Congress is currently working to pass the $1 billion bipartisan infrastructure bill and the $3.5 trillion reconciliation bill, which would include climate-related investments to help curb emissions and other global warming-related actions. The bills come at a time when the American population has shifted its views on global warming, particularly after a summer that saw droughts, hurricanes, flash floods, and other global warming-related weather patterns wreaking havoc.

A survey just released by the Yale Program on Climate Change Communication found that in the last six months, Americans’ attitudes towards global warming have increasingly changed. The belief that global warming is happening has increased 6% since March, with the number of Americans who believe that we are currently experiencing global warming outnumbering those who don’t in a six to one ratio.

The overall threat of global warming is one that is being taken much more seriously by the American populace; fully 70% of Americans reported being either very or somewhat worried about global warming, with the percentage of people “very worried” increasing ten more points since March. These are record numbers all around.

For the very first time, the majority of Americans now believe that global warming is happening right now and that they are being harmed by it.

The survey was carried out in September of this year and carries a margin of error of +/- three percentage points and directly reflects the realities of a harsh summer driving home the threats of global warming to the American population — and the world.

FlexShares Offers Climate Conscious Investment Options

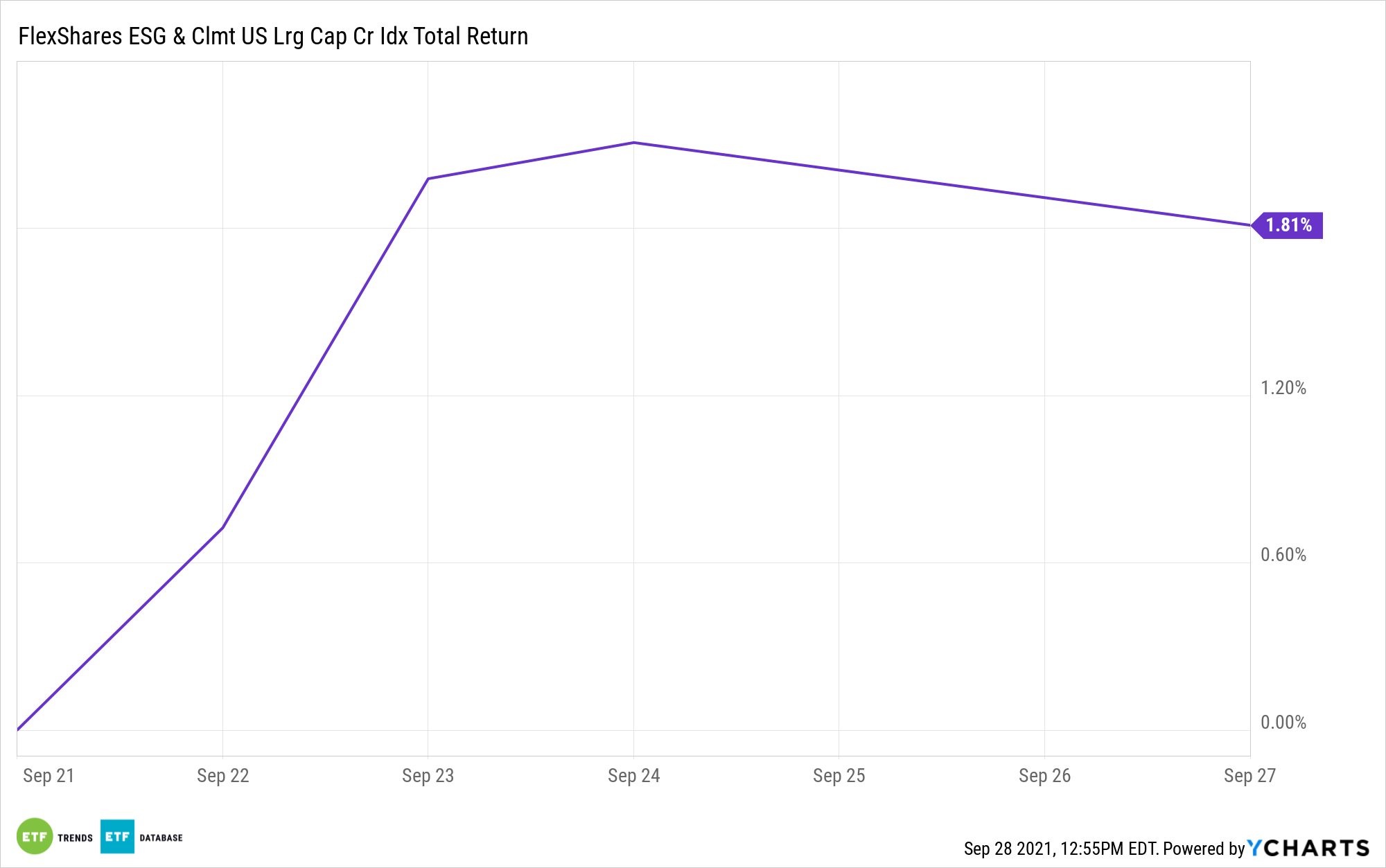

For investors that are looking for exposure to large-caps but through the lens of ESG, the FlexShares ESG & Climate US Large Cap Core Index Fund (FEUS) offers just that.

The fund tracks the Northern Trust ESG & Climate US Large Cap Core Index, which seeks broad-market, core exposure to large-cap companies that exhibit certain ESG qualities. The index pulls from the 600 largest companies in the Northern Trust 1250 Index, measured by their float adjusted market cap.

The index utilizes the Northern Trust ESG Vector Score, which ranks companies based on their material ESG metrics, defined by the Sustainability Accounting Standards Board (SASB). These metrics are broken down into five categories: environmental, social capital, human capital, nosiness model and innovation, and leadership and governance. Companies are then ranked based on those ESG metrics compared to their peers and are evaluated by the Task Force on Climate-Related Financial Disclosure that also looks at governance, strategy, and risk management. Collectively, all of this accounts for 80% of the ESG Vector Score.

The remaining 20% of the ESG Vector Score comes from a corporate governance score that evaluates the following: board and management quality and integrity, board structure, ownership and shareholder rights, remuneration, financial reporting, and stakeholder governance.

The index provider also obtains data from the Institutional Shareholder Services ESG Solutions to measure carbon emissions intensity, reserves, and risk rating for each company.

The index provider screens for and excludes companies that are involved in verified infringement of established international initiatives and guidelines (including the United Nations Global Compact Principles and Organisation for Economic Co-operation and Development Guidelines for Multinational Entities), that are involved in the production of tobacco, and that manufacture controversial weapons. Exclusions also include companies that make more than 5% in revenue from manufacturing civilian firearms, providing support services through military contracting, thermal coal extraction, coal-fired energy generation, or the retail sale of tobacco and related products or services.

Each reconstitution of the underlying index seeks to weight securities that increase the aggregate ESG Vector Score, reduce aggregate carbon emissions and reserves, and improve the aggregate risk rating of the securities in the index.

The top sector breakdown for FEUS is information technology at 28.8%, healthcare at 12.90%, consumer discretionary at 12.11%, financials at 11.44%, and communication services at 11.28%, among others.

FEUS has an expense ratio of 0.09%.

For more news, information, and strategy, visit the Multi-Asset Channel.