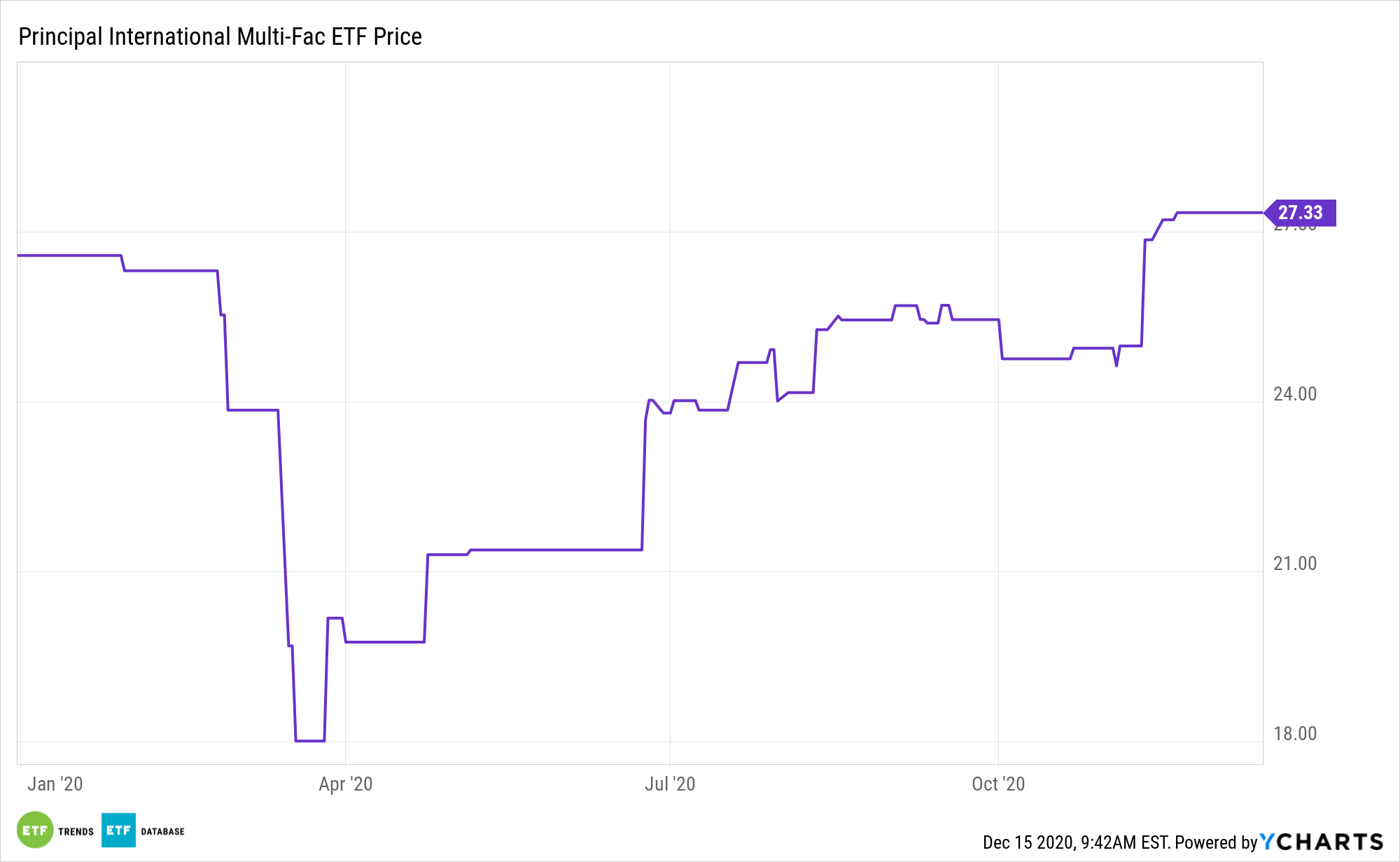

A prominent theme emerging to toward the end of 2020 has been increasingly bullish views on international equities for 2021. Investors can tap into that theme with the added benefit of a multi-factor umbrella through the Principal International Multi-Factor Core Index ETF (PDEV).

PDEV is designed to provide broad index-aware developed international equity exposure while incorporating a multi-factor model and a modified weighting process to potentially enhance the risk/return profile. The multi-factor model seeks to identify equity securities of companies in the Nasdaq Developed Market Ex-US Ex-Korea Large Mid Cap IndexSM that exhibit potential for high degrees of sustainable shareholder yield (value), pricing power (quality growth), and strong momentum. The fund’s objective is to track the Nasdaq Developed Select Leaders Core Index.

Investors may want to take cues from institutional players today, and not wait until 2021 for international allocations.

“Investment firms, including Comerica Wealth Management, Wolfe Research, and Northwestern Mutual Wealth Management, are shifting to an overweight position in equities outside the U.S., with many overweighting emerging market stocks,” reports Jacob Sonenshine for Barron’s. “Those firms cite the weakening dollar and stronger global growth against that of the U.S. as the world emerges from the pandemic-induced recession.”

The PDEV ETF and the Return of International Equities

Looking to the new year, international equities have increasingly become an attractive option for investors looking to generate income and pursue higher total return potential.

PDEV can potentially provide investors efficient access to international developed stocks with relatively low tracking error to the international developed market. Its index-aware design may make PDEV an attractive replacement for passive, cap-weighted, and active strategies.

Investors’ renewed interest in international stocks is attributable in some part to Europe, a region a PDEV features robust exposure to.

“That change is largely due to positive stimulus news in Europe. The European Central Bank said this week it will increase the size of its bond-buying program by 500 billion euros, or $600 billion, to further support the economic recovery in the bloc. Plus, a $900 billion EU fiscal stimulus package is in the works,” according to Barron’s.

For more on multi-factor strategies, visit our Multi-Factor Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.