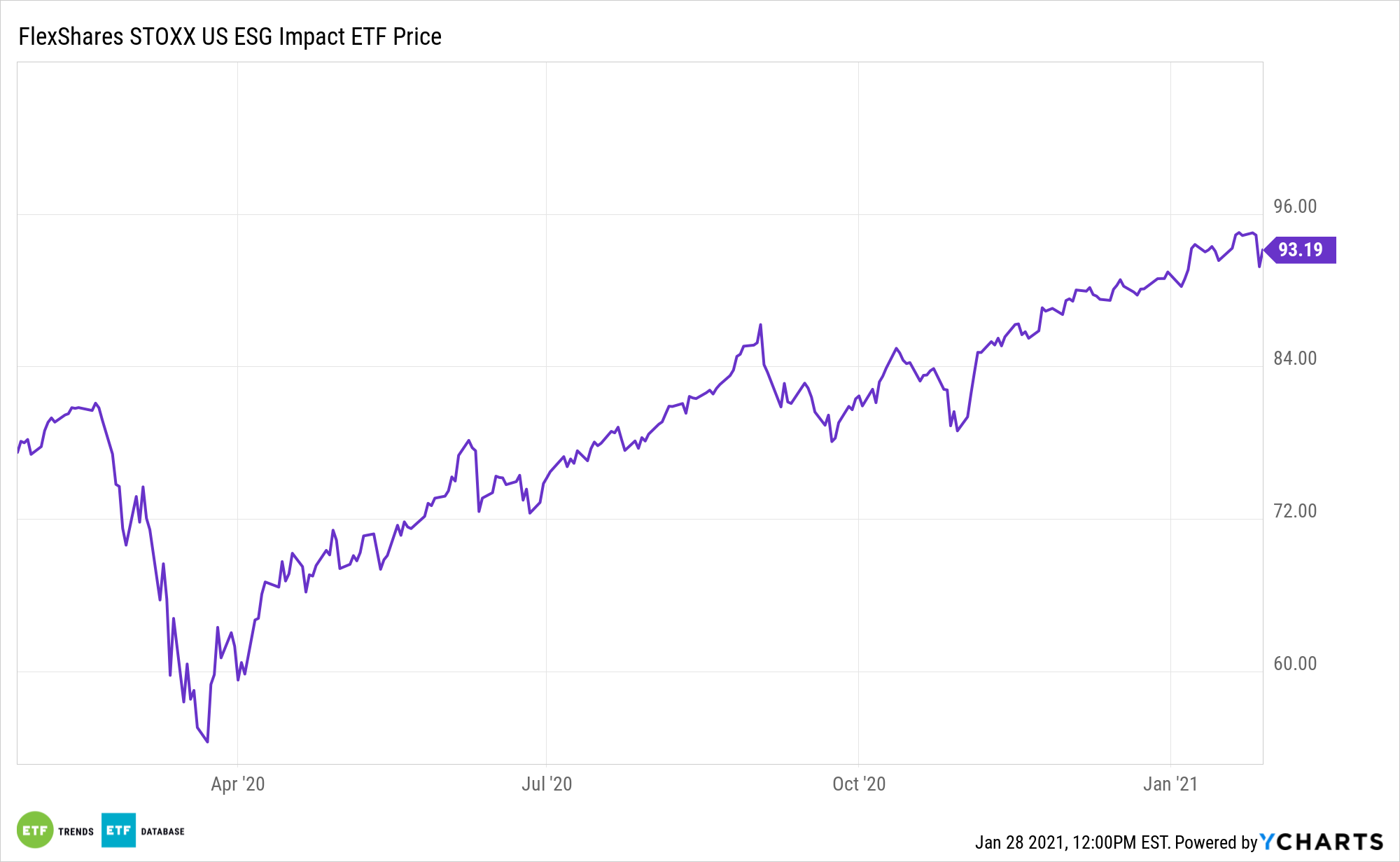

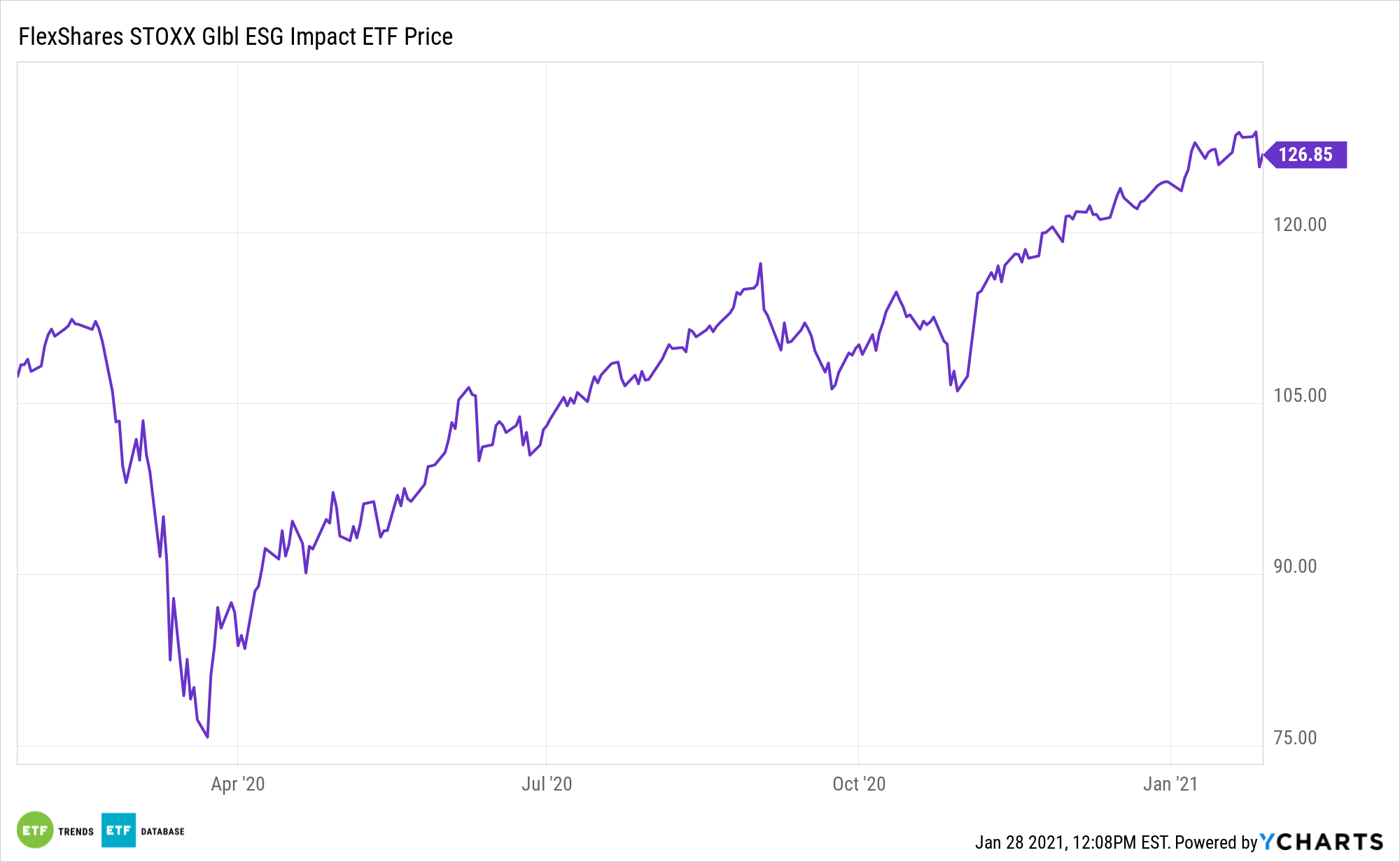

Environmental, social, and, governance (ESG) exchange traded funds, including the FlexShares STOXX US ESG Impact Index Fund (CBOE: ESG) and the FlexShares STOXX Global ESG Impact Index Fund (CBOE: ESGG), notched an array of milestones last year.

Those landmarks include outperforming traditional equity benchmarks and a prolific pace of asset gathering.

“Assets invested in ESG (Environmental, Social, and Governance) ETFs and ETPs reached a new milestone of US$187 billion at the end of 2020. Assets invested in ESG ETFs and ETPs increased by 206% in 2020,” according to ETFGI, a London-based ETF research firm.

Flows to ESG ETFs accelerated late in 2020.

“During December ESG ETFs and ETPs gathered net inflows of US$18.46 billion during, bringing 2020 net inflows to US$88.95 billion which significantly greater than the US$27.79 billion gathered in 2019,” adds ETFGI.

ESG Excellence Gaining Steam

FlexShares’ ESG seeks investment results that correspond generally to the price and yield performance, before fees and expenses, of the STOXX® USA ESG Impact Index. The underlying index is designed to reflect the performance of a selection of companies that, in aggregate, possess greater exposure to ESG characteristics relative to the STOXX® USA 900 Index, a float-adjusted market-capitalization weighted index of U.S.-incorporated companies. Under normal circumstances, the fund will invest at least 80% of its total assets in the securities of the underlying index.

In 2020, funds with exposure to less environmental, social, and governance risks outperformed those that did not account for ESG principles.

Jeffrey Ptak, head of global manager research for Morningstar, points out that funds courting less ESG risks beat their benchmark indices more often and with a greater average margin than funds courting more ESG risk in 2020.

Around 46% of funds rated ‘High’ or exhibiting low ESG risk generated higher returns compared to their benchmark, while only 30% of funds rated ‘Low’ or showing high ESG risk did the same. Furthermore, there was a better average payoff to investing in funds that courted less ESG risk, as these funds beat their benchmarks by a larger average margin than funds with lower ESG ratings.

“Since the launch of the first ESG ETF/ETP in 2002, the iShares MSCI USA ESG Select ETF, the number and diversity of products has increased steadily. Globally there were 497 ESG ETFs and ETPs, with 1,452 listings, assets of U$187 Bn, from 113 providers listed on 35 exchanges in 29 countries at the end of 2020,” concludes ETFGI.

For more on multi-asset strategies, visit our Multi-Asset Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.