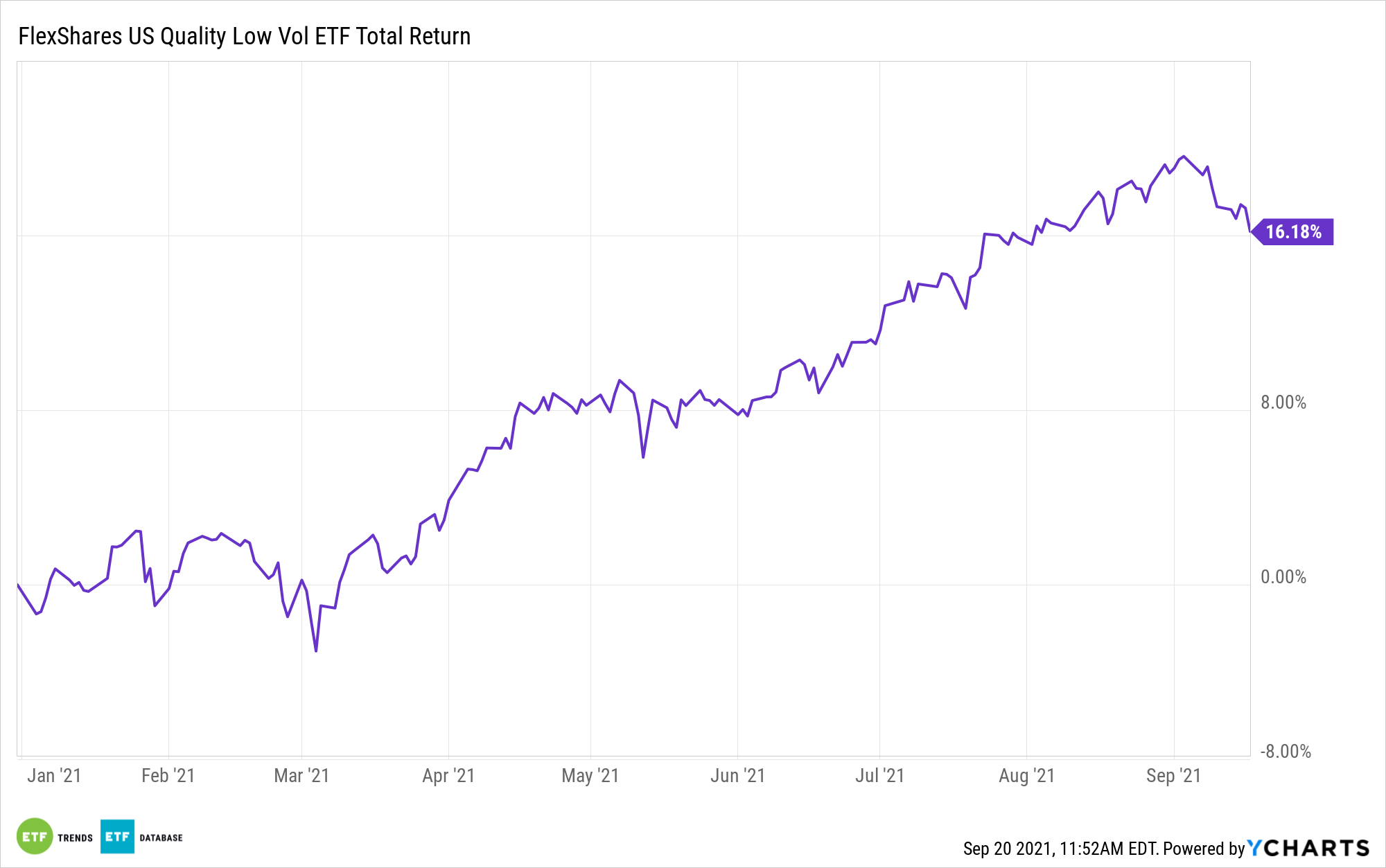

A non-volatile September could be paving the way for some larger market movements ahead, putting low-volatility ETFs like the FlexShares US Quality Low Volatility Index Fund (QLV) in focus.

“With September already acknowledged to be a seasonally weaker month for equities, stocks are now also anticipated to be entering a period of potential volatility ahead of this week’s FOMC meeting where the Fed is expected to provide more clarity on its next tapering moves,” a Investing.com article said. “As well, investors have been growing jittery as “an alarming number of companies have warned that profits won’t meet expectations when they report in a month,” noted Bloomberg on Saturday.”

A prime indicator of volatility, the CBOE Volatility Index (ViX), has primarily been heading downward year-to-date. It looks to have reached an area of support back in mid-July and could spring up heading into the end of the year.

QLV seeks investment results that correspond generally to the price and yield performance, before fees and expenses, of the Northern Trust Quality Low Volatility Index. The underlying index is designed to reflect the performance of a selection of companies that, in aggregate, possess lower overall absolute volatility characteristics relative to the Northern Trust 1250 Index, a float-adjusted market capitalization weighted index of U.S. domiciled large- and mid-capitalization companies.

“The FlexShares US Quality Low Volatility Index Fund (QLV) is designed to provide exposure to US-based companies that possess lower overall absolute volatility and that also exhibit financial strength and stability, which we believe are quality characteristics,” a FlexShares Fund Focus said.

Eyes Remain Fixated on the Fed

As mentioned, the Fed is expected to meet this week to discuss their direction on stimulus tapering. That will largely depend on how they interpret the current economic data and with that, eyes will be fixated on the Fed this week.

“Our natural inclination is to characterize the upcoming Federal Reserve meeting as eagerly awaited,” the Investing.com article added.

“It’s hard to signify just how ‘eagerly awaited’ every one of the recent Federal Reserve meetings have been, since, after years of QE, the Fed has been indicating it’s ready to trim back stimulus and consider raising interest rates,” the article said further. “Both actions are a big deal after such a lengthy period of easy money, and each announcement by itself could be dramatic enough to generate serious waves in financial markets—perhaps especially in September.”

For more news, information, and strategy, visit the Multi-Asset Channel.