When it comes to fighting inflation, many investors turn to Treasury inflation protection securities (TIPS). When it comes to commodities exposure, many investors opt for futures-based strategies.

Others still can reconsider that line of thinking and opt for equity-based fare with the FlexShares Morningstar Global Upstream Natural Resource Index Fund (NYSEArca: GUNR).

GUNR provides exposure to the rising demand for natural resources and tracks global companies in the energy, metals, and agriculture sectors. It maintains a core exposure to the timberlands and water resources sectors, part of its risk management theme.

“We believe an equity-based approach to natural resources may be a good alternative way to gain commodity exposure versus a futures-based approach,” said FlexShares. “Historically speaking, it has materially and persistently outperformed a futures-based approach.”

Gunning for ‘GUNR’?

An array of factors make GUNR a compelling industry allocation in the current environment.

“Driving this outperformance was the equity market exposure, but commodity prices still played a large part in the return expectation. The modest growth environment during the time frame — combined with OPEC-controlled supply — which steadily removed the oil glut of the prior decade also played a role. We believe that the continued rise of the Emerging market middle class should support commodity demand more broadly in the years ahead,” adds FlexShares.

GUNR specifically identifies upstream natural resources equities based on a Morningstar industry classification system, with a balanced exposure to three traditional natural resource sectors, including agriculture, energy, and metals. With some wild moves in downtrodden energy stocks, the gambling element of energy investing is back, but investors can take some risk out of the equation with GUNR.

The ETF “is designed to give investors exposure to global equity securities with an emphasis on the ‘upstream’ portion – referring to the very beginning of the supply chain where the resources are ‘in the ground.’ It is a focused, convenient way for investors seeking to potentially capture the favorable growth and price impacts of the global demand for natural resources,” concludes FlexShares.

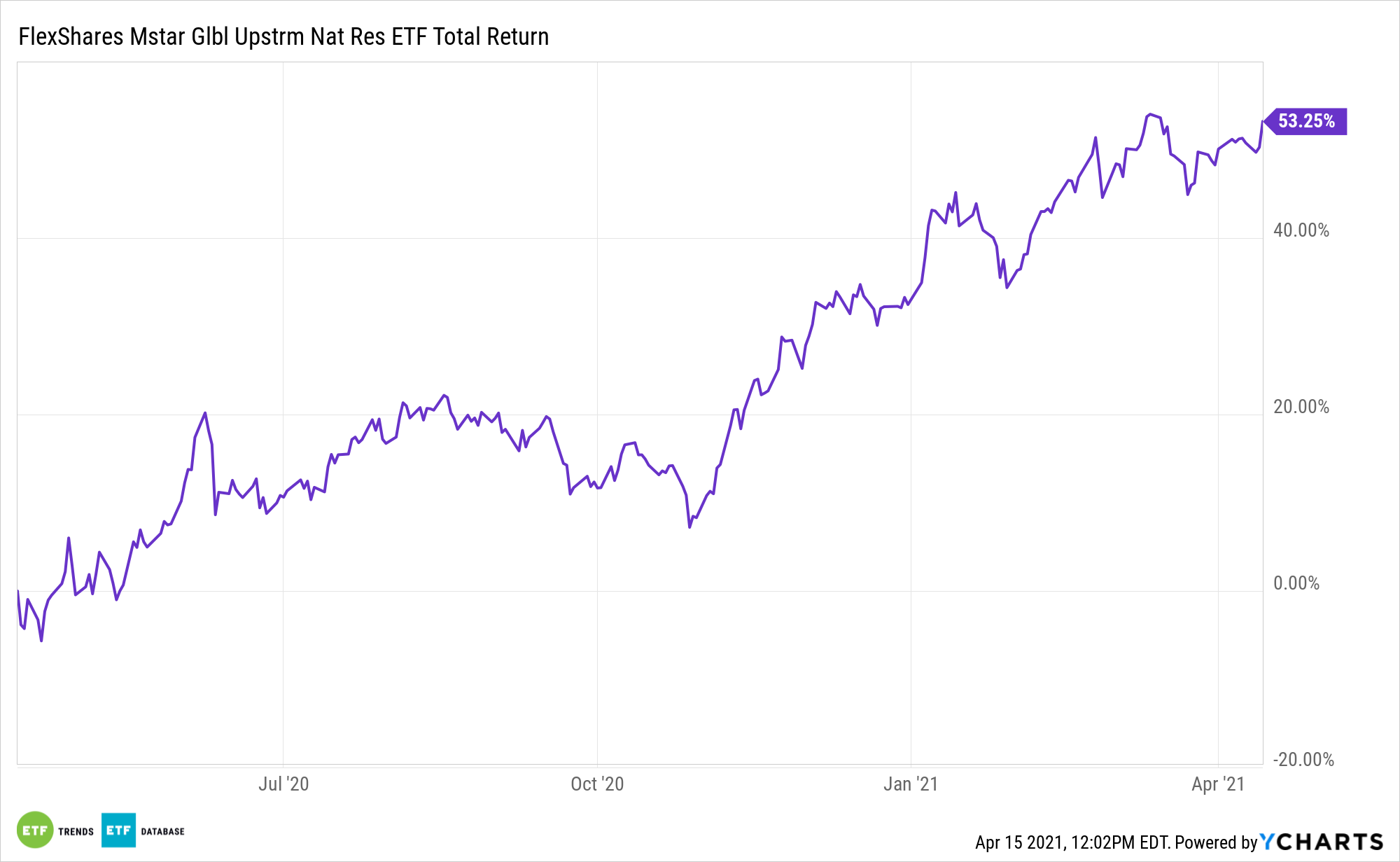

GUNR yields 2.56% and is higher by 16% year-to-date.

For more on multi-asset strategies, please visit our Multi-Asset Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.