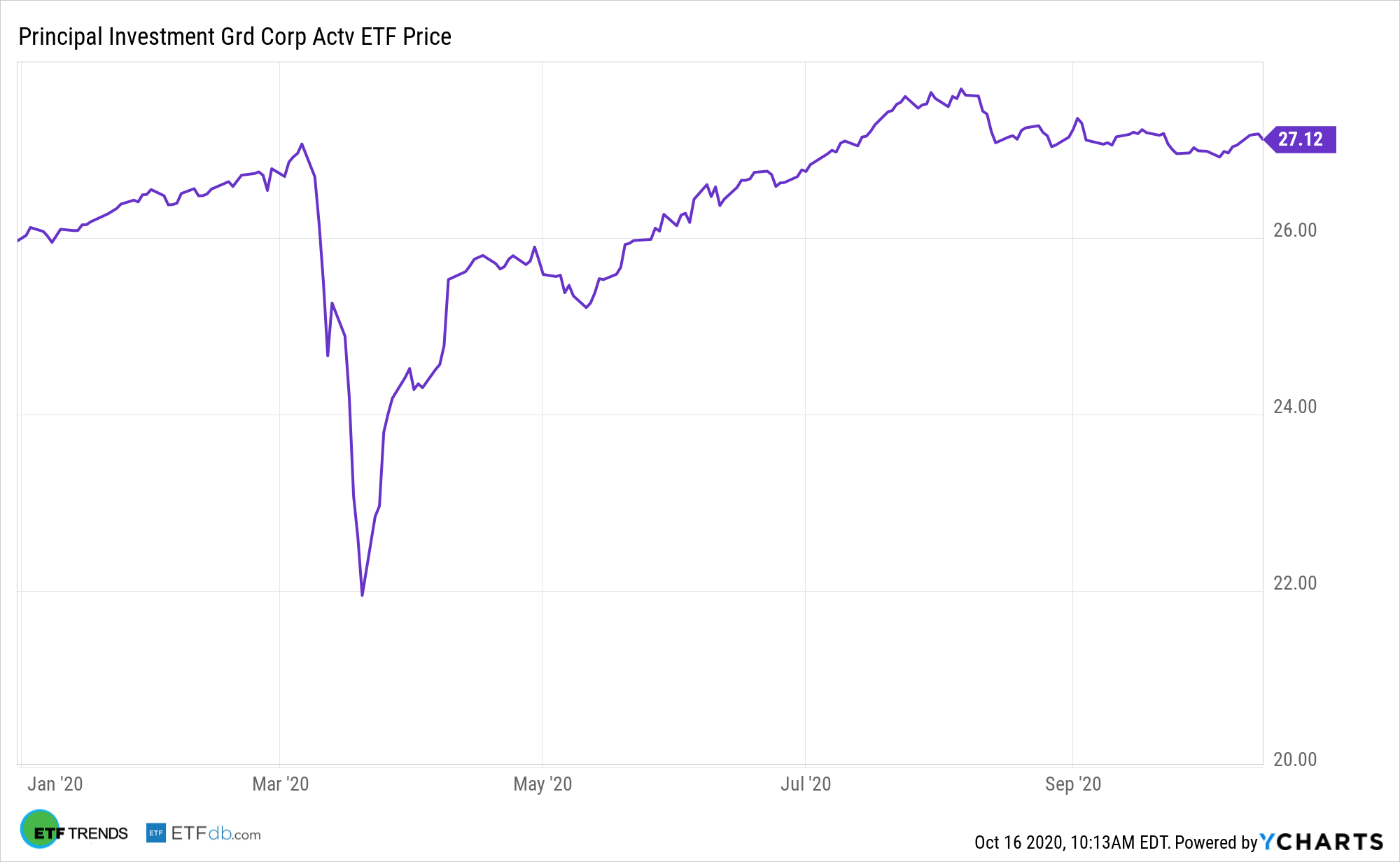

With corporate bonds still not out of the downgrade woods, an active approach to investment-grade credit could be alluring for income investors. The Principal Investment Grade Corporate Active ETF (NYSEArca: IG) checks that box.

IG is an actively managed fund, a potentially beneficial trait at a time when demographic shifts could disrupt traditional corporate bond investing. IG tries to provide current income and capital appreciation by investing in investment-grade corporate bonds rated BBB- or higher by S&P Global Ratings or Baa3 or higher by Moody’s Investors Service.

IG can be durable across myriad market settings, but the current climate is conducive to the fund’s active methodology.

“Though unresolved issues stemming from COVID-19 warn of substantial tail risk, investors have become more tolerant of above-average risk according to the recent narrowing of corporate bond yield spreads. The moving five-day averages of investment- and speculative-grade corporate bond yield spreads recently fell to their narrowest bands since March 2020,” notes Moody’s Investors Service.

Investment-Grade Helps with Volatility

A recent spate of equity market volatility didn’t punish investment-grade corporate debt, highlighting benefits associated with IG.

“Despite elevated equity market volatility, the Bloomberg/Barclays 467 basis point average high-yield bond spread of the five-days-ended October 14 was well under its 1,039 bp cycle peak of the five-days-ended March 25 but was wider than its 369 bp average of 2016-2019,” according to Moody’s.

IG combines bottom-up independent credit research with top-down strategy, seeking alpha through credit selection, industry rotation, and curve positioning and a forward-looking, iterative process seeks credits exhibiting stable-to-improving credit rating trajectory which may benefit from spread compression and income premiums, an approach that’s relevant in today’s corporate credit climate.

“A drop in net credit rating downgrades reflects a stabilization of the credit standing of U.S. investment-grade corporations. Notwithstanding how the Baa rating category comprised a much greater share of the U.S. investment-grade bond market compared to previous recessions, the COVID-19 downturn has not been especially harsh to the credit rating revisions of U.S. investment-grade corporations,” according to the ratings agency.

For more on multi-factor strategies, visit our Multi-Factor Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.