Interest rates reside near historic lows, but short-term fixed income instruments still play roles in balanced bond portfolios. The FlexShares Ready Access Variable Income Fund (RAVI) offers that balance with a steady income stream.

RAVI primarily invests in investment-grade debt securities with a heavy tilt toward U.S. corporate bonds. According to the fund prospectus, the ETF may also invest, without limitation, in fixed-income securities and instruments of foreign issuers in developed and emerging markets, including debt securities of foreign governments, and may invest more than 25% of its total assets in securities and instruments of issuers in a single developed market country. RAVI can hold up to 20% of its total assets in fixed-income securities and instruments of issuers in emerging markets.

The fund is a relevant consideration as money market regulations have shifted following the global financial crisis.

“However, with these added protections came tradeoffs. Prior to the GFC, investors could potentially receive overnight liquidity, a stable dollar NAV, and a competitive return from money market funds,” notes Jehan Mady. “While the new SEC rules offer greater protection of asset value and overnight liquidity, these protections can come at the expense of higher income.”

RAVI: A Stellar Tool for a Low Rate Environment

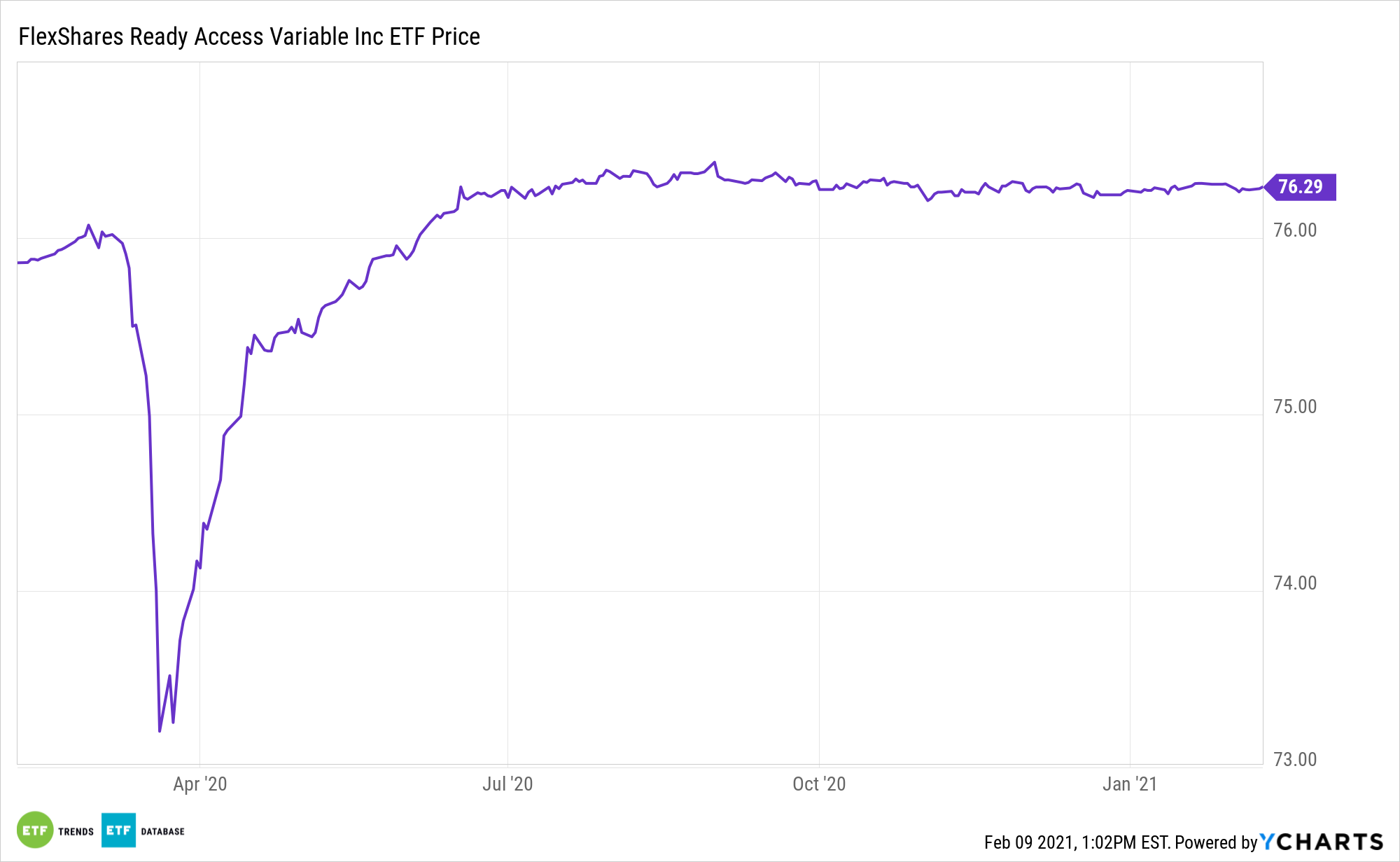

RAVI may be something for investors looking for a little more yield than what’s currently offered by money market funds, but don’t want to move too far out of the short-duration end of the yield curve. Additionally, RAVI’s recent performance has been solid.

The ETF seeks maximum current income consistent with the preservation of capital and liquidity. The fund seeks to achieve its investment objective by investing at least 80% of its total assets in a non-diversified portfolio of fixed-income instruments, including bonds, debt securities, and other similar instruments issued by U.S. and non-U.S. public and private sector entities.

The dollar-weighted average portfolio maturity of the fund is normally not expected to exceed two years. It may invest up to 20% of its total assets in fixed-income securities and instruments of issuers in emerging markets.

“At FlexShares, we believe these rules mean investors will increasingly have to choose between capital preservation and the potential for higher income. And in today’s ZIRP environment, investors who can tolerate some level of price volatility might look to their liquidity holdings as a potential source of income,” notes Mady. “We describe this concept of prioritizing income over capital preservation in liquidity holdings as ‘investing liquidity’. This concept was behind the development of our FlexShares Ready Access Variable Income Fund (RAVI), which is an ETF designed to offer investors a short-term vehicle with strong return potential while maintaining liquidity. And with the current ZIRP environment and uncertainty around the future direction of global markets, RAVI can be a solution for investors seeking current income consistent with the preservation of capital and liquidity.”

For more on multi-asset strategies, visit our Multi-Asset Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.