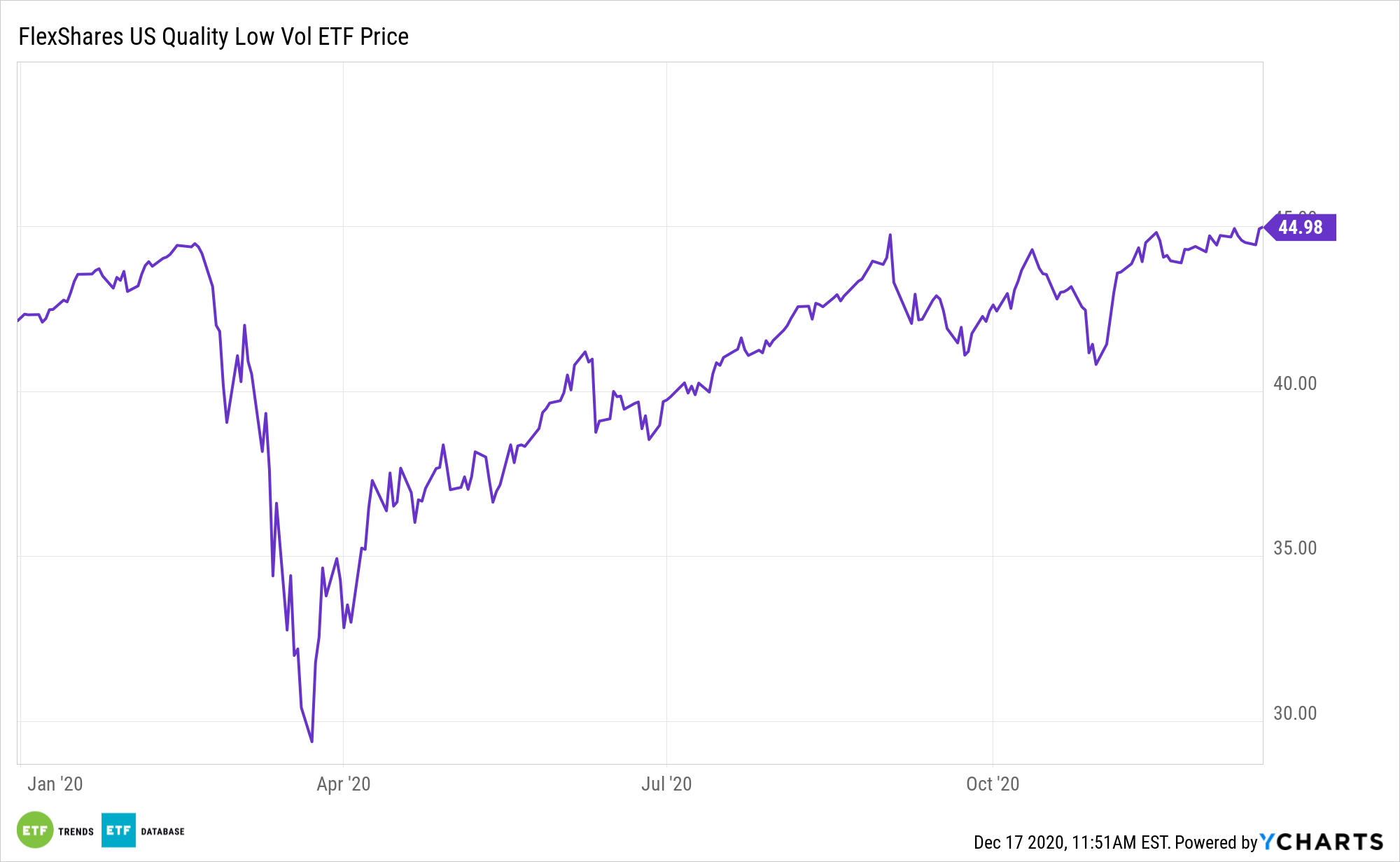

The quality factor is serving investors well in 2020, but with talk of a cyclical resurgence in the works, some investors may be pondering how to blend quality and cyclical exposure. The FlexShares US Quality Low Volatility Index Fund (NYSE: QLV) accomplishes that objective while simultaneously lowering volatility.

QLV follows the Northern Trust US Quality Low Volatility Index. The ETF’s benchmark employs a quality screen to provide exposure to high-quality companies with lower absolute risk, thereby limiting potential future volatility. The quality screen analyzes a broad universe of equities based on key indicators such as profitability, management efficiency, and cash flow, and then excludes the bottom 20% of stocks with the lowest quality score. The index is then subject to the regional, sector, and risk-factor constraints, in order to manage unintended style factor exposures, significant sector concentration, and high turnover.

QLV is positioned to deliver if either growth or cyclicals rally next year.

“While growth stocks have outperformed the broader market throughout this year’s rally, many cyclical stocks have also been generating strong relative returns since market performance has become more nuanced during the past three months,” according to BlackRock research. “At the sector level, materials and industrials have been among the better performers. We see a similar pattern at the industry level. Within information technology (IT), semiconductors posted robust gains, while the less-cycle software industry generated more muted returns.”

A ‘Q’ for Quality, an ‘LV’ for Low Volatility

QLV integrates rigorous fundamental analysis through a quality screen of US-based companies that can be viewed as a potential means to mitigate future volatility. FlexShares believes this is different than other low volatility funds that may utilize only historical return and/or correlation data in hopes the lower volatility will carry forward.

QLV, as its name implies, focuses on quality and low volatility, but it does offer some cyclical exposure at the sector level. This exposure is not so much as to put investors at risk if the trade disappoints in 2021, but enough to benefit from cyclical upside next year.

“We believe the combination of considerable monetary stimulus, a strong household sector, improvements in manufacturing and growing optimism for a vaccine distribution in 2021 will support risk assets in the coming months. Sustained improvement in jobs data may be challenged in the near term, especially in industries such as restaurants, leisure and hospitality,” notes BlackRock.

For more on multi-asset strategies, visit our Multi-Asset Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.