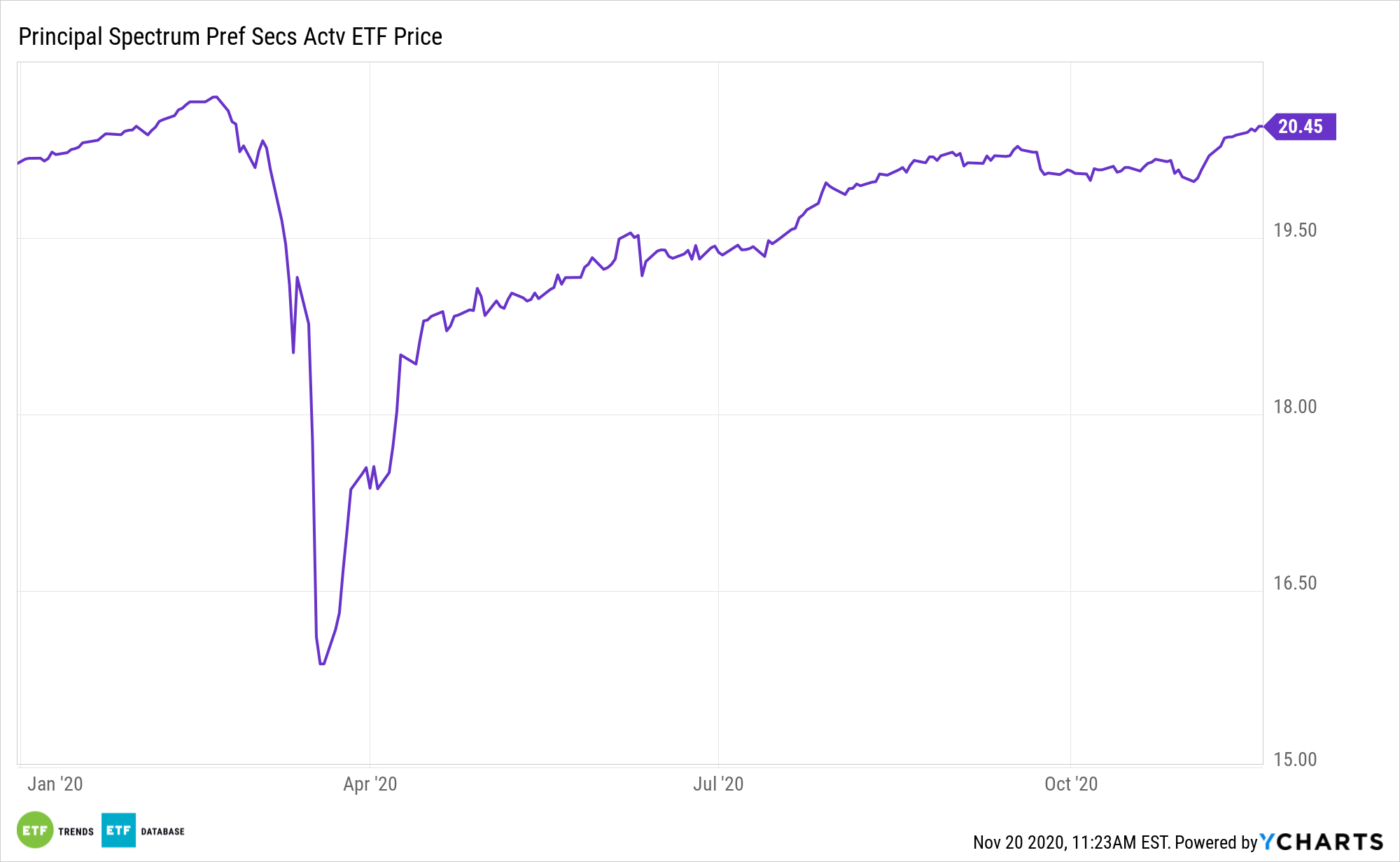

Advisors and investors are running low on credible income-generating assets in the current environment, a scenario making the Principal Spectrum Preferred Securities Active ETF (NYSEArca: PREF) a standout among exchange traded funds.

Rates are certainly faltering this year, but that also means yields on preferreds are declining. However, some market observers don’t see that as a mark against the asset class. PREF can also be paired with other non-bond income assets.

PREF is increasingly relevant today because conservative fixed income investments, including Treasuries and municipal bonds, sport yields at or near historic lows.

“A preferred stock is issued by a charter amendment to the Articles of Incorporation. They are actually share capital instruments that are not dilutive to common shareholders. In other words, they are senior to common equity,” notes Spectrum Chief Investment Officer Philip Jacoby.

A Solid PREFerence for Income

Income investors have looked to preferred stock ETFs in their portfolios for a number of reasons. For instance, the asset class offers stable dividends, does not come with taxes on qualified dividends for those that fall into the 15% tax bracket or lower, is senior to common stocks in the event liquidation occurs, is less volatile than bonds, and provides dividend payments before common shareholders.

The Spectrum active management process backing PREF is particularly important.

“The fundamental process of what we do is led by analysis, which we simply call CAMEL. That’s an acronym for capital, asset quality, management, earnings, and liquidity,” according to Jacoby. “We have various scoring mechanisms that score each one of the letters in CAMEL as they relate to the fundamental attributes; from that, we develop an outlook. Spectrum is able to score, on a relative basis, all of the credits to develop a relative ranking of one entity compared to another and then develop a general outlook on the direction of credit.”

For more on multi-factor strategies, visit our Multi-Factor Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.