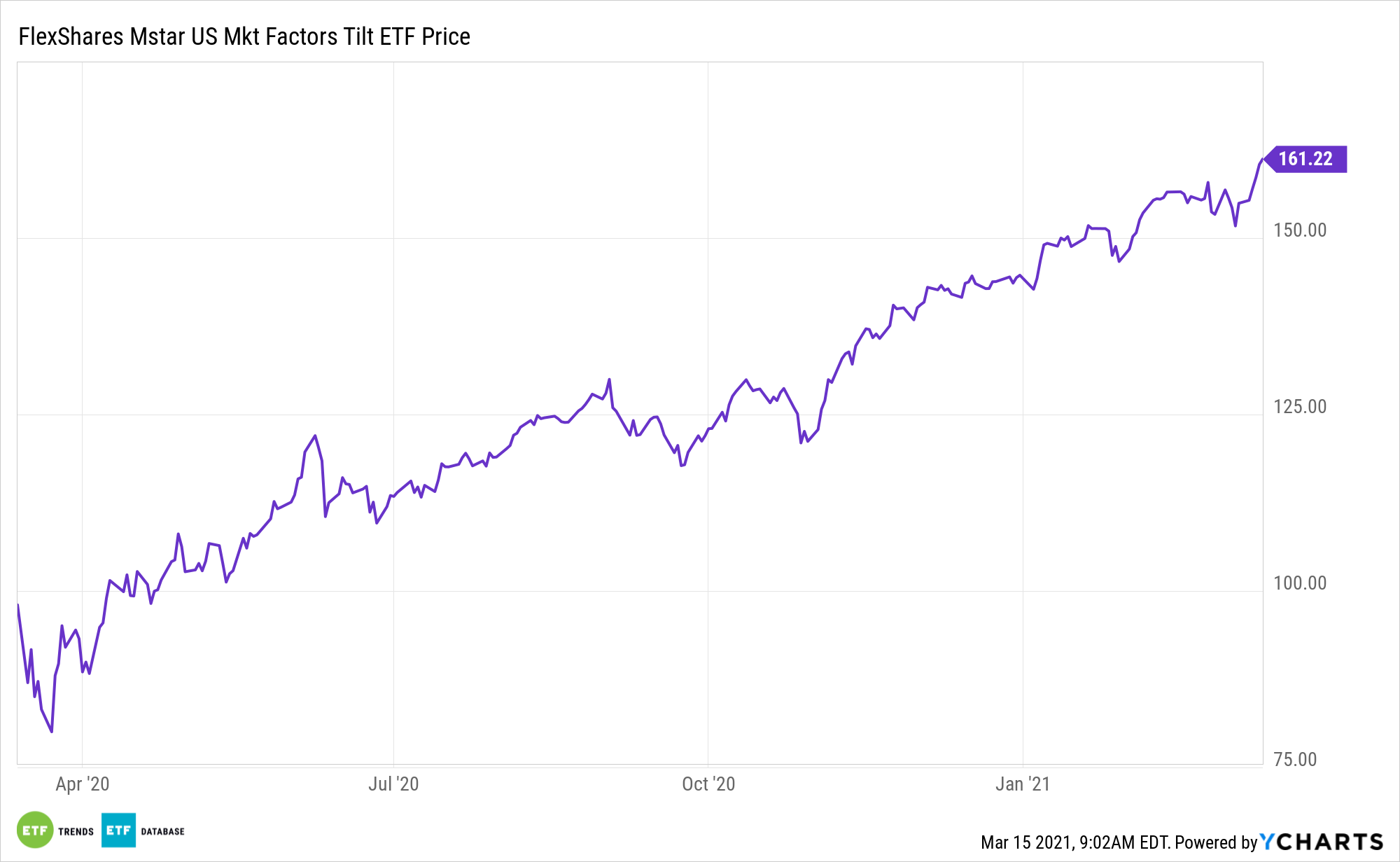

The value factor is roaring back to life. Investors can capitalize on that trend without being fully allocated to said stocks with the FlexShares Morningstar U.S. Market Factor Tilt Index Fund (NYSEArca: TILT).

TILT tries to reflect the performance of the Morningstar U.S. Market Factor Tilt Index, which provides enhanced exposure to U.S. equities by tilting the portfolio toward long-term growth potential of small cap and value stocks.

“The recent rotation into value has caused some long-dormant stocks and sectors to wake up, but not every value play is getting enough attention, according to Bank of America,” reports Jesse Pound for CNBC. “Cyclical sectors, such as energy stocks, are having one of their best stretches in years, and value fund managers are seeing major returns. However, the firm said in a note that investors may want to look at stocks that haven’t seen a surge of interest.”

A Sound Way to Play the Value Rebound

Making TILT appealing for some investors is that it doesn’t sacrifice growth exposure like many traditional value ETFs do. That goes a long way toward explaining why the fund has topped standard value benchmarks over the past several years.

Value stocks usually trade at lower prices relative to fundamental measures of value, like earnings and the book value of assets. On the other hand, growth-oriented stocks tend to run at higher valuations since investors expect rapid growth in those company measures. Many investors are growing wary of high valuations in growth stocks.

Value-related ETFs are on pace for their best-ever quarter for new inflows, and are just $5 billion shy from overtaking their growth factor counterparts in assets.

These strategies focus on stocks that are more sensitive to the business cycle. In comparison, growth trades are tied to companies capable of providing reliable profits over the long-term.

Importantly, TILT allocates 16.42% of its weight to financial services sectors, one of this year’s best-performing sectors.

“Bank stocks have been some of the best performers since late last year, but some financial stocks still appear cheap,” adds CNBC.

For more on multi-asset strategies, visit our Multi-Asset Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.