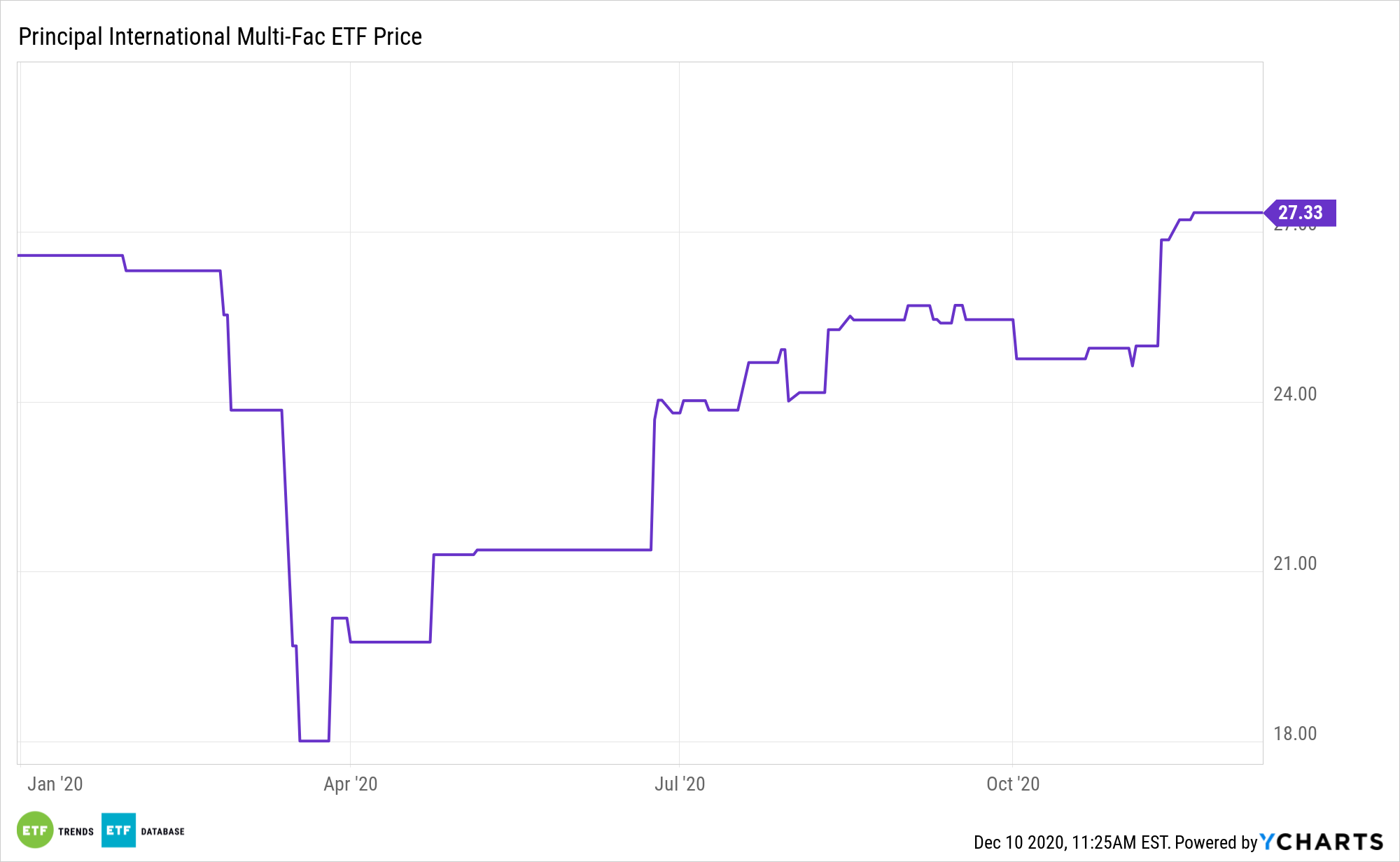

International equities are among the heaviest-favored assets heading into 2021, a theme that highlights multi-factor strategies like the Principal International Multi-Factor Core Index ETF (PDEV).

PDEV is designed to provide broad index-aware developed international equity exposure while incorporating a multi-factor model and modified the weighting process to potentially enhance the risk/return profile. The multi-factor model seeks to identify equity securities of companies in the Nasdaq Developed Market Ex-US Ex-Korea Large Mid Cap IndexSM that exhibit potential for high degrees of sustainable shareholder yield (value), pricing power (quality growth), and strong momentum. The fund’s objective is to track the Nasdaq Developed Select Leaders Core Index.

“Multifactor funds are sound in theory. They target stocks with characteristics that have historically been associated with market-beating performance, also known as factors,” notes Morningstar analyst Alex Bryan. “Just as it’s prudent to diversify across asset classes, sectors, regions, and securities, it’s a good idea to spread bets across factors that have a good chance of long-term success. Doing so can reduce risk and make it easier to stick with these factors through their inevitable rough patches.”

PDEV’s multi-factor approach is all the more meaningful today because broader baskets of ex-US developed market stocks are recently surging.

Analyzing Principal’s PDEV ETF

PDEV can potentially provide investors efficient access to international developed stocks with relatively low tracking error to the international developed market. Its innovative factor definitions and combinations may enhance the risk/return profile without significantly differing from the targeted index holdings. Finally, its index-aware design may make PDEV an attractive replacement for passive, cap-weighted, and active strategies.

Another point in PDEV’s favor is that international developed multi-factor strategies more frequently beat cap-weighted rivals over the past three and five years than do domestic multi-factor funds, according to Morningstar data.

“Factor diversification helps, but it doesn’t eliminate the risk of underperformance, even over long periods,” notes Bryan. “That’s because there are only a handful of robust factors to diversify across. Just as underperformance in one stock can sink a five-stock portfolio, significant underperformance in one or two factors can cause a multifactor fund to underperform. However, diversification is still prudent because it’s hard to know which factors will do well in the short term.”

One last PDEV pro is that it’s not heavily allocated to value, the factor that’s been weighing on multi-factor funds this year.

For more on multi-factor strategies, visit our Multi-Factor Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.