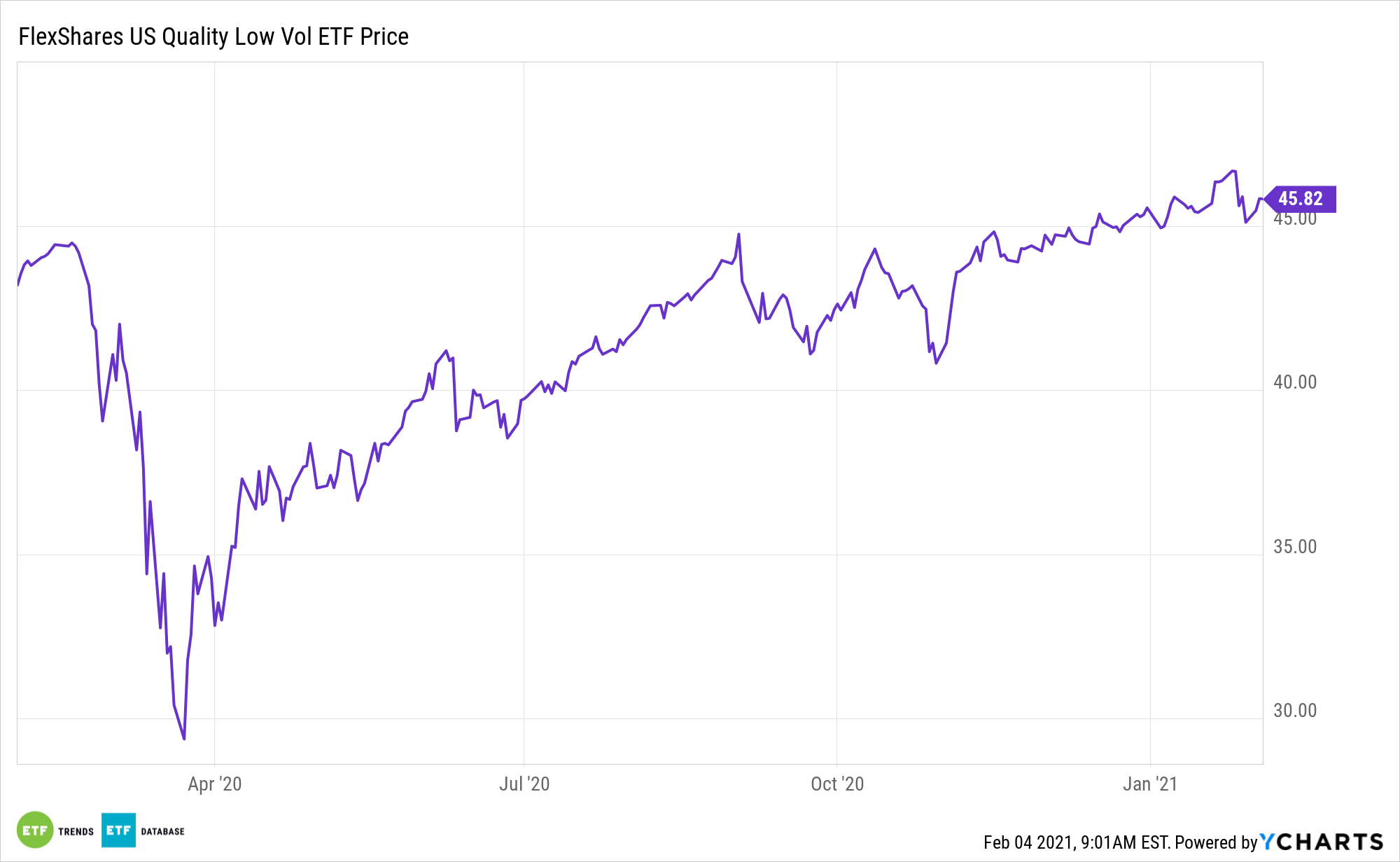

With quality growth stocks still in style and cyclical stocks performing well, investors may want to consider strategies with exposure to both factors. It doesn’t advertise as such, but the FlexShares US Quality Low Volatility Index Fund (NYSE: QLV) accomplishes that objective.

QLV follows the Northern Trust US Quality Low Volatility Index. The ETF’s benchmark employs a quality screen to provide exposure to high-quality companies with lower absolute risk, thereby limiting potential future volatility. The quality screen analyzes a broad universe of equities based on key indicators such as profitability, management efficiency, and cash flow, and then excludes the bottom 20% of stocks with the lowest quality score. The index is then subject to the regional, sector, and risk-factor constraints, in order to manage unintended style factor exposures, significant sector concentration, and high turnover.

“Some growth businesses may be permanently accelerated by COVID, but for others, the 2020 bump was a temporary pull-forward of demand,” according to BlackRock research. “Meanwhile, cyclical value stocks, those with ties to economic growth and low valuations, have been most depressed and should enjoy a larger bounce with market and economic recoveries. A look back also shows that value historically has outperformed in the early stages of a recovery.”

Why QLV Is the Right Idea, Right Now

QLV integrates rigorous fundamental analysis through a quality screen of US-based companies that can be viewed as a means to mitigate future volatility. FlexShares believes this is different than other low volatility funds that may utilize only historical return and/or correlation data in hopes that the lower volatility will carry forward.

Translation: QLV has the potential to outshine standard low volatility strategies while providing investors with decent growth allocations and exposure to the value resurgence.

“Notwithstanding our outlook for a value resurgence, we see good reason to stick with stocks with dominant and emerging business models that can continue to deliver for shareholders. Sectors like technology and healthcare contain many high-quality businesses with the ability to compound growth across time,” writes BlackRock.

Technology and healthcare are QLV’s two largest sector allocations, combining for about 42.5% of the fund’s weight.

For more on multi-asset strategies, visit our Multi-Asset Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.