sources of capital income are taxed at preferential rates, with a top rate of 23.8 percent when including the net investment income tax (NIIT). Some argue that the preferential rates are unfair, as labor income is taxed at higher levels in our progressive income tax system, up to 37 percent.”

The Current Tax Landscape

PQDI is an actively managed so it can take some of the risks out of the income-generating equation for yield-hungry investors and that’s meaningful at a time when so many high dividend stocks are cutting or suspending dividends.

“The preferential tax rates for qualified capital gains and dividends exist in part to mitigate the double taxation of returns to corporate equities, which are taxed once at the firm level at 21 percent before being taxed again when shareholders receive corporate dividends or realize a capital gain,” notes the Tax Foundation.

What happens after Election Day and how affects PQDI remains to be seen, but the hope is some element of pragmatism will prevail on Capitol Hill.

“Short of a deeper reform, however, policymakers and political candidates must consider how the trade-offs and avoidance opportunities change when modifying the taxation of wealth and work,” according to the Tax Foundation.

For more on multi-factor strategies, visit our Multi-Factor Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.