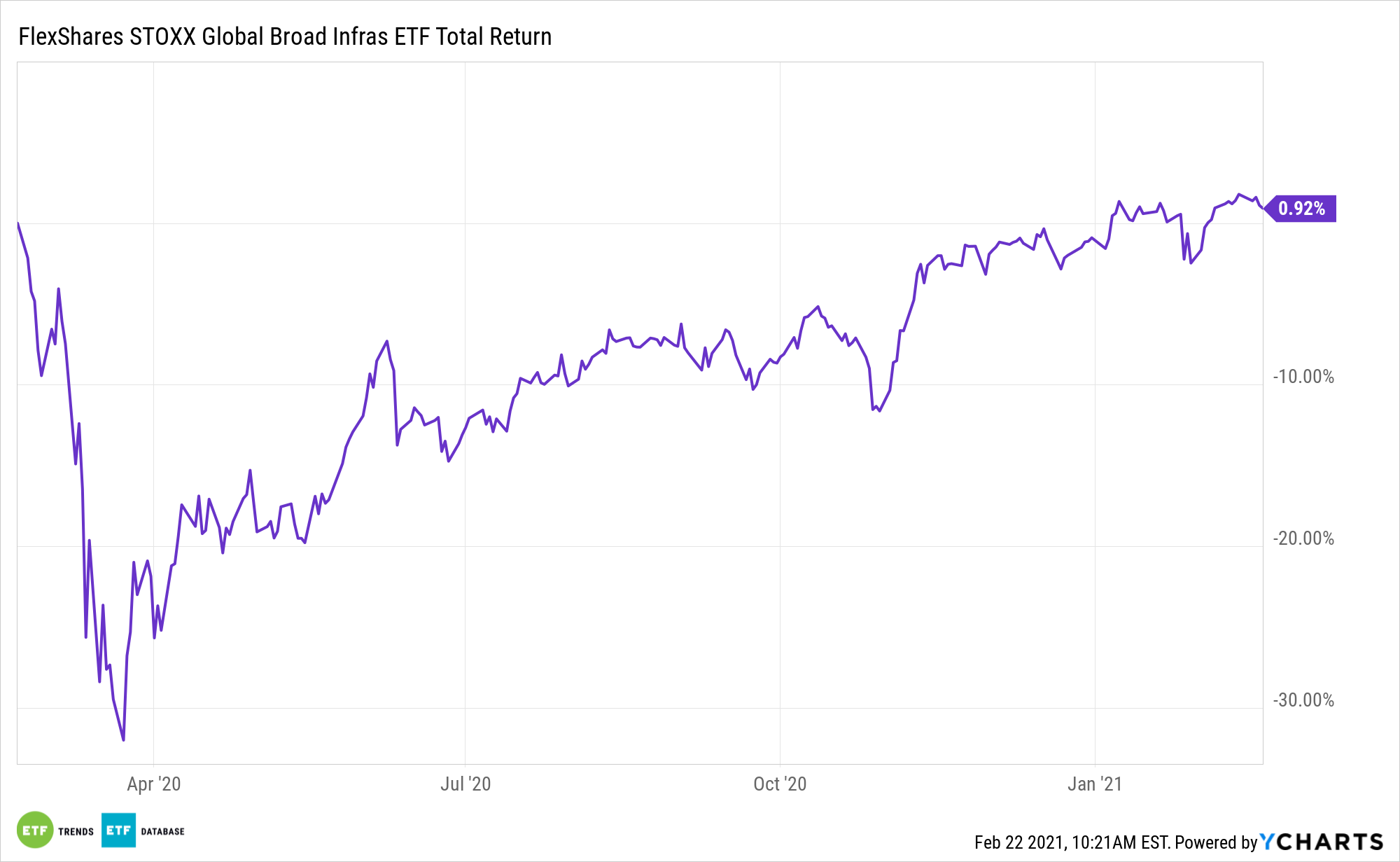

The 2020 election season is a thing of the past, but that doesn’t damage the case for infrastructure assets such as the FlexShares STOXX Global Broad Infrastructure Index Fund (NYSEArca: NFRA).

NFRA tries to reflect the performance of the STOXX Global Broad Infrastructure Index, which identifies equities that derive the majority of revenue from infrastructure business, providing exposure to both traditional and non-traditional infrastructure sectors. Investors considering NFRA or any other infrastructure asset are betting this time will be different when it comes to policy execution under President Biden.

Chris Huemmer, a senior investment strategist at FlexShares, sees infrastructure as an asset class poised to benefit this year.

“From infrastructure, we are seeing more people looking at this as a distinct asset class. We have been an advocate for years now, and it has paid off in our own asset allocation models,” Huemmer said in an interview with Business Insider.

No Elections? No Problem for NFRA

NFRA’s index focuses on long-lived assets in industries with very high barriers to entry, with at least 50% of their revenue from key sectors with a 3-month average daily trending volume of at least $1 million. The portfolio is weighted based on a free-float market cap with certain constraints to limit exposure in any one security, sub-sector, or country. The fund is rebalanced annually.

Huemmer “highlighted that energy infrastructure, just like transportation and electricity are, in fact, key components of the infrastructure complex, but there is much more to it today. He argued that communication technology has been just as mission critical as water, waste management and energy utilities this past year, given the structural shifts brought about by the pandemic,” adds Business Insider.

Investors should consider infrastructure sector-specific exchange traded funds after President Joe Biden laid out plans to upgrade aging U.S. infrastructure.

The White House stated that the administration’s is looking to build “sustainable infrastructure that will withstand the impacts of climate change and fuel an American clean energy revolution.”

Transportation Secretary Pete Buttigieg previously said the U.S. government needs to rebuild the transportation sector in this post-pandemic environment.

The funding has been a major sticking point, after Congress ceased using fuel tax revenue to pay for infrastructure repairs.

For more on multi-asset strategies, visit our Multi-Asset Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.