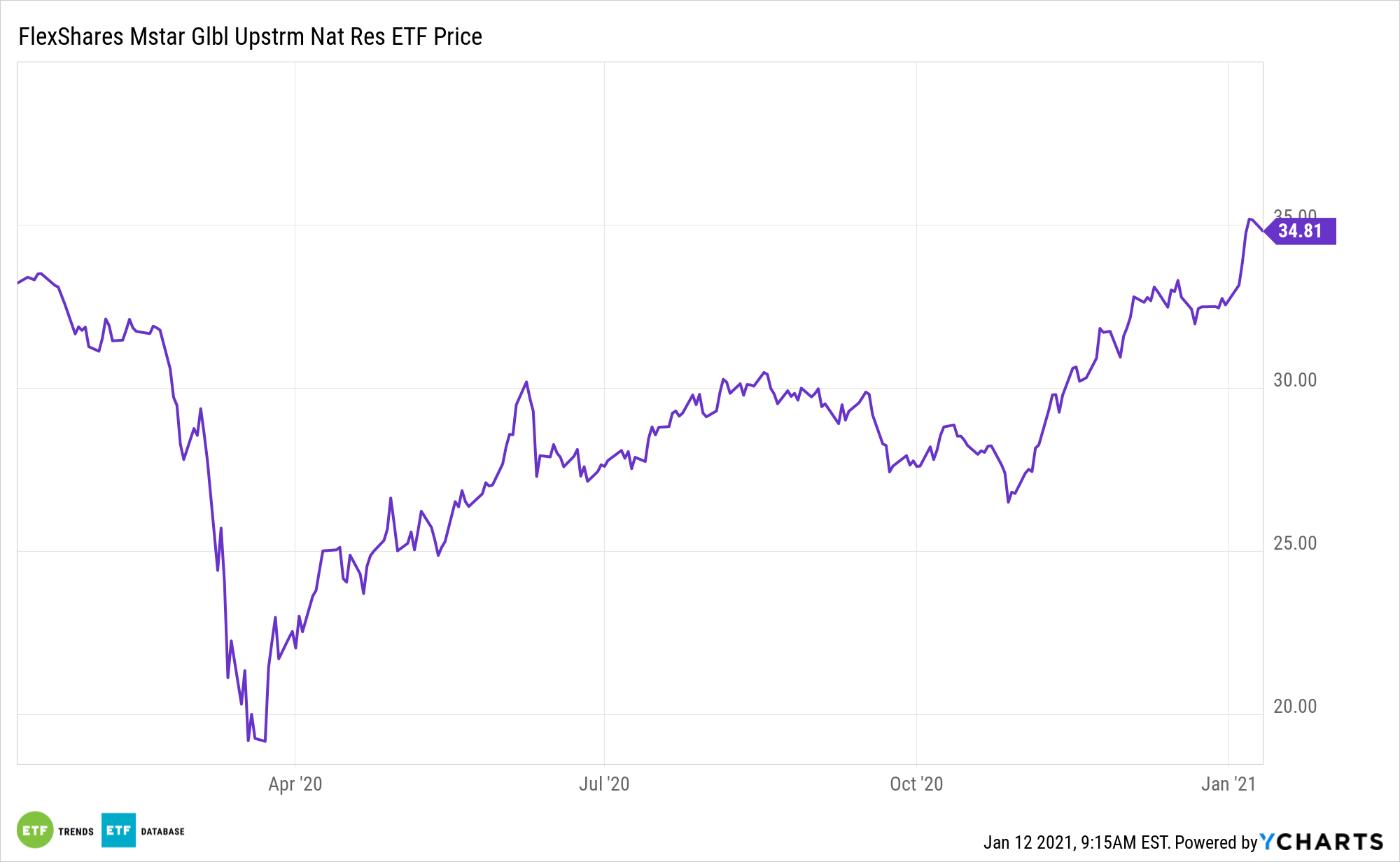

After being drubbed for much of 2020, oil prices and the energy sector are off to sound starts in 2021, and some market observers are forecasting more upside for exchange traded funds like the FlexShares Morningstar Global Upstream Natural Resource Index Fund (NYSEArca: GUNR).

GUNR provides exposure to the rising demand for natural resources, and tracks global companies in the energy, metals, and agriculture sectors. It maintains a core exposure to the timberlands and water resources sectors, part of its risk management theme.

“Goldman Sachs sees Brent crude oil rising to $65/bbl by the middle of this year, as much as six months earlier than it previously forecast, as increased demand from the rollout of COVID-19 vaccines and potential delays in restarting OPEC+ production keeps the oil market tight over the coming months,” according to Seeking Alpha.

Oil prices can finally put 2020 behind them, as the commodity hit the negative territory in a pandemic-ridden year. However, oil is off to a solid start in 2021.

Breaking Down the Energy Outlook

OPEC will always have a say in which direction oil prices will go. However, it looks like they’re looking to also put 2020 behind them, with a recent move from one of its biggest members.

Energy’s late 2020 resurgence is widely attributable to success on the coronavirus vaccine front. The faster a vaccine comes to market, the more rapidly demand will increase as industry ramps up and Americans unleash pent-up travel demand.

GUNR specifically identifies upstream natural resources equities based on a Morningstar industry classification system, with a balanced exposure to three traditional natural resource sectors, including agriculture, energy, and metals. With some wild moves in downtrodden energy stocks, the gambling element of energy investing is back, but investors can take some risk out of the equation with GUNR.

“The likelihood of a fast tightening market from 2Q 2021 is rising as the rebound in demand stresses the ability of producers to restart production,” notes Goldman Sachs.

GUNR is up almost 7% to start 2021.

For more on multi-asset strategies, visit our Multi-Asset Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.