When it comes to allocating capital in an unsure market where investors are wary that the current extended bull run can sustain itself, the cost is increasingly becoming a key component when evaluating the criteria for investment. To that end, State Street Global Advisors, the asset management business of State Street Corporation (NYSE: STT), and creators of the world’s first ETFs, recently announced index changes to four of its low-cost SPDR® Portfolio ETFs™, with a combined $11.3 billion1 in assets.

The index changes seek to respond to demand to provide a more stratified ETF toolkit that targets segments of the US equity market in a cost-effective way. For investors who prefer broad market exposure, the newly positioned funds include the only ETF currently available tracking the S&P Composite 1500® Index.

“‘Our goal is to offer products with purpose, providing a suite of low-cost precision exposures in an ETF wrapper that can then be deployed by investors as they build portfolios to deliver target investment outcomes,” said Rory Tobin, Global Head of SPDR Business at State Street Global Advisors. “There is strong investor demand for S&P benchmarks with over $12.5 trillion in global assets tracking their indices.2 SPDR is now the only ETF provider that offers the full spectrum of low-cost S&P ETFs spanning the S&P 500®, S&P MidCap 400®, S&P SmallCap 600® and S&P Composite 1500® – as well as the S&P 500® Growth, Value and Dividend style exposures.”

“Almost 27 years ago to the day, we launched SPY, the SPDR S&P 500 ETF Trust, the innovation that sparked the ETF investing revolution,” said Sue Thompson, Head of SPDR Americas Distribution at State Street Global Advisors. “Today we continue our history of democratizing investing with funds among the lowest cost in the industry – including an ETF indexed to the S&P 500 with a total expense ratio of 3 basis points. Taken together, our S&P products are designed to cater to both the ‘buy and hold’ investor as well as to those that value the flexibility of industry-leading levels of liquidity. In short, whichever feature investors value, we have a suite of S&P ETFs to suit their potential needs.”

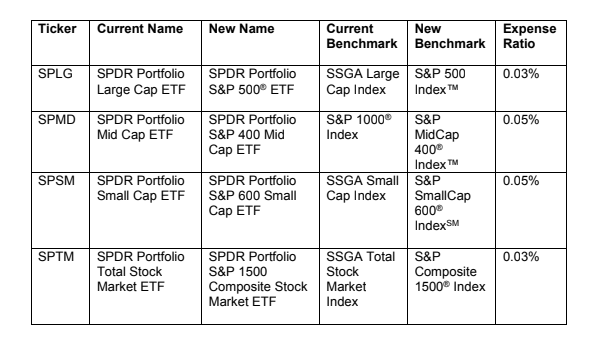

The index and name changes detailed below are effective as of market open on January 24, 2020.

Per the SSGA website, these funds offer “diversified and tax-efficient stock and bond index funds, available from as little as 3 bps. Covering US equity, international equity, and fixed income asset classes, they are designed to help investors allocate for the long term. They have a median cost 93% lower than the median US-listed mutual fund.”

For more market trends, visit ETF Trends.