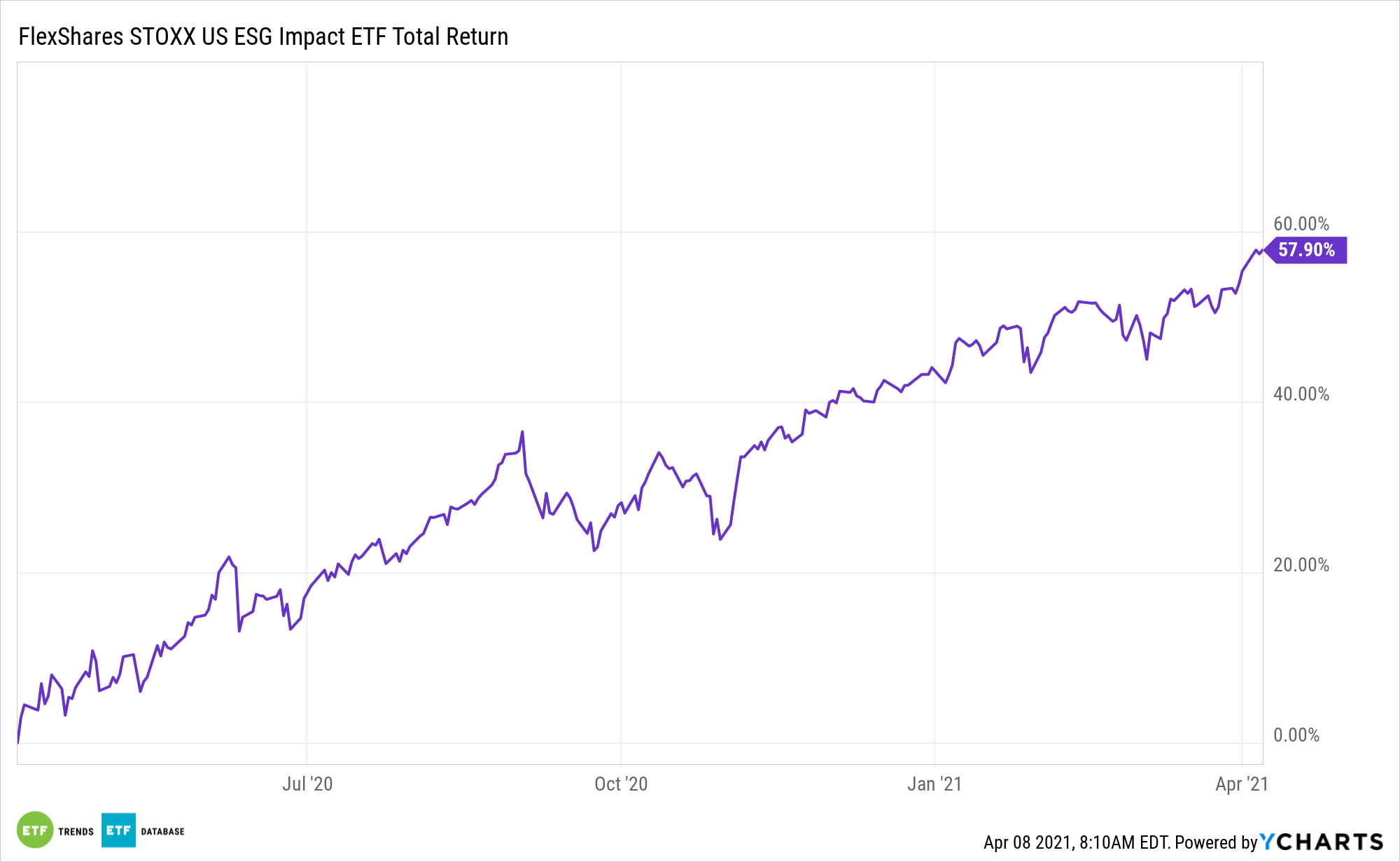

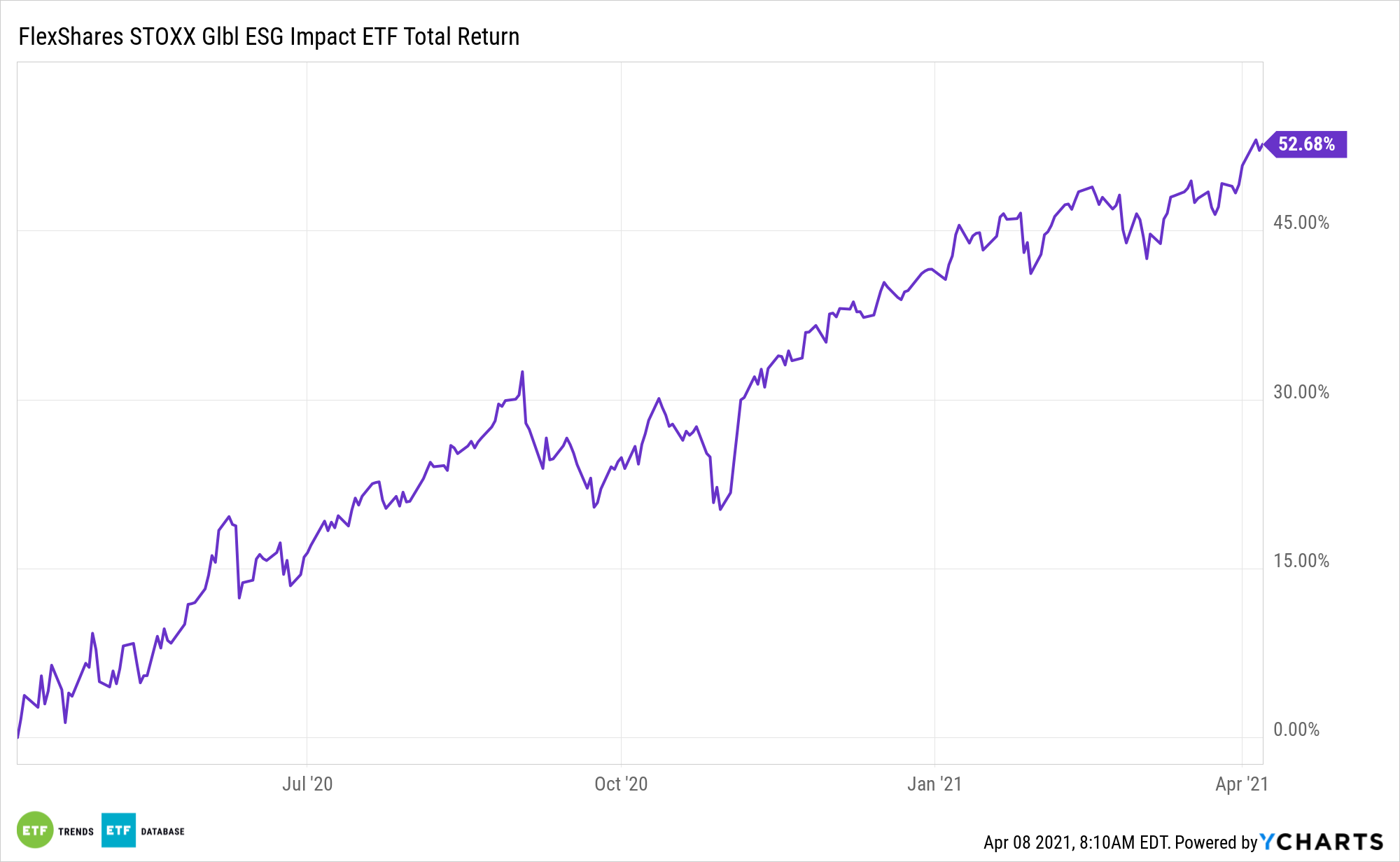

The coronavirus pandemic accelerated adoption of environmental, social, and governance (ESG), providing ballast for exchange traded funds like the FlexShares STOXX US ESG Impact Index Fund (CBOE: ESG) and the FlexShares STOXX Global ESG Impact Index Fund (CBOE: ESGG).

ESG seeks investment results that correspond generally to the price and yield performance, before fees and expenses, of the STOXX® USA ESG Impact Index. The underlying index is designed to reflect the performance of a selection of companies that, in aggregate, possess greater exposure to ESG characteristics relative to the STOXX® USA 900 Index, a float-adjusted market-capitalization weighted index of U.S.-incorporated companies. Under normal circumstances, the fund will invest at least 80% of its total assets in the securities of the underlying index.

While the pandemic provided an assist to ESG funds, the concept has long-lasting momentum.

“While the pandemic has negatively impacted some areas of the market, it has only accelerated the ESG trend. For one, it’s led to heightened emphasis on employee health and work-from-home policies,” according to FlexShares research. “Also, many have observed the environmental impact of quarantine and stay at home orders on air quality, bringing global emissions concerns to the forefront. And the pandemic has coincided with a broader societal emphasis on racial equity and renewed US commitment to green policy under the new Biden administration—both significant tailwinds for ESG strategy growth.”

The Start of Something Substantial?

Embracing ESG principles to enhance long-term value has become a strategic goal for both businesses and investors.

“The growth of ESG is evident in recent fund flows. ESG funds brought in record flows of $20.6 billion in 2019 and shattered yet another record in 2020 with $51 billion in inflows. Looking ahead, experts are projecting ESG assets to reach more than one third of global assets under management in 2025,” notes FlexShares.

See also: ESG Doubled in 2020. Can ETFs Help Do It Again in 2021?

As interest in ESG investing gains in popularity, naysayers and skeptics are coming out of the woodwork, but that shouldn’t deter investors with a sustainable investing mindset.

Practices like greenwashing are deplorable and critics have been quick to accuse fund strategies of only giving off the semblance of acting in the good faith. Nevertheless, committed ESG asset managers who are acting in the best interest of investors will continue to play an essential role in tackling key global challenges we face today.

For more on multi-asset strategies, visit our Multi-Asset Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.