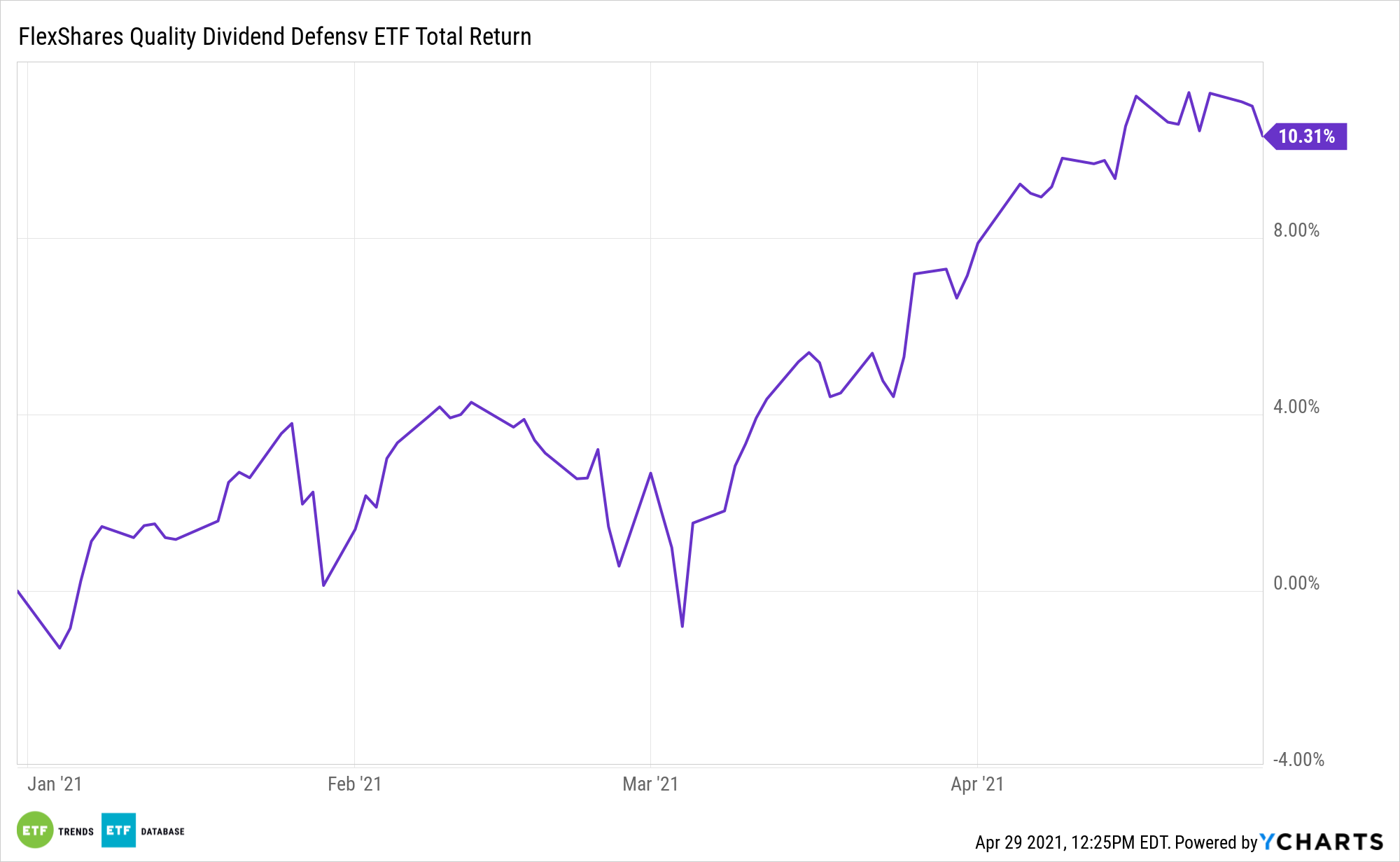

Value is getting plenty of adulation this year, but combing through it with the quality factor can be potent. One avenue for doing that is the FlexShares Quality Dividend Defensive Index Fund (NYSEArca: QDEF).

QDEF’s underlying index is designed to reflect the performance of a selection of companies that, in aggregate, possess greater financial strength and stability characteristics relative to the Northern Trust 1250 Index, a float-adjusted market-capitalization weighted index of U.S. domiciled large- and mid-capitalization companies. The fund will invest at least 80% of its total assets (exclusive of collateral held from securities lending) in the securities of the underlying index.

QDEF is useful today because some investors may have loaded about on lower quality value names as the factor started rebounding late last year.

“Since November several related themes have dominated the markets: a remarkably quick vaccine effort, layer-upon-layer of fiscal stimulus, growing fears of inflation and higher interest rates. Against this backdrop, investors have rotated from secular growth companies to high beta, more cyclical and lower quality value stocks,” according to BlackRock’s Russ Koesterich.

Defensive and Dependable

As a result of today’s low interest rate environment and a value resurgence, some investors are flocking to high dividend stocks.

While those names may appear attractive on a yield basis, history proves high-yield companies are often vulnerable to negative dividend action – cuts or suspensions. With its quality emphasis, QDEF can steer investors away from payout offenders.

Another hallmark of quality is reliable growing earnings, which also support the 2021 case for QDEF.

“Given this dynamic I would look to trim the highest volatility names in favor of higher quality issues. Besides quality, another theme to lean into is earnings momentum. Unlike last year when earnings multiples surged, this year’s gains are being driven by earnings growth. Companies witnessing positive analyst earnings revisions are more likely to lead,” adds Koesterich.

Offering investors a veritable buffet of value, quality, dividend and earnings growth, QDEF is ideally positioned for today’s market.

“While this bull market is barely a year old, with major averages more than 80% above the 2020 lows we are no longer in the first stage. As the bull market matures chasing volatility may be less rewarding. Instead, focus on cyclical exposure, a reasonable price and an ability to drive earnings growth,” concludes Koesterich.

For more on multi-asset strategies, visit our Multi-Asset Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.