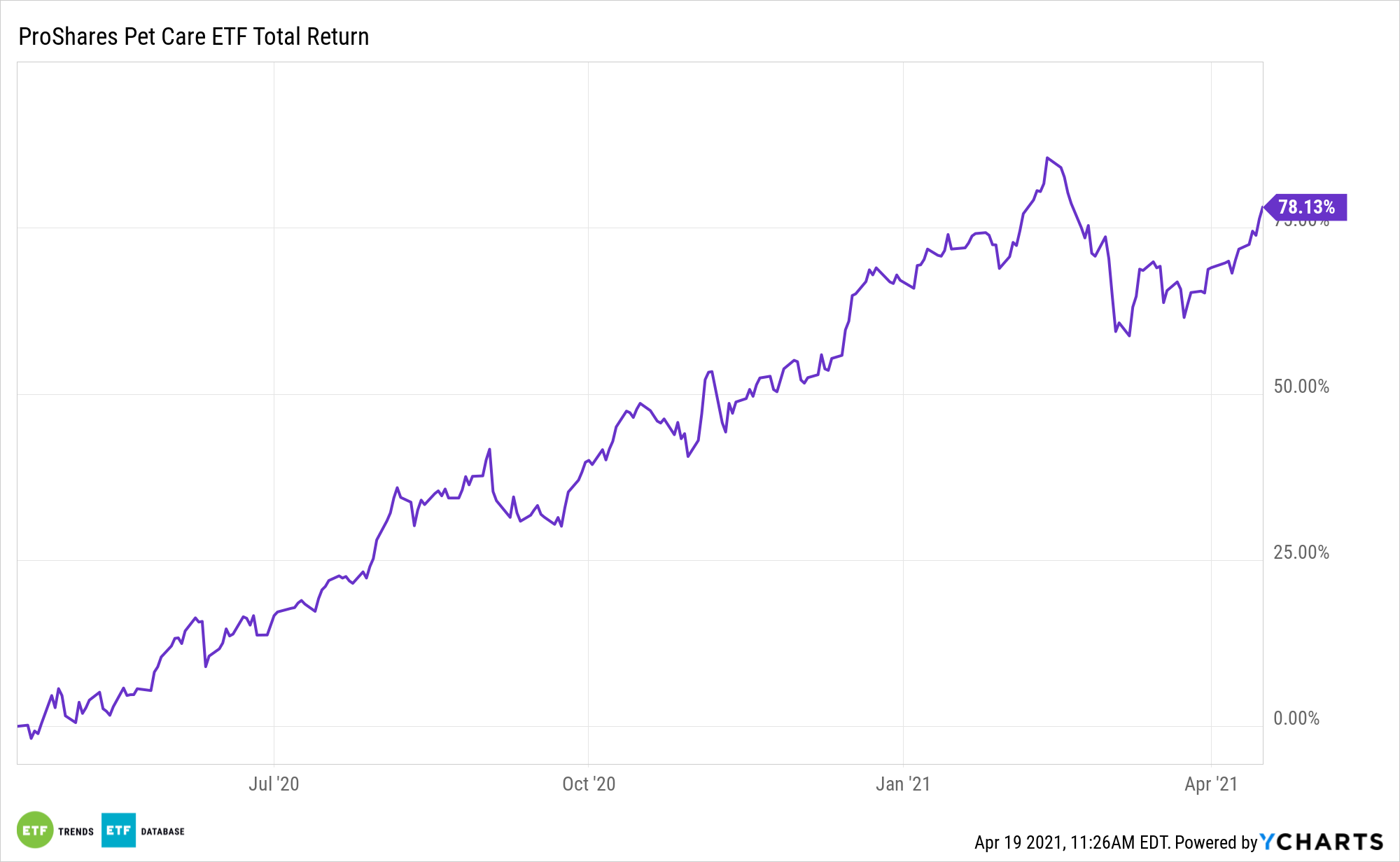

Pet adoption has soared during the coronavirus pandemic, providing another long-term tailwind for the ProShares Pet Care ETF (CBOE: PAWZ).

PAWZ, the first and only dedicated pet care and retail ETF, seek investment results, before fees and expenses, that track the performance of the FactSet Pet Care Index. The fund seeks to invest substantially all of its assets in the securities included in the index. Under normal circumstances, the fund will invest at least 80% of its total assets in the component securities of the index. The index consists of U.S. and non-U.S. companies that potentially stand to benefit from interest in and resources spent on pet ownership.

“If you’re treating your dog more like a person, you’re not alone. While the ‘humanization’ of pets has gained traction for years, dogs may have made an inexorable leap from the back yard to the sofa as people and pets bonded during the pandemic,” reports Daren Fonda for Barron’s.

A Positive ‘PAWZ’ Outlook

According to Euromonitor data, the global pet care business expanded by 7%, and is expected to enjoy an annual growth rate of about 6% through 2025, the Wall Street Journal reports.

The steady outlook is based on the calculations that the coronavirus pandemic likely increased the size of the pet population in key markets, so more pet owners will continue to support the industry. The numbers may have been even higher if not for supply constraints like empty shelters before the pandemic and breeder difficulty in meeting demand, which has caused a spike in prices.

PAWZ includes sectors such as veterinary pharmaceuticals, diagnostics, services, and product distributors; pet and pet supply stores; and pet food and supply manufacturing. Healthcare and retail stocks make up a significant portion of the PAWZ roster, and the ProShares ETF has the potential to outperform traditional funds tracking those sectors.

“Pet-supply sales are going strong as pet owners buy everything from kibble infused with quinoa and avocado to hip-and-joint supplements to prevent arthritis. Animal-health product sales are growing by 7% annually, reaching $11 billion in 2020. Retail sales are rising faster as volumes shift from vet offices to stores and online channels,” adds Barron’s.

FactSet identifies the company’s principal business as being pet care related. The index will tap into eight FactSet pet care subindustries, including pet food manufacturing, veterinary services, veterinary pharmaceuticals, pet supplies manufacturing, internet pet/supply retail, veterinary product distributors, pet supply stores, and veterinary diagnostics.

For more on multi-asset strategies, visit our Multi-Asset Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.