By Director, Global Research & Design, Indexology Blog

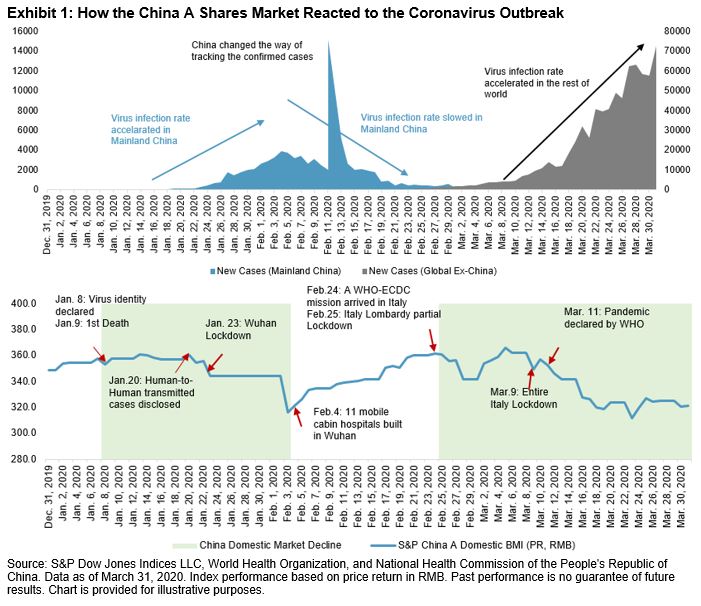

In the first quarter of this year, the China A shares market was on a roller coaster in response to the domestic coronavirus outbreak followed by the spread of coronavirus in other parts of the world. In our previous blog, “How the Chinese Equity Market Responded to the Domestic and Global Coronavirus Outbreak,” we looked into how industries reacted differently during recent market declines and rallies. In this blog, we extend our analysis to the performance of the S&P China A Factor Indices in the first quarter of 2020.

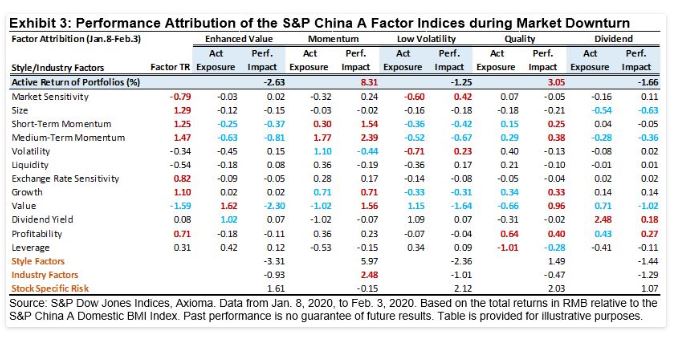

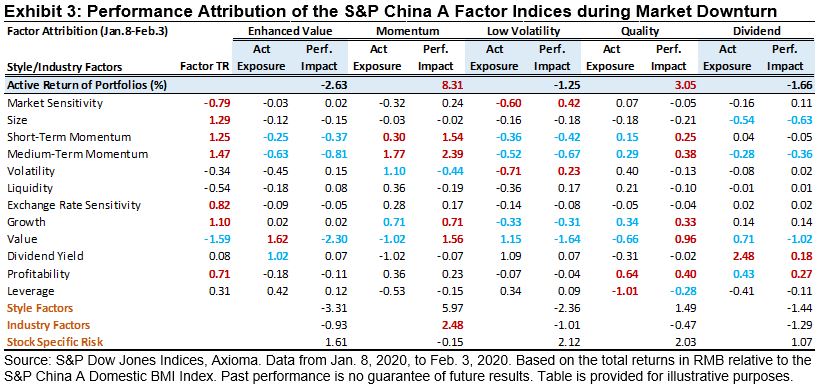

During the period from the day the virus was identified on Jan. 8, 2020, to Feb. 3, 2020, the Chinese equities market plunged by 10.5%. The S&P China A Enhanced Value Index, S&P China A Dividend Opportunities Index, and S&P China A Low Volatility Index decreased 13.2%, 12.2%, and 11.8%, respectively, while the S&P China A Short-Term Momentum Index and the S&P China A Quality Index only suffered 2.2% and 7.5%.

Momentum and value were the best- and worst-performing factors in this period, respectively, which explains the outperformance of S&P China A Short-Term Momentum Index and the underperformance of the S&P China A Enhanced Value Index. The excess return of the S&P China A Quality Index was mainly attributed to its active exposures to profitability, high momentum, and high growth and its negative exposure to value. In the S&P China A Low Volatility Index, the unintended biases to value and low momentum completely wiped out the positive impact of low beta and low volatility, which made the index underperform. Similarly, the unintended exposures to value, small cap, and low momentum caused the underperformance of the S&P China A Dividend Opportunities Index.

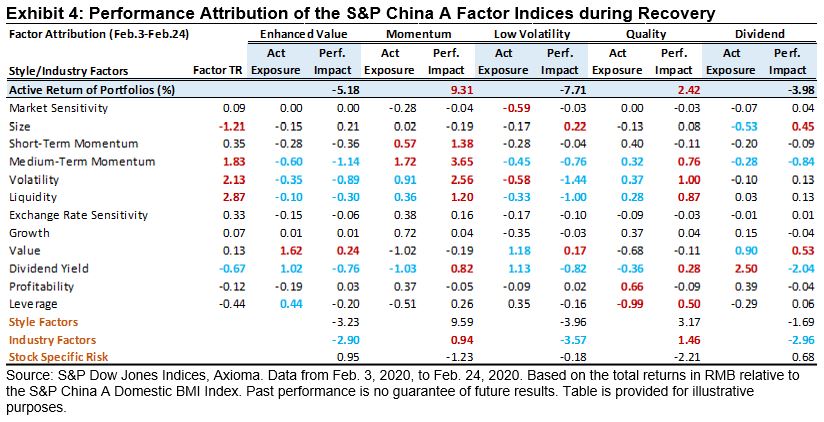

During the market recovery from Feb. 3, 2020, to Feb. 24, 2020, the outbreak in China was beginning to see declines in new infection cases, and the broad market increased 14.2% in response. Among the five S&P China A Factor Indices, the S&P China A Short-Term Momentum Index and the S&P China A Quality Index took the lead with gains of 23.5% and 16.7%, respectively, while the other three factor indices lagged the broad market.

During this period, liquidity, high volatility, and mid-term momentum were the best-performing factors, while dividend yield was the worst. This explains the outperformance of the S&P China A Short-Term Momentum and S&P China A Quality indices as both indices had favorable bets on these four factors. In contrast, the unfavorable bets on these four factors resulted in the underperformance of the S&P China A Enhanced Value Index and the S&P China A Low Volatility Index. Although the unintended exposures to small cap and value had contributed positively to the performance of the S&P China A Dividend Opportunities Index, it was not enough to offset the negative impact of its tilts to the dividend yield and low momentum factors.

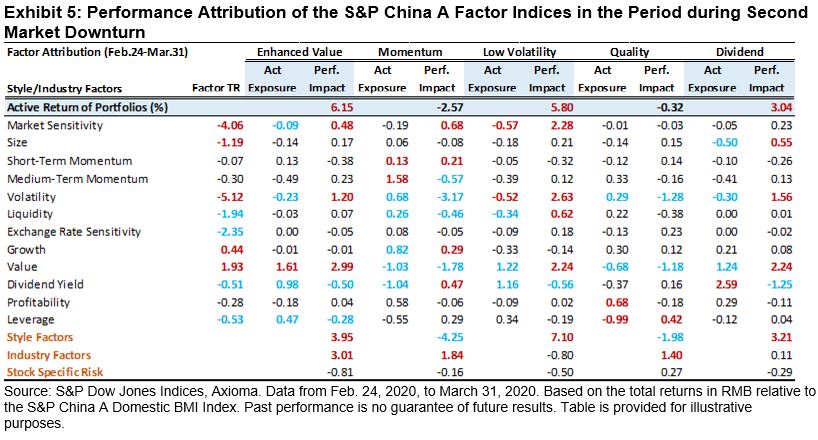

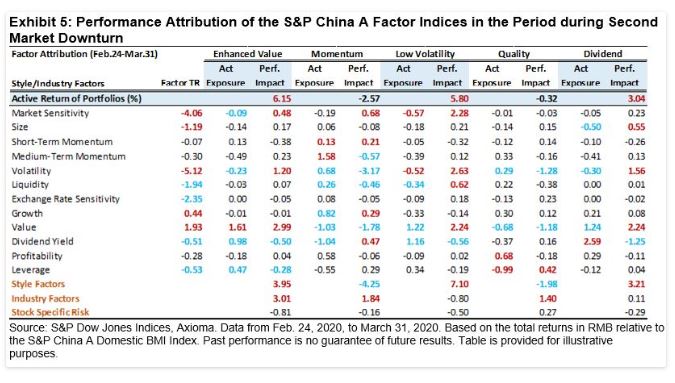

In the latest market crash following the acceleration of coronavirus infection in the rest of the world and increasing investor concern on a global recession, the broad China A market posted a loss of 11.0% from Feb. 24, 2020, to March 31, 2020. During this period, the S&P China A Enhanced Value Index, S&P China A Low Volatility Index, and the S&P China A Dividend Opportunities Index reacted defensively, posting an excess return of 6.1%, 5.8%, and 3.0%, respectively. The S&P China A Short-Term Momentum Index and the S&P China A Quality Index, in comparison, underperformed the broad market with losses of 13.6% and 11.3%, respectively.

Low volatility, low beta, and low leverage factors behaved defensively in this market drawdown as expected, value, and small-cap factors also generated decent returns. In contrast, exchange rate sensitivity was the worst-performing factor, suggesting the vulnerability of companies with high revenue exposure to offshore markets in this market crash. Although the dividend yield factor generated negative return in this period, the unintended exposure to value, low volatility, and small cap gave a boost to the performance of the S&P China A Dividend Opportunities Index. Most of the underperformance posted by the S&P China A Short-Term Momentum Index and the S&P China A Quality Index was attributed to the unintended exposures to high volatility and expensive valuation.