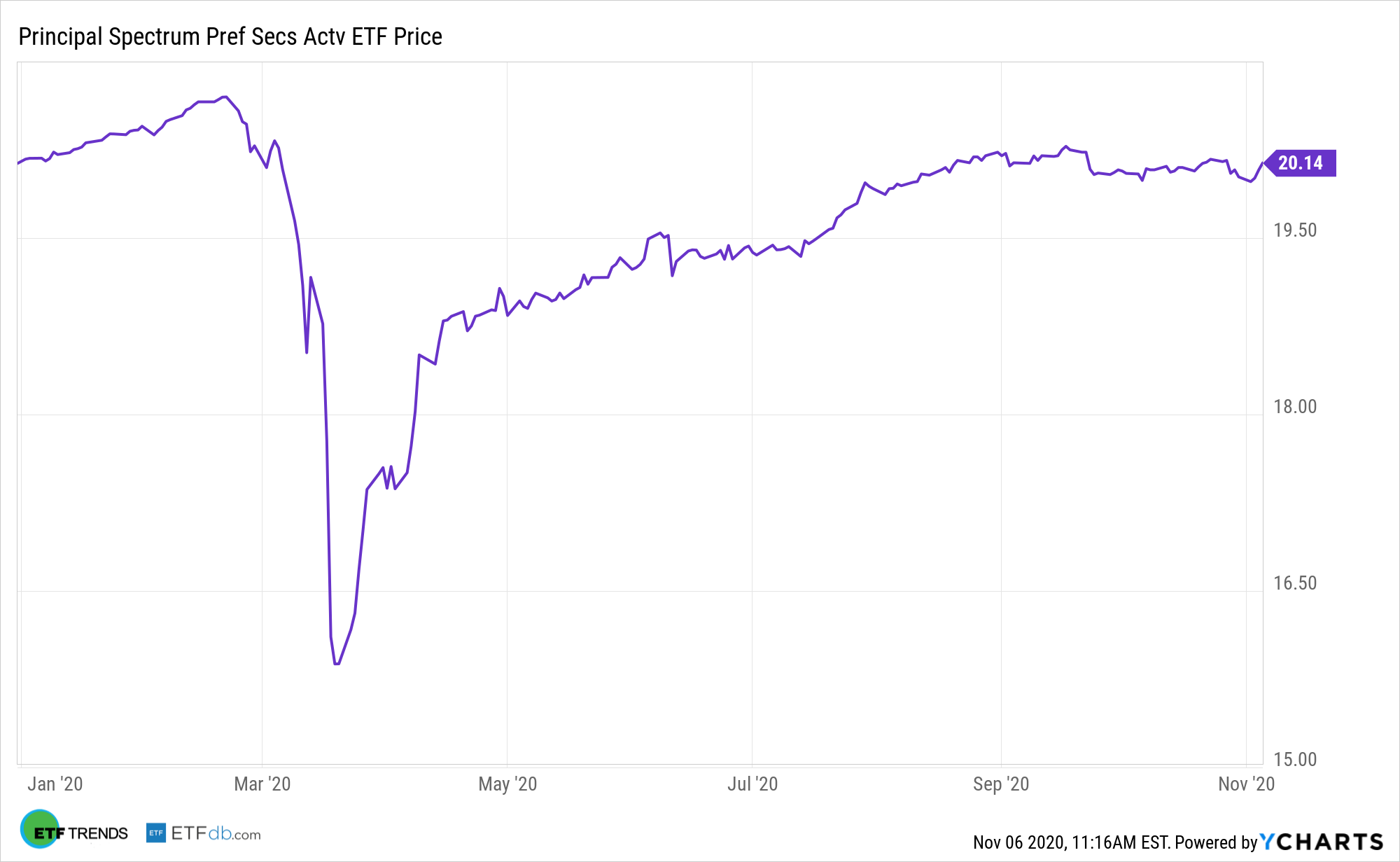

Vote counting is still happening in some marquee swing states, providing investors with an opportune time to dial back risk and bolster income streams with assets such as the Principal Spectrum Preferred Securities Active ETF (CBOE: PREF).

As a high-yield asset class, preferreds historically perform well as interest rates decline. Rates are certainly faltering this year, but that also means yields on preferreds are declining. However, some market observers don’t see that as a mark against the asset class. PREF can also be paired with other non-bond income assets.

“Some preferred stocks adjust their dividends periodically based on some index; for example, the 90-day U.S. Treasury bill rate. This provides protection against interest-rate increases. There are about 60 of these that trade on major exchanges,” reports The Sarasota Herald-Tribune. “Like bonds, preferred stocks are rated by Standard and Poor’s and Moody’s. Many are below investment-grade; that is, rated lower than BBB-. However, if bonds of the same company are investment-grade, it’s not critical.”

Preferred Stocks under the Microscope

Preferred stocks are a type of hybrid security that shows bond- and equity-like characteristics. The shares are issued by financial institutions, utilities, and telecom companies, among others. Within the securities hierarchy, preferreds are senior to common stocks but junior to corporate bonds. Preferred stocks issue dividends on a regular basis, but investors don’t usually enjoy capital appreciation on par with common shares.

Another benefit of PREF is that it’s an actively managed exchange traded fund. Constraint to an index is a relevant advantage, because PREF’s managers can eschew issuers with shaky financial profiles while focusing on those most likely to make good on dividend payments.

“The ‘ideal’ preferred stock would be investment-grade, have a cumulative dividend significantly higher than alternatives like a 5-year CD or the S&P 500, or be indexed to interest-rates, have several years of call protection and sell below its call price,” according to the Herald-Tribune. “In the current historically low interest-rate environment with the FED indicating its intentions to keep it that way for years, investors should carefully balance the higher dividends of fixed-rate preferred stocks versus the potential for higher future dividends from an indexed preferred.”

Income investors have looked to preferred stock ETFs in their portfolios for a number of reasons. For instance, the asset class offers stable dividends, does not come with taxes on qualified dividends for those that fall into the 15% tax bracket or lower, is senior to common stocks in the event liquidation occurs, is less volatile than bonds, and provides dividend payments before common shareholders.

For more on multi-factor strategies, visit our Multi-Factor Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.