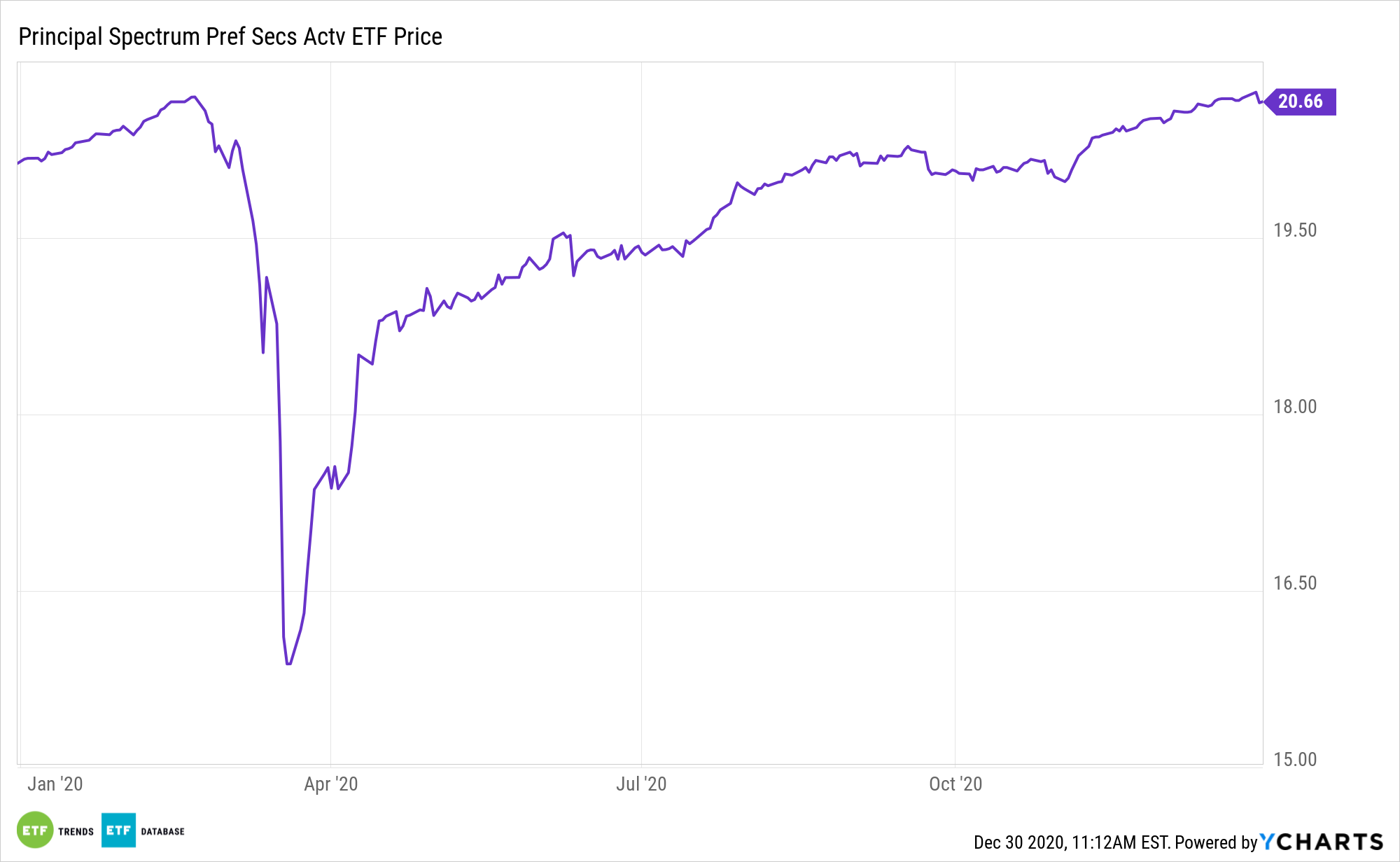

Interest rates are likely to remain low in 2021, meaning investors need to be selective with income-generating asset classes. The Principal Spectrum Preferred Securities Active ETF (NYSEArca: PREF) is a great starting point.

PREF can act as a portfolio diversification tool and reducer of correlations. Another advantage of PREF’s active management is that the manager’s can look for value in an asset class that has been expensive for much of this year.

Preferred stocks are a type of hybrid security that shows bond- and equity-like characteristics. The shares are issued by financial institutions, utilities, and telecom companies, among others. Within the securities hierarchy, preferreds are senior to common stocks but junior to corporate bonds. Additionally, preferred stocks issue dividends on a regular basis, but investors don’t usually enjoy capital appreciation on par with common shares.

“As sort of a bond-stock hybrid, preferred shares can serve as a viable, higher-paying alternative to bonds, but with lower volatility than common stock shares,” writes Dave Gilreath, partner/founder, Sheaff Brock Investment Advisors, LLC, in an op-ed for CNBC.

The PREF ETF Combines Preferred Pros and Active Advantages

As an actively managed ETF, PREF offers investors some perks relative to index-based preferred strategies. Those benefits include being able to allocate to higher quality preferreds and, in some cases, variable rate preferreds.

“With variable-rate preferred-share funds, investors can get some protection from rising interest rates — an effective selling point now that rates have nowhere to go but up. Current fund dividend yields float between 4% and 5%,” notes Gilreath.

Like common stock, preferred stock is issued by a company and traded on an exchange. Preferred stock prices can fluctuate, but most of the returns from preferred stock come from dividends. Unlike common stock, preferred stock dividends are predetermined and paid at regular intervals. These dividends are paid in full before any dividends are released to common stockholders.

With Treasury yields low and likely to remain that way for some time, PREF’s quality approach is meaningful for astute income investors.

“More recently, some companies have started to offer fixed- to floating-rate preferred shares, which offer a fixed yield for a term and then float with prevailing interest rates. Some recent issues have fixed rates of up to 4%, which later convert to variable rate pegged to the London Interbank Offered Rate or 10-year Treasuries, but a different benchmark may be used for future issues,” adds Gilreath.

For more on multi-factor strategies, visit our Multi-Factor Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.