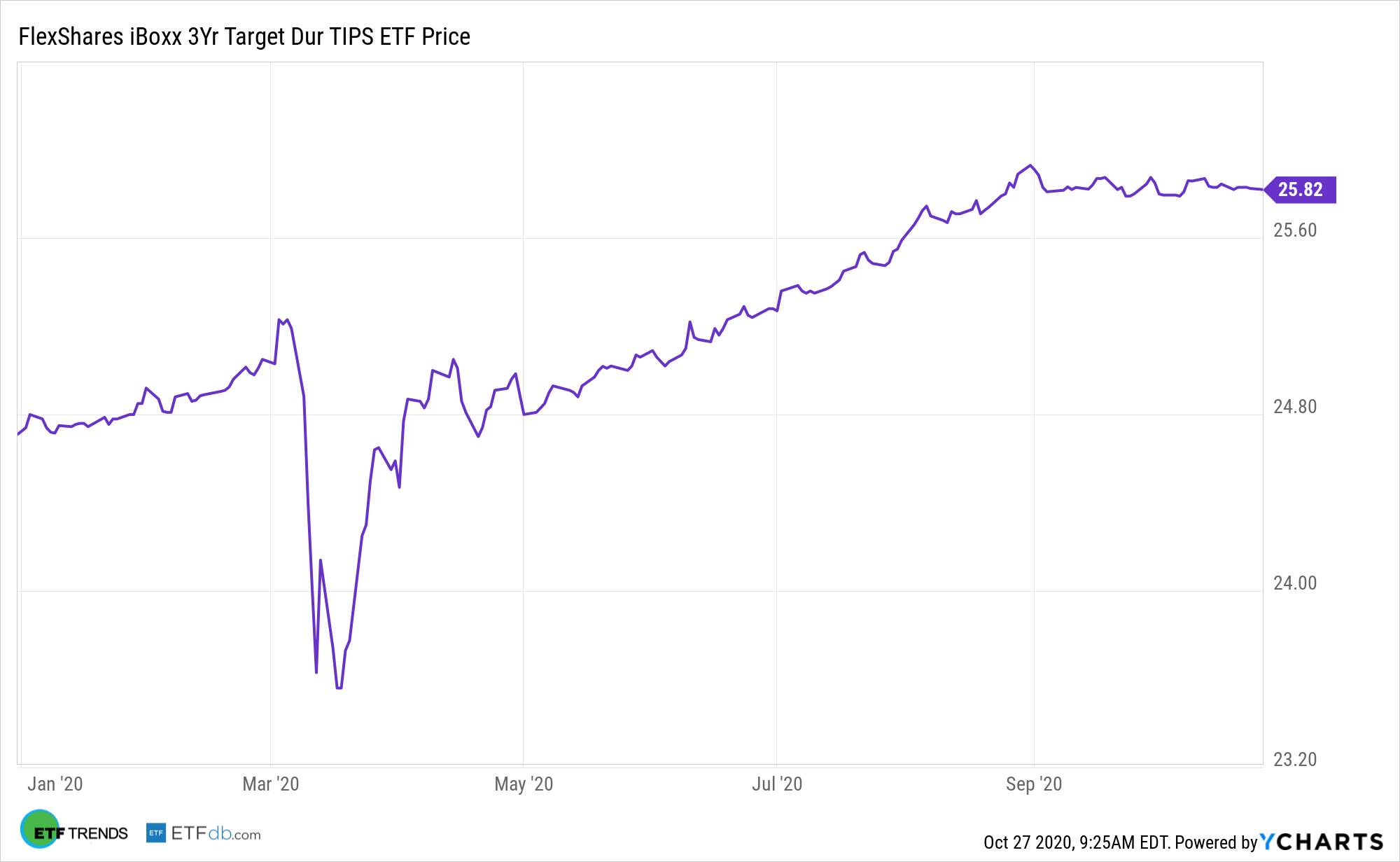

Inflation data remains benign, but exchange traded funds like the FlexShares iBoxx 3-Year Target Duration TIPS Index Fund (NYSEArca: TDTT) could be ready to shine with consumer prices increases, according to some market observers.

While inflation expectations may remain muted now, investors are already looking into TIPS as a hedge against rising prices ahead. TIPS returns are affected by interest-rate risk as well as changes in the principal value when the Consumer Price Index moves. TIPS will adjust their principal value upward in response to a higher CPI, but the reverse occurs during periods of deflation.

Inflation fears have crept back into the capital markets, according to global investment firm Goldman Sachs. A recent Reuters article noted that a confluence of other factors like a weaker dollar and rising demand for commodities could accompany inflation.

“The monetary-fiscal policy revolution may also place greater political constraints on the Fed’s ability to lean against inflation. We see the prospects of a unified Democratic government accelerating the market pricing of these dynamics,” said BlackRock in a recent note.

TIPS for the ‘Scourge of Inflation’

TDTT would be particularly useful in an environment where inflation data exceeds forecasts, meaning investors should monitor the breakeven inflation rate.

Treasury Inflation-Protected Securities (TIPS) are popular among fixed-income investors looking to protect against the scourge of inflation and ETFs make it easier to access TIPS.

Investors will typically look at TIPS ahead of an inflationary period since buying TIPS after inflation has gone up means that the security has already priced in the inflation and investors would likely be overpaying for the TIPS exposure.

Investors now argue that the Federal Reserve’s rate cuts this year have bolstered the outlook on inflation, with some even contending that inflation may rise fast enough to force the Fed to hike rates.

“Breakeven inflation rates, a market-based measure of expected inflation, have rallied since March. See the green line in the chart. We see inflation-adjusted, or real yields, falling further, supporting prices of Treasury Inflation-Protected Securities (TIPS),” according to BlackRock.

For more on multi-asset strategies, please visit our Multi-Asset Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.