The battered mortgage real estate investment trust sector and related ETFs were leading the charge on Wednesday as stimulus bets gain momentum.

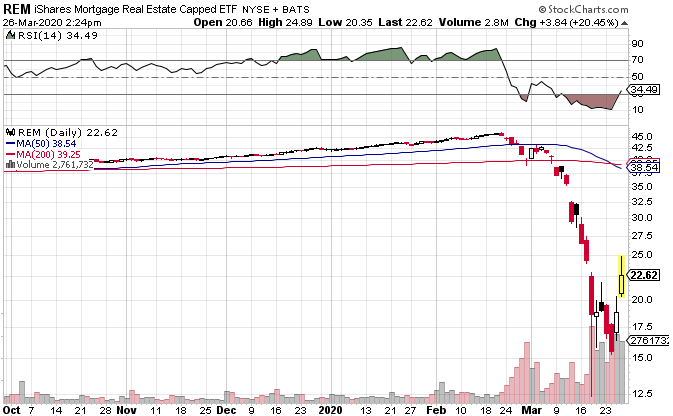

Among the best performing non-leveraged ETFs of Wednesday, the iShares Mortgage Real Estate ETF (NYSEArca: REM) surged 20.5% and the rival VanEck Vectors Mortgage REIT Income ETF (NYSEArca: MORT) jumped 21.5%.

Mortgage REITs were rallying along with the rebound in equity markets and hope the government stimulus efforts would ease emergency funding concerns, Reuters reports.

This relief rally comes after mortgage REITs were forced to sell assets to meet margin calls on loans used to finance positions.

The U.S. Federal Reserve earlier revealed a broad stimulus plan including purchases of government-guaranteed mortgages, but it does not cover non-agency mortgages that have no government guarantees. Consequently, mortgage REITs faced funding gaps as they are exposed to both types of loans.

Keefe, Bruyette & Woods analyst Eric Hagen calculated publicly traded mortgage REITs had aggregate assets of $400 billion to $450 billion as of 2019, and about $300 billion were government-backed mortgages with $125 billion related to credit-sensitive securities and loans not backed by the government.

Mortgage REIT investors are now looking more optimistic as the U.S. Congress works toward a vote on a $2 trillion stimulus package aimed at bolstering businesses and households after the coronavirus pandemic halted the economic activity.

Government Support

While mortgage REITs don’t benefit directly from the stimulus package, the government’s help will still support cash-strapped consumers or businesses that pay rent, which would enable landlords to make mortgage payments and in turn strengthen the REITs’ sector cash flow and share prices, according to Gina Szymanski, portfolio manager at AEW Capital Management.

“A ‘pause’ may be needed so other landlords can defer interest payments if tenants can’t pay rent, especially with a wave of mortgages maturating,” Morgan Stanley equity analyst Ricard Hill said in a research note.

Hagen also pointed out that mortgage REITs were helped by the Fed’s liquidity injection into government-guaranteed mortgage-backed securities.

“A week ago mortgage spreads were a lot wider. There was a lot less liquidity in that market,” Hagen told Reuters. “The fact that’s come under more control is positive.”

“Liquidity positions are becoming more healthy for these stocks. That’s positive,” he added, while still urging caution.

iShares Mortgage Real Estate ETF

For more information on real estate investment trusts, visit our REITs category.