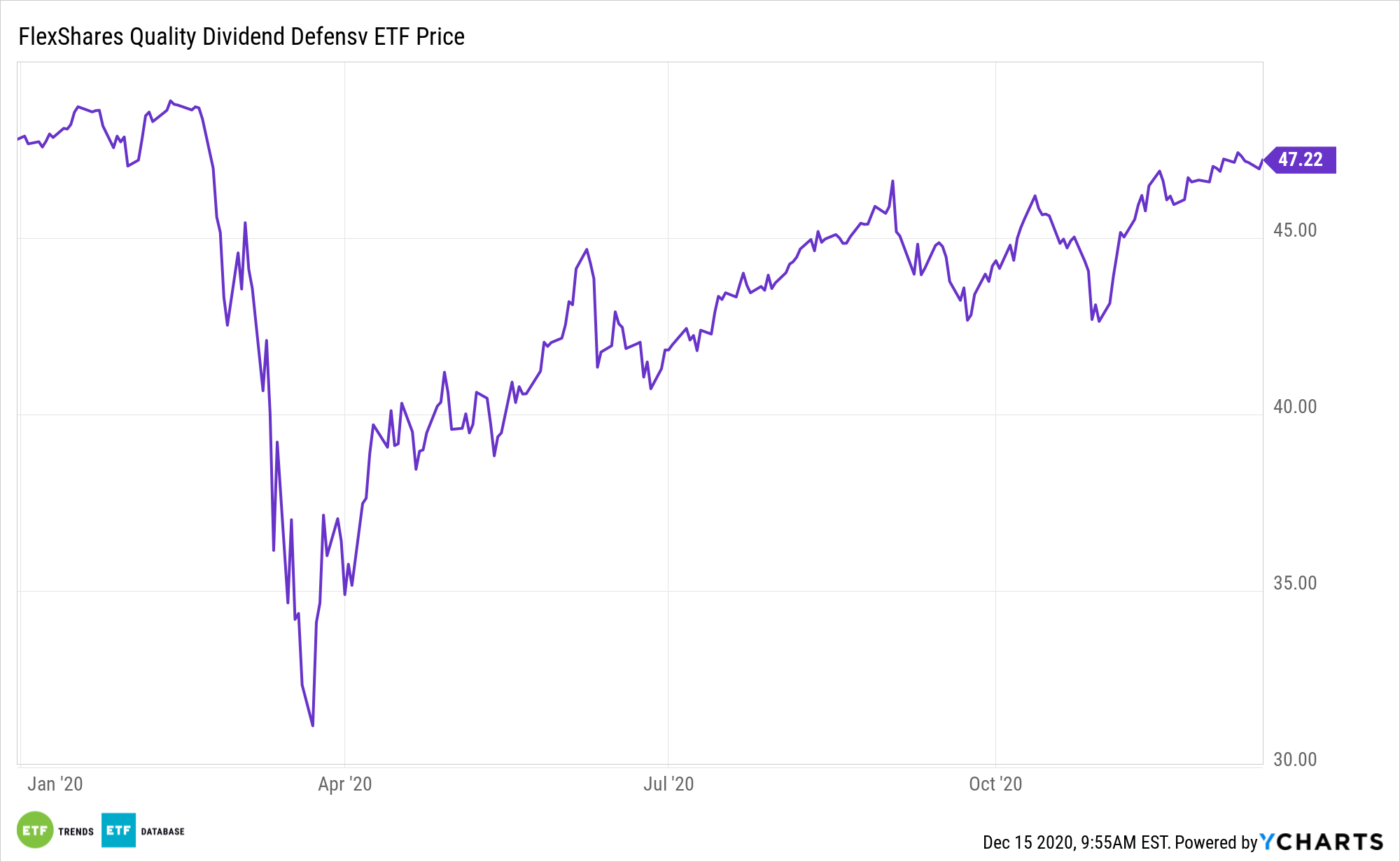

Expect big things from dividend stocks and payout growth next, scenarios highlighting opportunities with the FlexShares Quality Dividend Defensive Index Fund (NYSEArca: QDEF).

QDEF’s underlying index is designed to reflect the performance of a selection of companies that, in aggregate, possess greater financial strength and stability characteristics relative to the Northern Trust 1250 Index, a float-adjusted market-capitalization weighted index of U.S. domiciled large- and mid-capitalization companies. The fund will invest at least 80% of its total assets (exclusive of collateral held from securities lending) in the securities of the underlying index.

“The key seems to be focusing on those with high but sustainable payouts,” reports Spencer Jakab for the Wall Street Journal. “Slicing large U.S. companies into quintiles by dividend yield found that the second-highest-yielding group beat the market most consistently each year over many decades. Measured from 1928 through 2019, a basket of dividend payers in that quintile saw a $1 investment turn into $25,395, according to Dartmouth College.”

Are the Stars Aligning for QDEF?

As income-minded investors look for ways to bolster returns in a low-rate environment, various exchange traded funds can rise to the challenge. QDEF’s underlying portfolio weights is favorable for the current market environment.

Dividend-growing companies are high-quality names. Steady dividend payouts have also helped produce improved risked-adjusted returns over time.

The high-quality focus may additionally help dividend growers outperform or do less poorly than the broader markets during weaker periods. QDEF is also relevant because of the Federal Reserve’s low interest rate policy and value’s rebound newfound rebound.

“Part of the answer for why dividends mattered is that reinvesting them during those bleak times paid off—easier said than done when investors get discouraged. But another is what sort of company pays them in the first place. A dividend payer is more likely to be a value stock,” according to the Journal. “Value is out of fashion now, like it was in the 1990s and other bullish periods, but cheap stocks shine when the party ends. The same might not be true for companies that mostly reward shareholders through buybacks since they are much quicker to slash them just as stocks plunge.”

FlexShares’ quality dividend indexing methodology targets management efficiency or quantitative evaluation of a firm’s deployment of capital and its financing decisions. By using a management efficiency screen, the index can screen out firms that aggressively pursue capital expenditures and additional financing, which typically lose flexibility in both advantageous and challenging partitions of the market cycle.

For more on multi-asset strategies, visit our Multi-Asset Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.