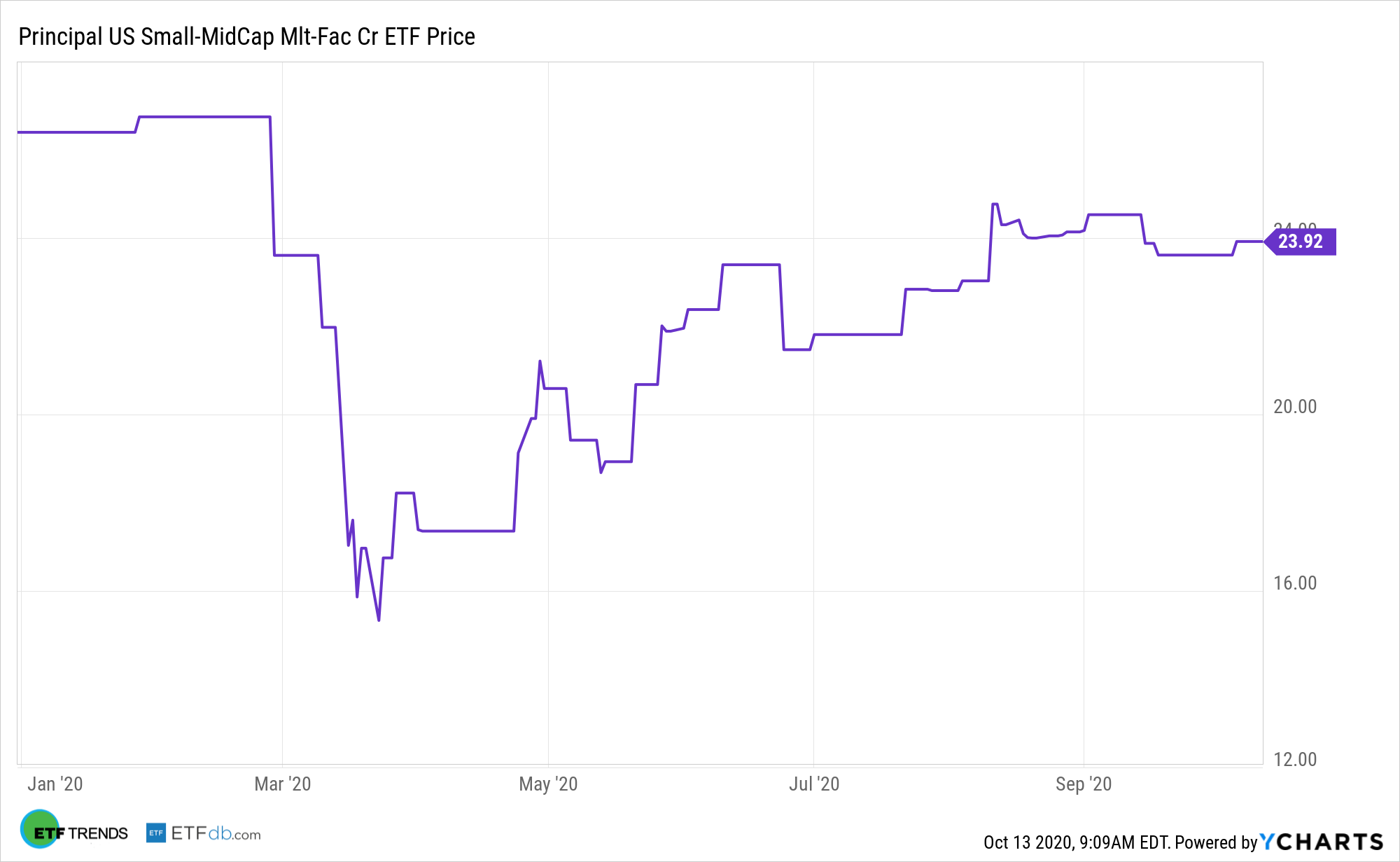

Data confirm scores of large- and mega-cap stocks are overvalued at present. That doesn’t mean those names will falter, but it does indicate investors can find some bargains with mid- and small-cap names, a scenario highlighting the allure of exchange traded funds, such as the Principal U.S. Small-Mid Cap Multi-Factor Core Index ETF (PSM).

PSM is designed to provide broad index-aware U.S. small, mid-cap equity exposure while incorporating a multi-factor model and modified weighting process to potentially enhance the risk/return profile. Multi-factor model seeks to identify equity securities of companies in the Nasdaq US Small Cap IndexSM and Nasdaq US Mid Cap IndexSM that exhibit potential for high degrees of sustainable shareholder yield (value), pricing power (quality growth), and strong momentum.

PSM is looking like a viable near-term idea.

“Yet, while we continue to see pockets of undervaluation, long-term investors may need to exhibit substantial fortitude in the fourth quarter,” said Morningstar analyst Dave Sekera in a recent note. “With many mega-cap stocks trading at levels that are significantly overvalued and the broad market not providing any margin of safety, there are numerous potential catalysts that could lead to sharp risk-off corrections.”

PSM: The Ideal Small- and Mid-Cap Mix?

In addition to small-cap potency, PSM’s mid-cap exposure is also important. Mid-cap companies are slightly more diversified than their small-cap peers, which allows many mid-sized companies to generate more consistent revenue and cash flow and provide more stable stock prices. Additionally, they are not so big that their size would slow down growth.

“In addition, we expect that mid-cap and small-cap stocks, which have lagged the broad market rebound, will outperform,” notes Morningstar’s Sekera. “Across our coverage, we find that the greatest number of stocks that are rated 4 or 5 stars are in the mid-cap category and that the highest percentage of 4- and 5-star stocks are encapsulated within the small-cap category.”

PSM can also help investors to use factor investing to filter out the best opportunities. Nowadays, the focus has been quality and value amid the market uncertainty caused by the pandemic, but investors also shouldn’t miss out on other factors like growth or momentum.

Speaking of momentum, PSM has plenty as highlighted by a gain of 16% over the past month.

For more on multi-factor strategies, visit our Multi-Factor Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.