It’s easy to have a home bias when it comes to investing in the capital markets. Investors could be missing out on international opportunities superseding common U.S. benchmarks.

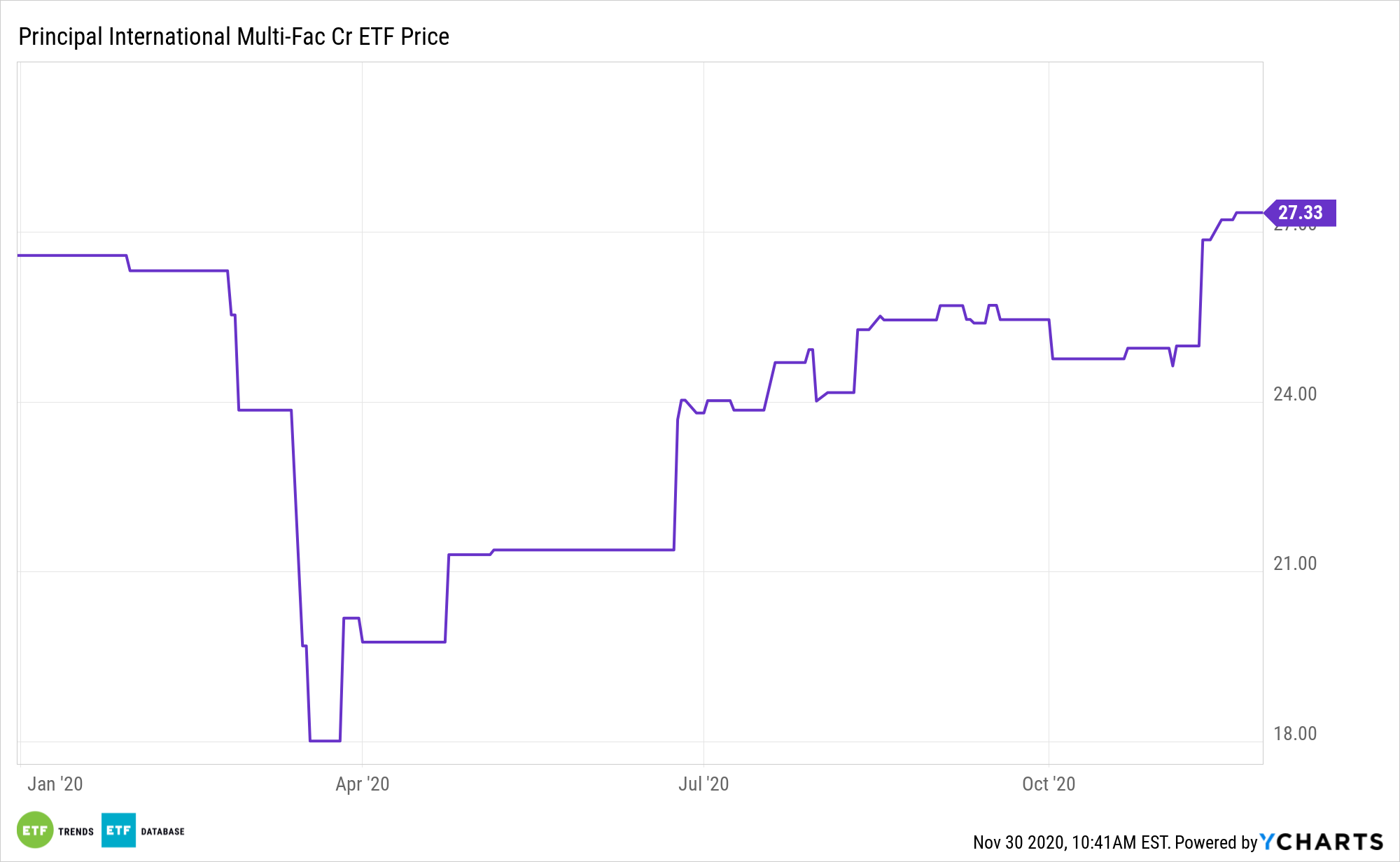

For some time now, U.S. investors have been served well by staying at home, but that tide could be turning, opening the door to opportunity with exchange traded funds such as the Principal International Multi-Factor Core Index ETF (PDEV).

PDEV is designed to provide broad index-aware developed international equity exposure while incorporating a multi-factor model and modified the weighting process to potentially enhance the risk/return profile. Multi-factor model seeks to identify equity securities of companies in the Nasdaq Developed Market Ex-US Ex-Korea Large Mid Cap IndexSM that exhibit potential for high degrees of sustainable shareholder yield (value), pricing power (quality growth), and strong momentum. The fund’s objective is to track the Nasdaq Developed Select Leaders Core Index.

With 2021 just a few weeks away, PDEV is an increasingly compelling idea for investors looking to add factor-based international diversification to their portfolios.

“Many international stocks are especially inexpensive, relative to their U.S. counterparts,” reports Reshma Kapadia for Barron’s. “At the same time, the political backdrop for international stocks is improving. Despite the European Union’s thorny negotiations with the United Kingdom over Brexit, the EU’s ability to pull off a stimulus fund for the region marked a major milestone toward rescuing its economy and enhancing the bloc’s stability.”

The PDEV ETF: Many Stocks to Choose from Amidst a Weak Dollar

Owing to the Federal Reserve’s move to take interest rates to record lows, the U.S. dollar is sagging this year. Greenback weakness doesn’t spell trouble for investors considering international equities.

Many asset allocators are enthusiastic about ex-US stocks heading into the new year due to dire forecasts for the U.S. dollar, some of which call for the currency to drop another 20% in 2021. PDEV lacks a currency hedge, which can be advantageous at a time of dollar weakness.

A fully hedged portfolio position has historically diminished returns when the U.S. dollar depreciated or international currencies strengthened. Since a hedged portfolio shorts foreign currencies, investors would miss out on the added boost if international currencies appreciated.

Home to nearly 600 stocks with an average market capitalization of $24.68 billion, PDEV is attractively valued relative to competing domestic strategies. The fund allocates over 40% of its combined weight to industrial, consumer cyclical and healthcare names.

For more on multi-factor strategies, visit our Multi-Factor Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.