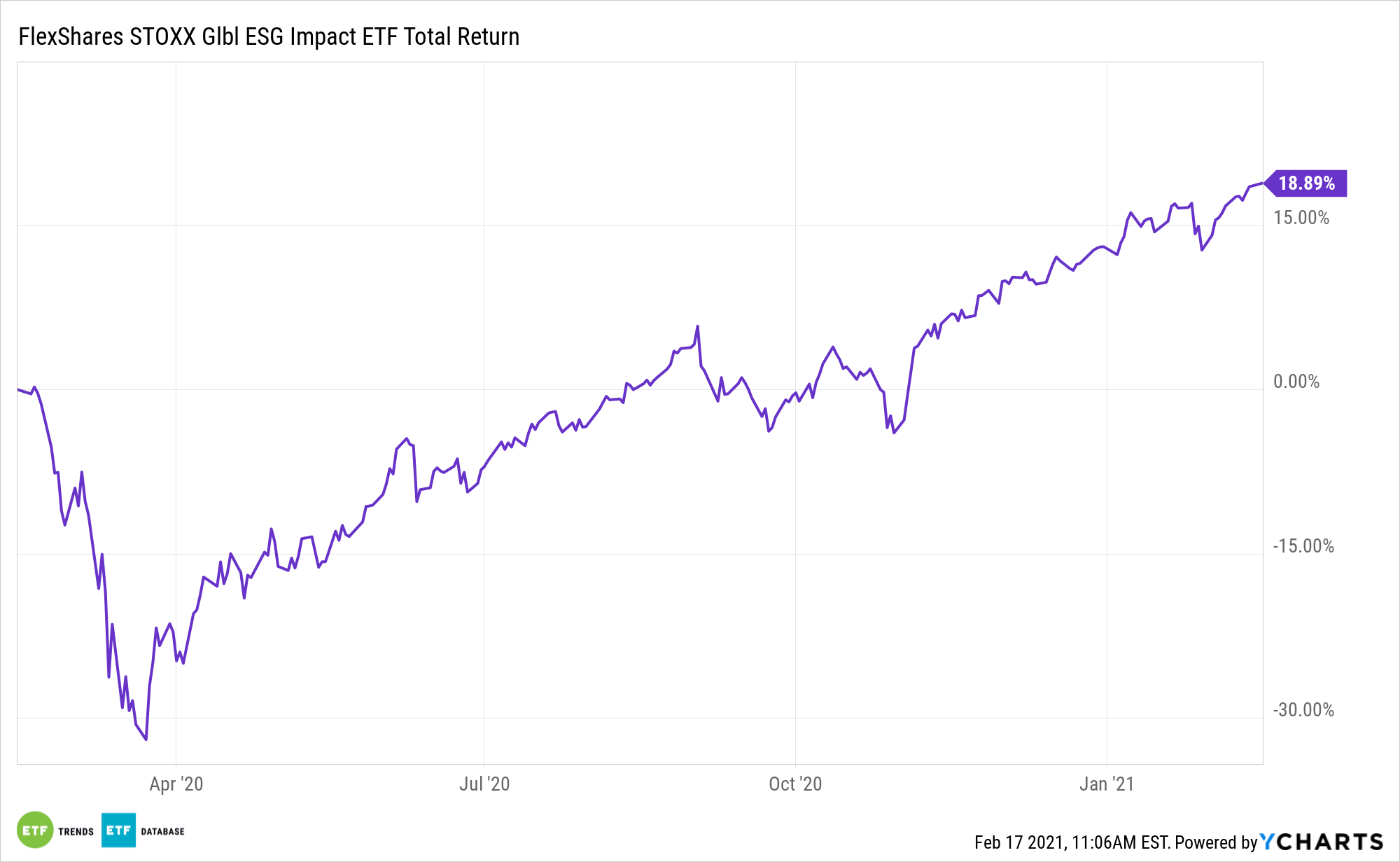

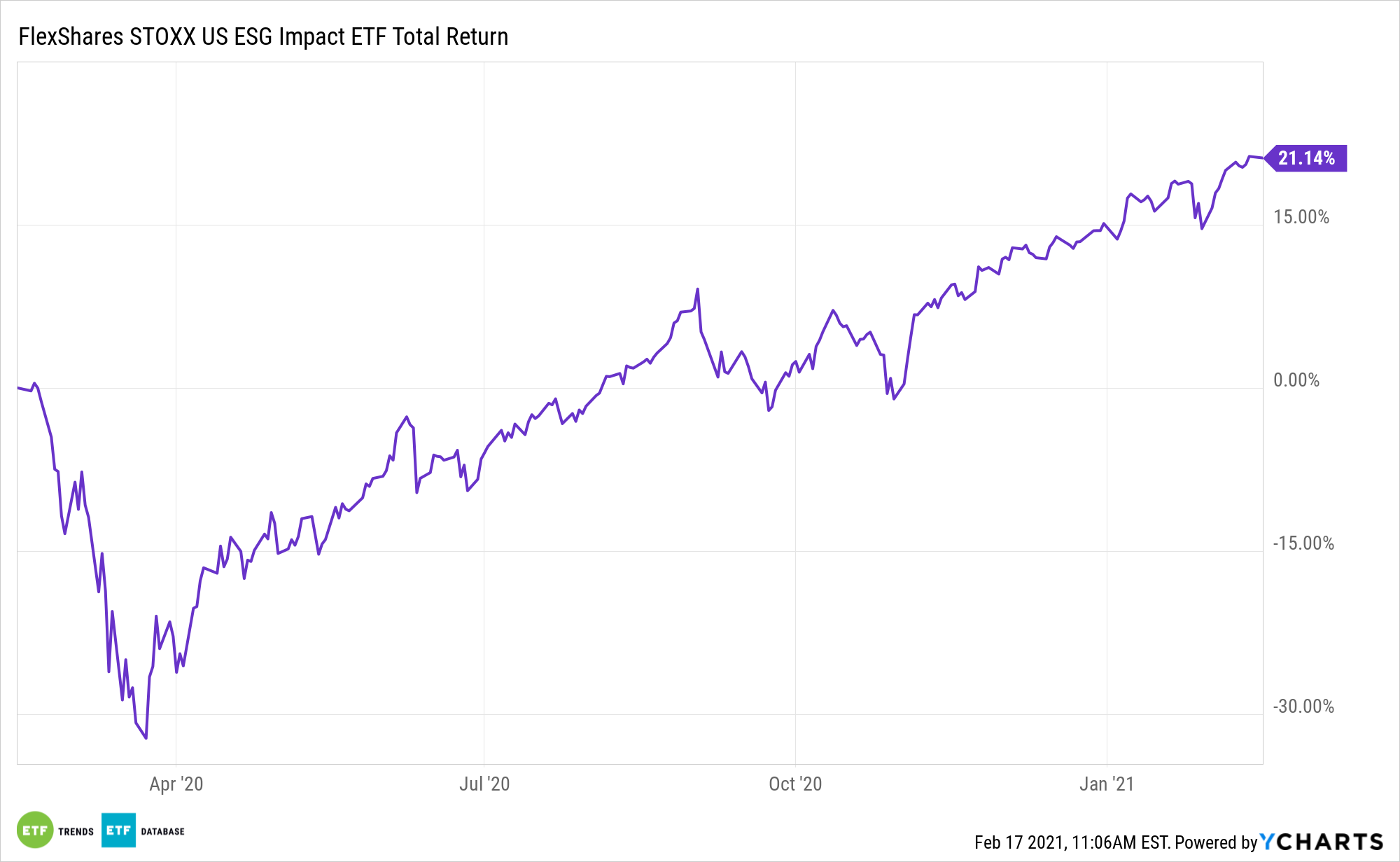

Last year, a staggering amount of capital was allocated to environmental, social, and governance (ESG) exchange traded funds, including the FlexShares STOXX US ESG Impact Index Fund (CBOE: ESG) and the FlexShares STOXX Global ESG Impact Index Fund (CBOE: ESGG).

With that renaissance just getting started, investors should remain choosy – an objective that can be accomplished with ESG and ESGG.

“Analysts at Wall Street’s biggest banks have listed their top stocks for environmental, social and governance (ESG) factors in a sector that has soared in popularity in recent years,” reports Lucy Handley for CNBC. “In the U.S. last year, investors pumped $47 billion into investment strategies that take ESG features into account, as well as financial metrics, according to Goldman Sachs. That’s almost double the amount of the previous five years combined.”

Pulling Apart the FlexShares ESG ETF

FlexShares’ ESG seeks investment results that correspond generally to the price and yield performance, before fees and expenses, of the STOXX® USA ESG Impact Index. The underlying index is designed to reflect the performance of a selection of companies that, in aggregate, possess greater exposure to ESG characteristics relative to the STOXX® USA 900 Index, a float-adjusted market-capitalization weighted index of U.S.-incorporated companies. Under normal circumstances, the fund will invest at least 80% of its total assets in the securities of the underlying index.

“Goldman’s analysts warned that the definition of ESG can be unclear and the data “unchallenged.” It has created its own scoring system for companies — the GS SUSTAIN framework — ranking firms based on 73 environmental and social factors such as greenhouse gas emissions, flexible working policies, waste recycling, diversity targets and the management of labor in supply chains,” according to CNBC. “Based on this framework, its top U.S. stocks include firms in the consumer discretionary, IT, energy and health care industries.”

Tech, consumer discretionary, and healthcare stocks combine for about 53% of ESG’s roster.

The ESG fund space could also gather more momentum if the Biden administration helps make it easier for businesses to offer sustainable funds to employees through retirement plans and 401(k)s.

For more on multi-asset strategies, visit our Multi-Asset Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.