As the world starts to continue moving towards renewable energy, the U.S. is reaching milestones with regards to its electric charging infrastructure.

This opens up opportunities for investors to consider adding infrastructure exposure to their portfolios. The trillion-dollar infrastructure package up for debate in the House of Representatives also puts the sector in focus.

“The United States passed an important electric vehicle milestone earlier this year. At some point during the first three months of 2021, the country installed its 100,000th EV charger,” a ARS Technica article said. “That’s according to the US Department of Energy’s Alternative Fueling Station Locator, an extremely helpful resource that tracks ‘ethanol (E85), biodiesel, compressed natural gas, electric vehicle (EV) charging, hydrogen, liquefied natural gas, and propane stations.'”

“That milestone coincided nicely with a call from President Joe Biden to build out more EV charging infrastructure,” the article added. “In March of this year, the Biden administration set a goal of reaching 500,000 publicly accessible EV chargers by the year 2030. (This preceded an August announcement from the White House that set a lukewarm target of half of all new cars and trucks being zero-emissions, also by 2030.)”

An Infrastructure ETF to Consider

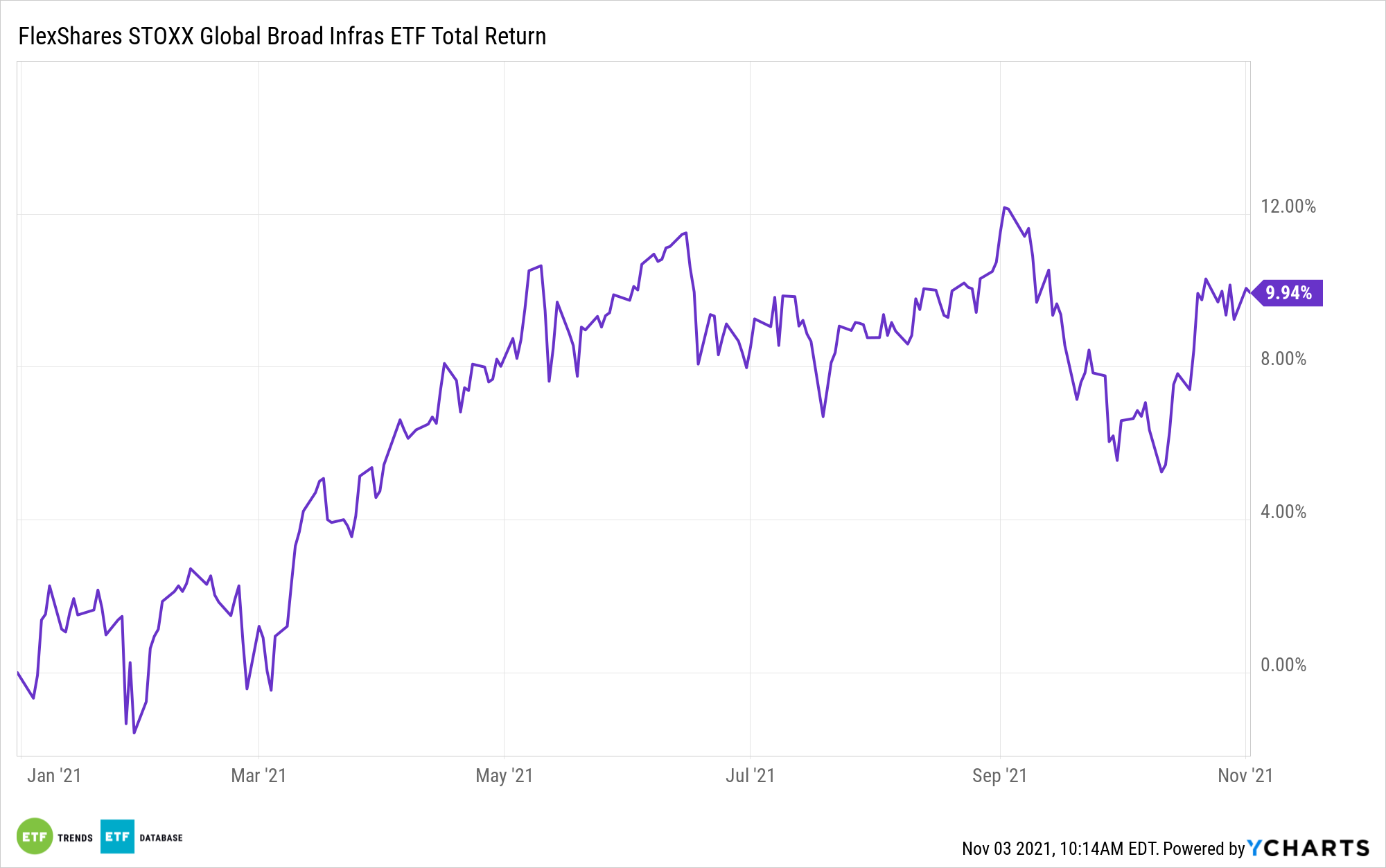

ETF investors looking to get infrastructure exposure can look to funds like the FlexShares STOXX Global Broad Infrastructure Index Fund (NFRA). The fund comes with a 0.47% net expense ratio.

“NFRA follows a market-cap-weighted index that invests in companies that derive at least 50% of their revenue from segments including energy, communications, utilities, transportation and — an unusual twist — government outsourcing, like hospitals, prisons and postal services,” an ETF Database analysis said.

Per its fund description, NFRA seeks investment results that generally correspond to the price and yield performance (before fees and expenses) of the STOXX® Global Broad Infrastructure Index. The index reflects the performance of a selection of companies that, in aggregate, offer broad exposure to publicly traded developed and emerging market infrastructure companies, including U.S. companies, as defined by STOXX Ltd. pursuant to its index methodology.

For more news, information, and strategy, visit the Multi-Asset Channel.