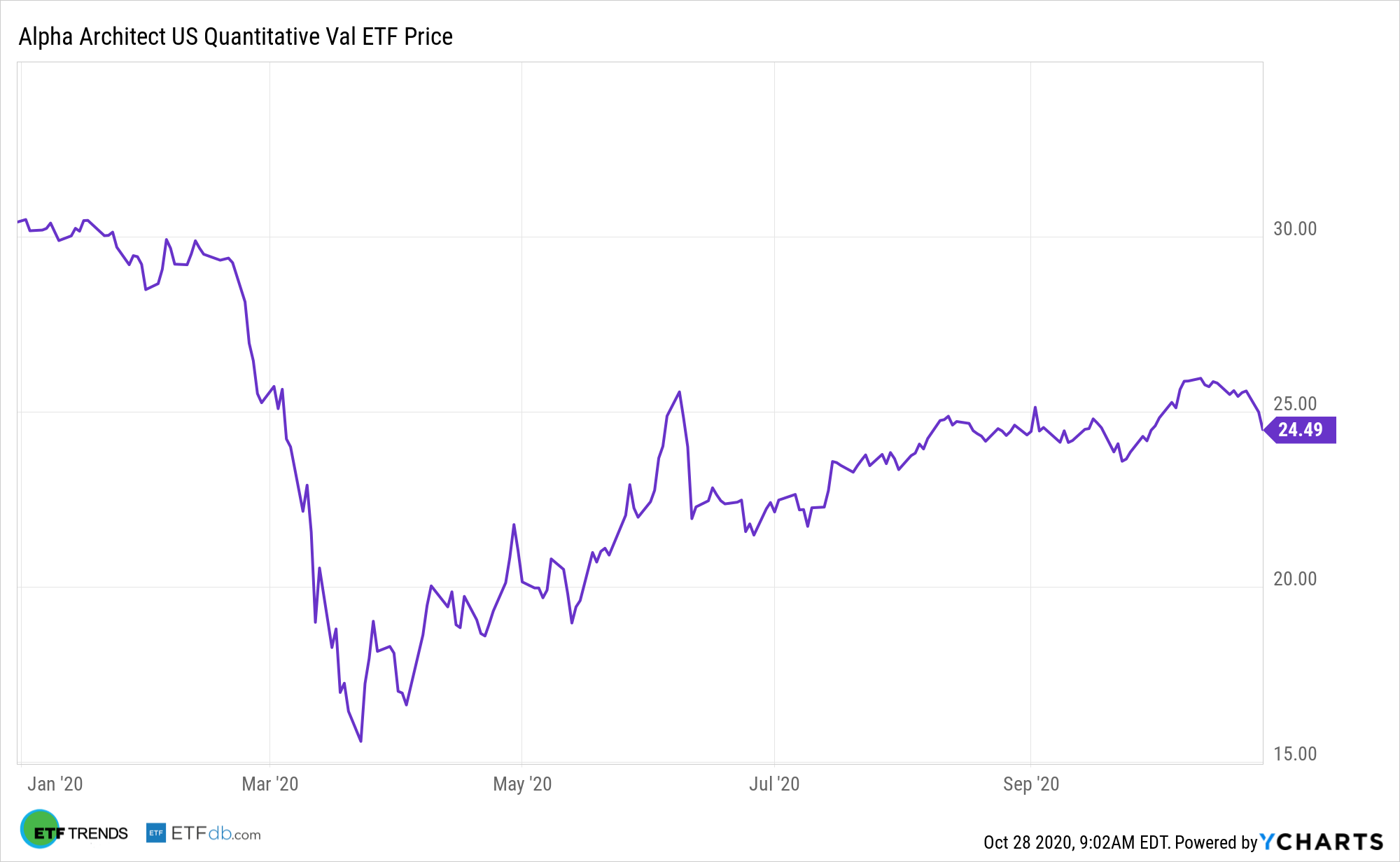

At a time when value stocks continue vexing investors, it can pay to examine fresher approaches to the once-beloved metric. Enter Alpha Architect’s U.S. Quantitative Value ETF (CBOE: QVAL).

With QVAL, Alpha Architect tries to eliminate any company with dubious finances or accounting schemes, along with stocks with operating cash flows that persistently fall behind net income, volatile financial statement ratios, high leverage, and rapid sales growth. The remaining picks are then sorted by earnings before interest and taxes, or EBIT, over total enterprise value, or TEV. TEV is equal to market cap plus debt, minus excess cash, preferreds and minority interests.

“Instead of using traditional metrics such as price-to-earnings and price-to-book ratios, the firm uses earnings before interest and taxes / total enterprise value (EBIT/TEV),” reports Forbes. “While not identical, this metric is closer to the free cash flow (FCF) yield calculation used in my overall risk/reward ratings than more traditional metrics.”

QVAL: A Better Value Mousetrap?

Value stocks tend to trade at a lower price relative to their fundamentals (including dividends, earnings, and sales). While they generally have solid fundamentals, value stocks may have lost popularity in the market and are considered bargain priced compared with their competitors. However, QVAL extends beyond that approach.

QVAL managers “also try to account for the unreliability of reported numbers by using ‘forensic accounting screens’ that look for differences between reported earnings and cash from operations,” according to Forbes.

Economic moats are also emphasized in QVAL, a rarity among value ETFs, but a possible advantage for investors.

Investing in companies with a sustainable competitive advantage and trading at attractive prices can be one way to manage market turbulence. The economic moat investment strategy can help investors achieve improved long-term, risk-adjusted return by focusing on quality companies that help limit downside risk while still participating in potential gains.

QVAL holdings are superior to those found in traditional, broad-based value benchmarks on the basis of vital metrics, such as cash flow analysis, and price-to-enterprise book value.

“The market expectations for stocks held by QVAL imply permanent profit decline (measured by PEBV ratio) while the expectations embedded in IWS’s holdings imply a more than tripling of profits. High historical profits and low expectations for future profits are an attractive combination,” according to Forbes.

For more on multi-asset strategies, please visit our Multi-Asset Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.