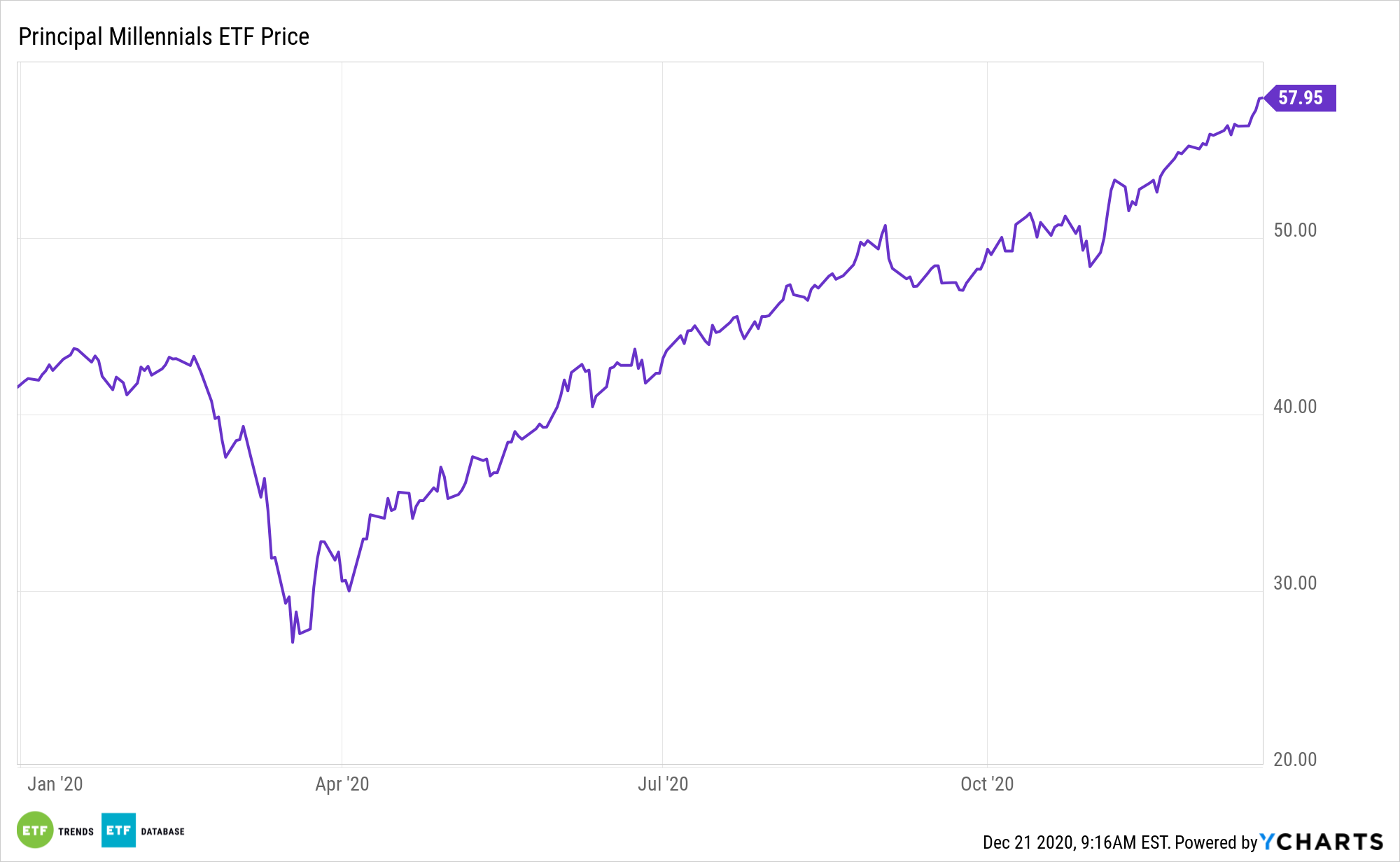

How consumers spend their hard-earned money is changing. Investors are adapting to the times with exchange traded funds such as the Principal Millennials Index ETF (Nasdaq: GENY).

GENY tracks the Nasdaq Global Millennial Opportunity Index. This index seeks to capture the global spending and lifestyle activities of the largest generation ever, offering exposure to brand name companies specializing in social media, digital media, technology, healthy lifestyles, travel, and leisure. The companies will evolve over time as the spending patterns of millennials change as they age.

“Relative strength in consumer stocks slipped this fall, although the sector is still the second-best performer year-to-date. While consumer stocks have underperformed non-consumer cyclicals since September, I would continue to favor the sector,” writes BlackRock’s Russ Koesterich.

In a Changing Economy, the GENY ETF Merits Consideration

Recent data points indicate that there are opportunities in the consumer discretionary and housing sectors. The sector is one offering investors more gains. Recent performers that stood out have also been those that were previously hardest hit by the coronavirus-driven fallout in the markets.

With the U.S. economy showing some signs of life and with the holiday shopping season here, considering consumer cyclical stocks over the near-term could be a winning idea.

“Certain categories, notably restaurants and travel, are again struggling as the 3rd wave accelerates. That said, overall spending remains resilient and flexible,” according to BlackRock. “To the extent consumers have the wherewithal to spend, they spend. Real-time credit card data demonstrates the point. When consumer mobility drops spending picks up in complimentary categories, such as groceries and online commerce. Put differently, when people can no longer dine out they spend more on eating at home or ordering online.”

Integral parts of the Gen Z-related investment thesis are shopping and entertainment consumption trends. Shopping and consumer trends are changing as more buyers rely on the convenience of online retailers to quickly and easily meet their discretionary needs. As the retail landscape changes, investors can also capitalize on the trend through ETFs that target the e-commerce segment.

“Fungible spending creates an opportunity to invest in market segments that both benefit from solid consumption and secular shifts in wallet-share. Consider payment companies, which are tied to overall spending and an increasing reliance on electronic payments, as well as names geared to housing, such as homebuilders and home improvement retailers. In the end, U.S. consumers continue to demonstrate their fabled resilience,” adds BlackRock.

For more on multi-factor strategies, visit our Multi-Factor Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.