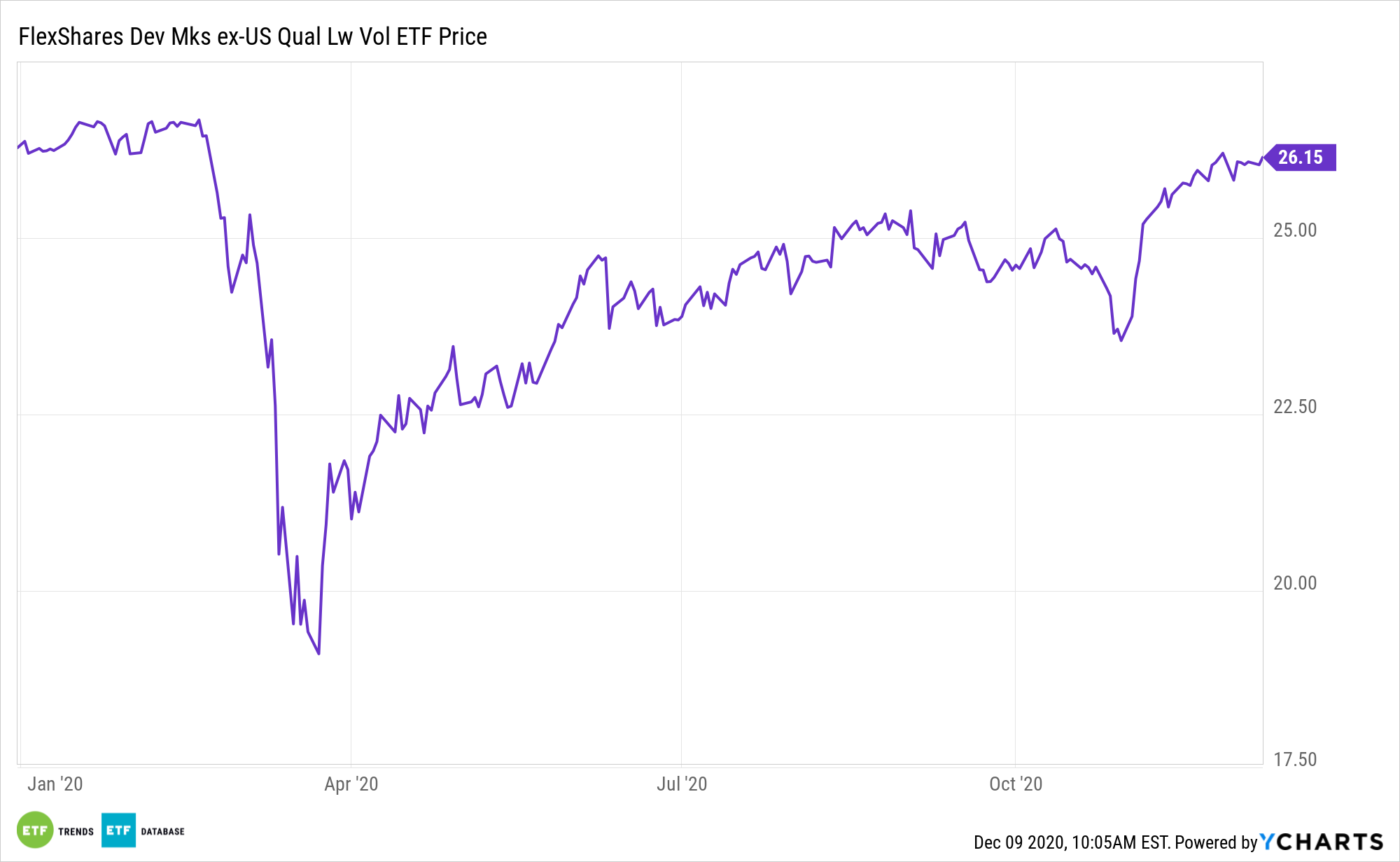

One of the more notable equity market rebounds taking place right now is in Japan, spotlighting opportunity with exchange traded funds like the FlexShares Developed Markets ex-US Quality Low Volatility Index Fund (NYSE: QLVD).

QLVD’s quality screen analyzes a broad universe of equities based on key indicators such as profitability, management efficiency, and cash flow, and then excludes the bottom 20% of stocks with the lowest quality score. The index is then subject to the regional, sector, and risk-factor constraints, in order to manage unintended style factor exposures, significant sector concentration, and high turnover.

As its name implies, QLVD is a diversified fund, not a dedicated Japan product. But combine geographic diversification with more-than-adequate Japanese exposure, and QLVD is a relevant consideration today.

“The Nikkei 225 index is now outperforming the S&P 500 for the year to date in dollar terms by around 4 percentage points. International investors don’t seem to have particularly noticed,” reports Mike Bird for Wall Street Journal. “The entire surge in international purchases of Japanese equities recorded from late 2012 to mid-2015, totaling around $240 billion, has melted away in the subsequent years. And foreigners have again sold more Japanese stocks than they bought this year.”

Japanese Fundamentals Are Strong

Japan does show some solid fundamentals. Specifically, the weaker yen, strong corporate fundamentals, bargain valuations, and central bank buying are all positives. Furthermore, Japan’s political temperature is relatively stable. Further still, stocks in the world’s third-largest economy are inexpensive relative to their U.S. counterparts, bolstering the near-term case for QLVD.

“The recovery story that most analysts and investors seem prepared for would be good news for Japanese stocks,” according to the Journal. “Analysts at BCA Research note that almost 40% of the MSCI Japan is made up of industrial and consumer discretionary stocks, compared with more like 20% in the U.S. The index has a price-to-earnings ratio of a little over 18, compared with a little below 24 for the U.S., and is more cheaply valued even on a sector-by-sector basis.”

QLVD offers other benefits, including access to strong balance sheets in Japan.

Ex-U.S. developed market dividend payers often feature larger yields than their U.S. counterparts, an assertion proven by comparing large- and mega-cap dividend stocks from familiar dividend sectors such as consumer staples, energy, financial services, and telecommunications. QLVD’s Japan exposure could prove beneficial to investors in a volatile dividend environment. As a low-yield nation, Japan has the capacity to drive dividend growth.

For more on multi-asset strategies, visit our Multi-Asset Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.