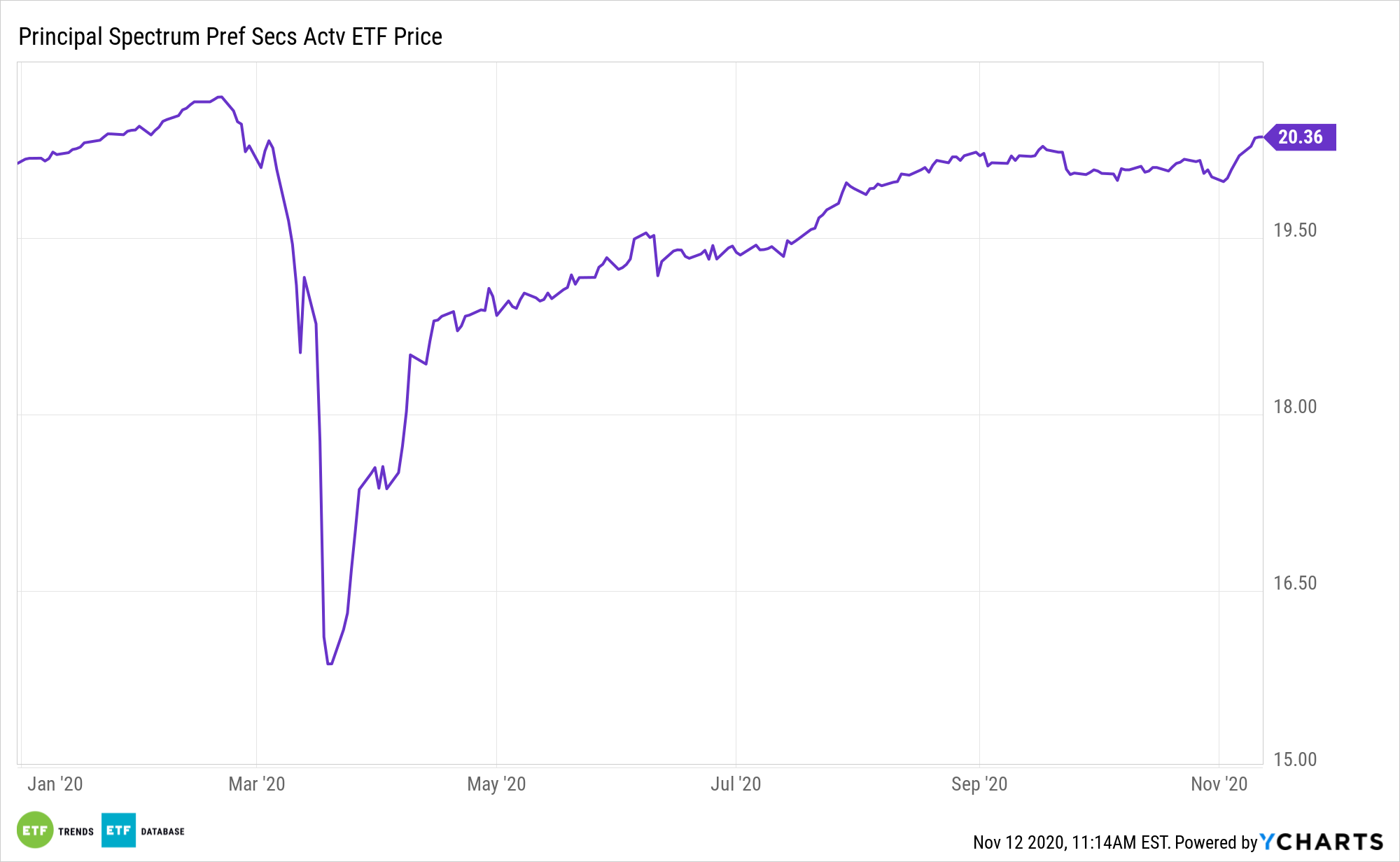

Preferred stocks are known as a high-yield asset class, but amid a post-election rally in various asset classes, those yields are declining. That could augur well for the active management offered by the Principal Spectrum Preferred Securities Active ETF (CBOE: PREF).

PREF can act as a portfolio diversification tool and reducer of correlations. Another advantage of PREF’s active management is that the manager’s can look for value in an asset class that has been expensive for much of this year.

“The preferred securities sector is beginning to look like a seller’s market again,” wrote Frank Sileo, Senior Fixed-Income Strategist at UBS, in a client note last month. “The latest refinancing wave continues a multiyear trend toward lower coupons.”

That scenario could spell opportunity with PREF because its managers can focus on high quality preferred stocks with strong odds of maintaining payouts while eschewing names that have flimsy credit ratings, which could be vulnerable to downgrades or dividend duress.

A Good Time for PREF?

Preferred stocks are a type of hybrid security that shows bond- and equity-like characteristics. The shares are issued by financial institutions, utilities, and telecom companies, among others. Within the securities hierarchy, preferreds are senior to common stocks but junior to corporate bonds. Additionally, preferred stocks issue dividends on a regular basis, but investors don’t usually enjoy capital appreciation on par with common shares.

“While yields are historically low, they are comfortably above those on Treasuries and many high-grade corporate bonds,” according to Barron’s.

For its part, PREF yields a stout 4.62%. Like common stock, preferred stock is issued by a company and traded on an exchange. Preferred stock prices can fluctuate, but most of the returns from preferred stock come from dividends. Unlike common stock, preferred stock dividends are predetermined and paid at regular intervals. These dividends are paid in full before any dividends are released to common stockholders.

“One of the key risks with new preferreds is higher rates. As perpetual securities with historically low dividend yields, they could fall sharply if long-term Treasury rates rise. The upside is capped by provisions that typically allow issuers to redeem the securities at face value in five years,” reports Barron’s.

For more on multi-factor strategies, visit our Multi-Factor Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.