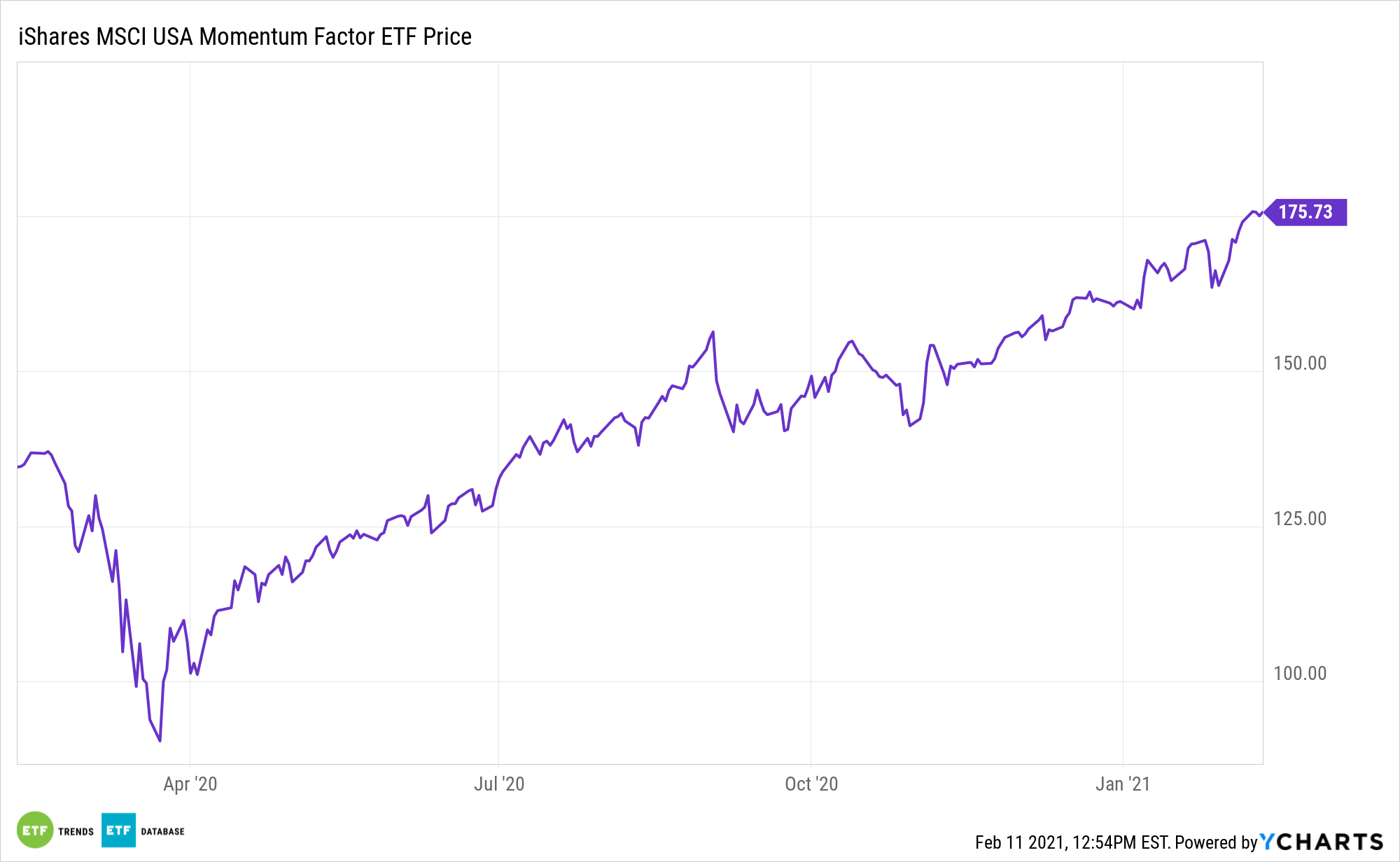

The momentum factor remains compelling, but investors should be selective when embracing it. One way to do so is through the iShares Edge MSCI USA Momentum Factor ETF (CBOE: MTUM).

MTUM seeks to track the investment results of the MSCI USA Momentum Index, which consists of stocks exhibiting relatively higher momentum characteristics than the traditional market capitalization-weighted parent index, the MSCI USA Index, which includes U.S. large- and mid-capitalization stocks.

Momentum tends to be negatively correlated to factors like size and value since momentum identifies securities that are trending upwards. These stocks tend to reflect successful companies with positive trends that become bigger and bigger. Consequently, investors can also enjoy the diversification benefits of adding momentum strategies to small cap and value-heavy portfolios.

“Momentum strategies perform well when markets persistently trend in one direction, allowing past performance to forecast near-term future performance,” writes Morningstar analyst Daniel Sotiroff. “The most widely accepted reason for this anomaly rests with investor behavior. Market participants likely digest new information more slowly than they should, causing a trend to develop as they incorporate that information into market prices. And that trend can persist after a stock’s price reaches its intrinsic value.”

Understanding Momentum with the MTUM ETF

Momentum investing is rooted in the notion that securities that are on torrid paces will continue acting that way over the near-term, while laggards will continue slumping. Long-term data for the momentum factor are compelling, but the factor can be volatile.

Momentum—once it picks up, it can be difficult to stop and while the debate in the capital markets is whether value can sustain its lead overgrowth, investors can’t forget about the momentum factor, especially if events like a coronavirus easing stir a rally for riskier assets.

“Along that line of reasoning, momentum strategies perform poorly when past information no longer serves as an accurate predictor of near-term future performance, which typically occurs when the market changes direction or market volatility spikes. This doesn’t happen often, but the effect can be profound when it does,” adds Sotiroff.

Fortunately, MTUM’s methodology mitigates some of the sting associated with momentum investing risks.

“MTUM uses this type of adjustment, dividing each stock’s price momentum by its trailing three-year volatility. It also has the freedom to perform a conditional rebalance when the market’s volatility reaches extreme levels. That allows MTUM to rebuild its portfolio using recent information that is more relevant to current market conditions,” adds Sotirorff.

Morningstar maintains a ‘silver’ rating on the iShares fund.

For more on multi-asset strategies, visit our Multi-Asset Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.