By Fei Mei Chan, Director, Index Investment Strategy, S&P Dow Jones Indices

So far, 2020 has brought us a global pandemic, a coordinated global economic shutdown, and, in the U.S., a notably contentious election. So it’s no surprise that volatility has been, and remains, elevated. Despite all this, equities have fared reasonably (some would say surprisingly) well, with the S&P 500® climbing 13% through Nov. 19 since the end of 2019.

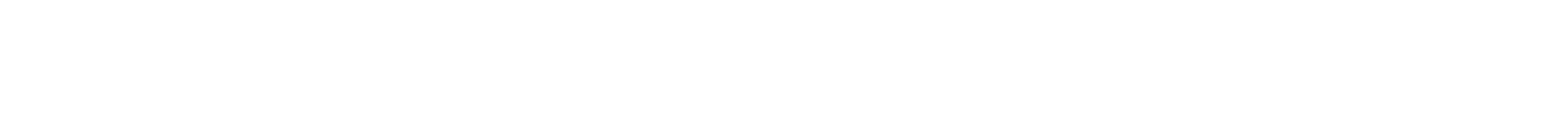

The elevated volatility can be seen across all sectors of the S&P 500 relative to the beginning of the year, despite having declined a bit in the past three months. The highest volatility sectors continue to be Energy and Financials.

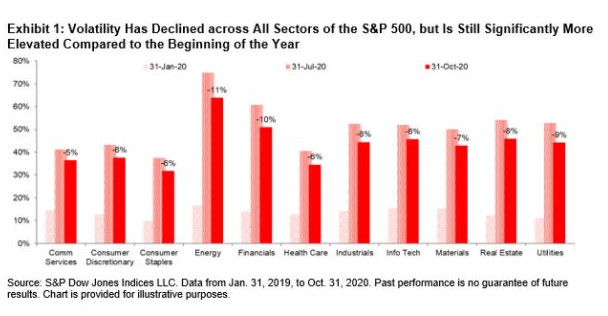

The latest rebalance for the S&P 500 Low Volatility Index (effective after market close Nov. 20, 2020) wrought minimal changes. Only eight names, accounting for about 7% of the index’s weight, cycled out of the index. The Energy, Financials, and Utilities sectors, traditionally low volatility stalwarts, continued to hold only a small fraction of the portfolio. Consumer Staples and Health Care together accounted for just over 50% of the rebalanced portfolio’s weight, as our methodology targets the 100 least volatile stocks in the benchmark S&P 500.

Originally published by Indexology, 11/20/20

The posts on this blog are opinions, not advice. Please read our Disclaimers.