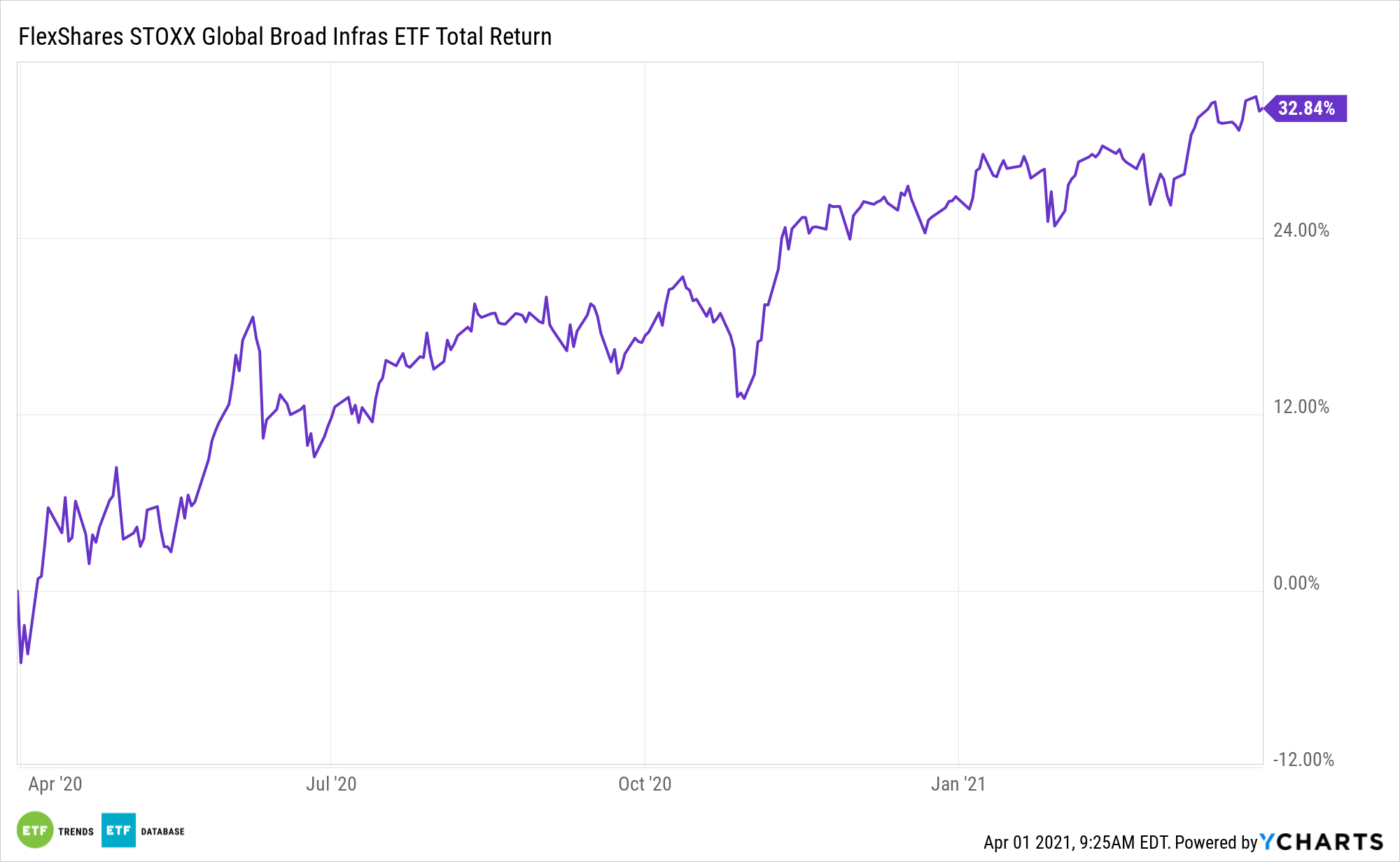

Infrastructure tends to be a political buzzword. Yet in today’s climate, it’s also a valid thesis for investors to consider. Infrastructure exposure can be had with the FlexShares STOXX Global Broad Infrastructure Index Fund (NYSEArca: NFRA).

NFRA tries to reflect the performance of the STOXX Global Broad Infrastructure Index, which identifies equities that derive the majority of revenue from the infrastructure business, providing exposure to both traditional and non-traditional infrastructure sectors.

NFRA and other infrastructure funds are receiving renewed attention as President Biden looks to infrastructure to shore up the economy while unleashing his green energy agenda.

“Infrastructure often comes up in the context of political discussions. Politicians love to talk about our country’s crumbling infrastructure and the need to invest in it, but they’re frequently shy when it comes to actually ponying up the billions required,” notes Morningstar analyst Josh Charlson.

Assessing the NFRA Thesis

NFRA’s index focuses on long-lived assets in industries with very high barriers to entry, with at least 50% of their revenue from key sectors with a 3-month average daily trending volume of at least $1 million. The portfolio is weighted based on a free-float market cap with certain constraints to limit exposure in any one security, sub-sector, or country. The fund is rebalanced annually.

“The potential investment benefits of infrastructure, relative to other asset classes or sectors, derive from intrinsic properties of the underlying assets, which can include inelastic demand for certain services (such as energy or highway access), monopolistic position in a market (such as an airport), regulated prices, stable revenues, and long duration,” adds Charlson. “Such traits (this isn’t a comprehensive list) in turn lead to some potentially desirable investment characteristics.”

Infrastructure exposure can also help protect against long-term inflationary risks since most infrastructure operators pass through the cost increases of inflation to users through the long-term contracts that typically underpin the infrastructure business models.

“While infrastructure would likely not contribute excessive risk relative to equities (from which it makes most sense to be funded), at the same time it won’t provide much of a diversification benefit, based on the historical data,” finishes Charlson. “Investors should also consider how such an investment would affect their foreign/domestic and sector exposures, as infrastructure funds tend to have a heavy international component and load up in the industrials and utilities sectors.”

For more on multi-asset strategies, visit our Multi-Asset Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.