Stocks in Japan, the world’s third-largest economy, are rebounding. Investors can capitalize on that theme without the constraints of a dedicated Japan exchange traded fund with the FlexShares Developed Markets ex-US Quality Low Volatility Index Fund (NYSE: QLVD).

QLVD’s quality screen analyzes a broad universe of equities based on key indicators such as profitability, management efficiency, and cash flow, and then excludes the bottom 20% of stocks with the lowest quality score. The index is then subject to the regional, sector, and risk-factor constraints, in order to manage unintended style factor exposures, significant sector concentration, and high turnover.

“Nikko Asset Management’s John Vail said the Japanese benchmark index is set to trade even higher going into 2021, as stocks in the world’s third largest economy are ‘sort of firing on all cylinders,’” reports Eustance Huang for CNBC.

Japanese stocks account for over a quarter of QLVD’s weight, making the country the fund’s largest geographic exposure.

Japanese Economic Strength

Japan is more than capable of weathering a storm. In addition to the pandemic, the country has had to endure a change of leadership, installing a new prime minister just two months ago.

Japan does show some solid fundamentals. Specifically, the weaker yen, strong corporate fundamentals, bargain valuations, and central bank buying are all positives. Furthermore, Japan’s political temperature is relatively stable. Further still, stocks in the world’s third-largest economy are inexpensive relative to their U.S. counterparts.

“North Asia has often been praised for its relatively strong management of the coronavirus pandemic, with major economies in the region weathering the crisis better compared to some of their peers elsewhere,” according to CNBC. “The recent bounce in Japanese stocks has in part also been bolstered by positive momentum on the coronavirus vaccine front that triggered gains across many major markets globally, with the Dow Jones Industrial Average breaching the 30,000 level.”

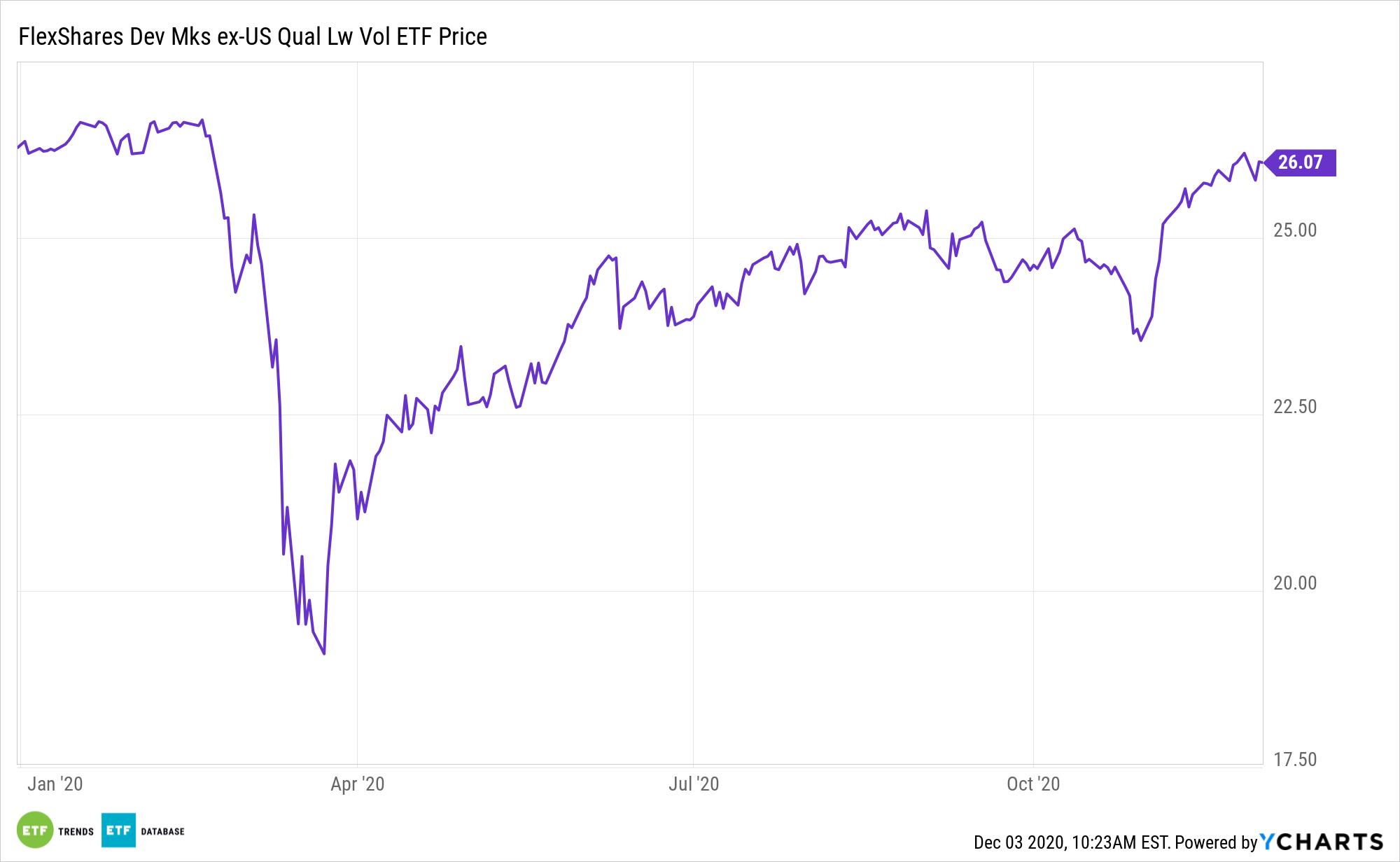

Quality should not be conflated with low volatility, but there are times when quality stocks display low volatility traits. That was the case during the March market swoon, indicating that the quality factor can provide some protection during times of elevated market stress. QLVD’s ability to blend both factors is a potential advantage for investors.

Home to some of the strongest balance sheets in the developed markets, Japan has plenty of quality companies capable of boosting shareholder rewards.

For more on multi-asset strategies, visit our Multi-Asset Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.