Whether it’s cloud computing, e-commerce, fintech, or healthcare innovation, the pandemic has ramped up the adoption of disruptive technologies. With those advancements expected to remain in place permanently, investors may want to consider funds like the ProShares MSCI Transformational Changes ETF (NYSE: ANEW).

ANEW, which debuted last October, follows the MSCI Global Transformational Changes Index and provides access to companies involved with one or more of four key transformational changes, as determined by MSCI. Those include the Future of Work, Genomics & Telehealth, Digital Consumer, and Food Revolution.

The way people behave as workers and consumers is changing—accelerated by COVID-19—and investors should pay attention to the companies evolving to meet these challenges. Just look at the work from home theme, which ANEW provides exposure to.

“For businesses, remote work may transition from a contingency to competitive requirement as about 75% of American office workers would like to work remotely at least two days a week,” notes Scott Helfstein, Executive Director of Thematic Investing at ProShares. “75% of Fortune 500 CEOs plan to accelerate the technological transformation of their company.”

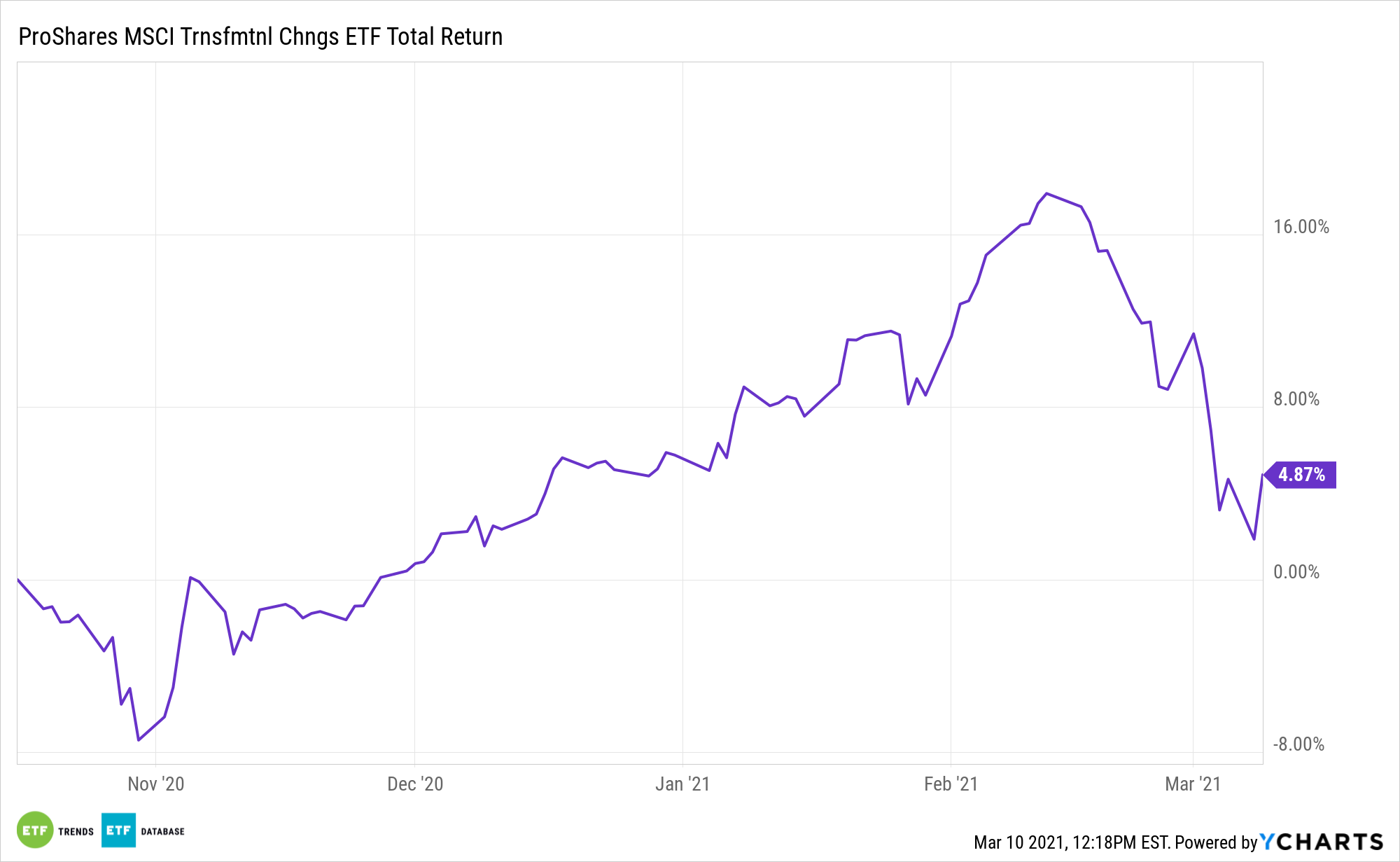

‘ANEW’ Is Delivering the Goods

ANEW’s multi-theme approach is relevant for investors that want the convenience of growth-oriented disruptive avenues under a single umbrella. ANEW’s online retail exposure checks those boxes.

Moving on to digital shopping, eCommerce has come a long way. Online spending should remain elevated, at least for the early part of 2021.

“E-commerce had been expanding and penetrating the overall retail space well before the pandemic, but COVID-19 accelerated the trend, driving a substantial spike in e-commerce sales in the U.S— up 32% in Q4 of 2020 vs. Q4 2019,” notes Helfstein.

Additionally, there’s the potential to capture broad shift in economic activity ahead. Online retail has fundamentally disrupted the sector, putting pressure on traditional stores and the changing retail landscape. It may only be the beginning: under 60% of the world’s population is currently online. However, mobile devices are proliferating—especially in developing markets—and potentially creating new e-commerce consumers. Growing incomes among emerging market consumers will also increase demand for goods, especially in areas where internet access is quickly proliferating.

ANEW’s healthcare exposure is alluring, too. With its positioning at the cusp of healthcare innovation, a theme being spotlighted by the COVID-19 pandemic, ANEW is proving youthful healthcare investments can in fact thrive.

For more on multi-asset strategies, visit our Multi-Asset Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.