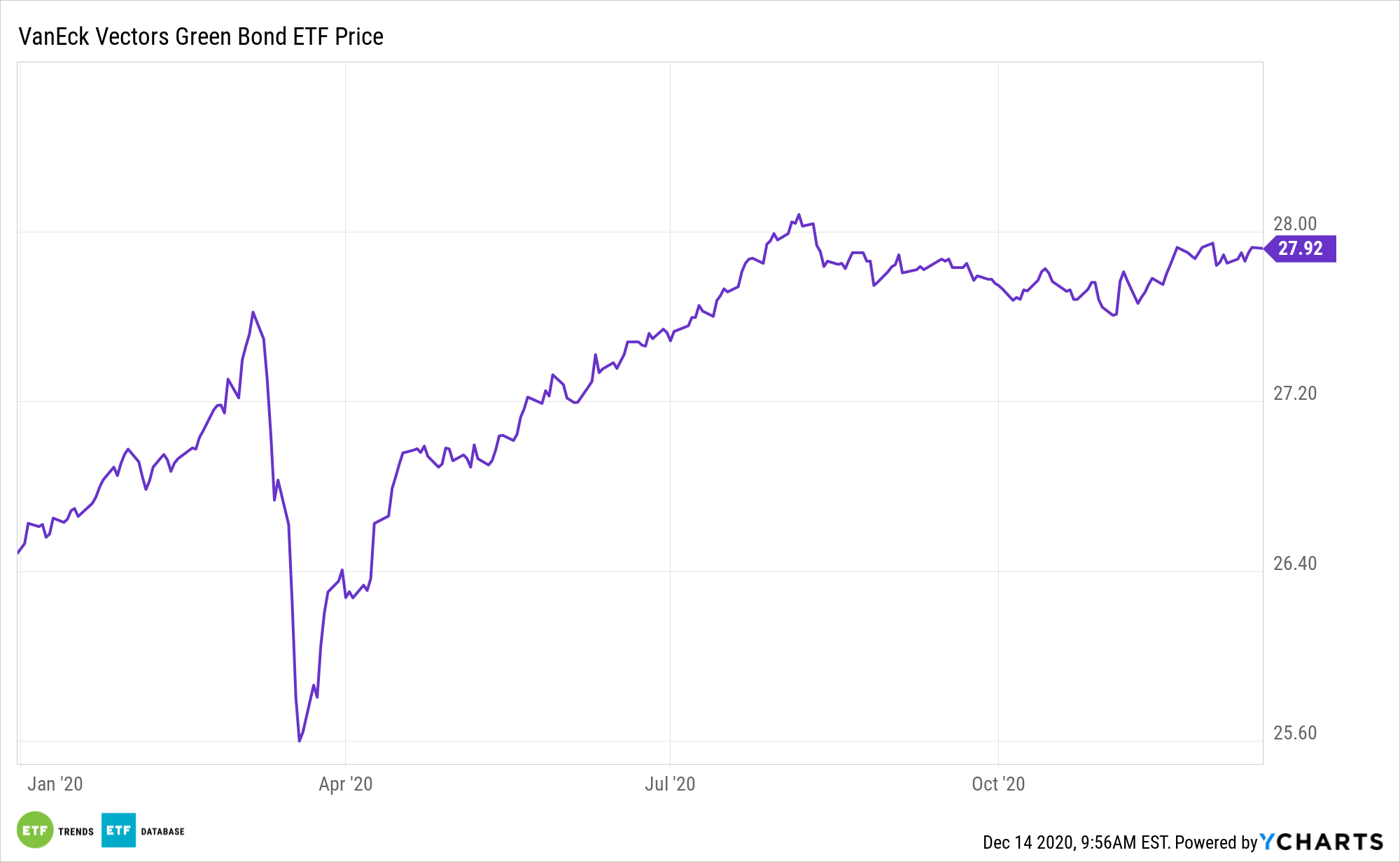

An array of asset classes will benefit from the incoming Biden/Harris Administration. Not to be lost in the shuffle are green bonds and the VanEck Vectors Green Bond ETF (NYSEArca: GRNB).

GRNB tracks the S&P Green Bond Select Index, which is “comprised of labeled green bonds that are issued to finance environmentally friendly projects, and includes bonds issued by the supranational, government, and corporate issuers globally in multiple currencies,” according to VanEck.

Green bonds are debt securities issued to finance projects that promote climate change mitigation or the adaptation of other environmental sustainability purposes. The new breed of green bonds has gained momentum in the global market ever since the European Investment Bank issued the first green bond in 2007. With a new president soon to be inaugurated, plenty of eyes are turning to the U.S. green bond market.

“U.S. green bond market is far from where it should be based on the size of its bond market, and even further from where it needs to be to finance a transition to a low carbon economy,” writes William Sokol, senior ETF product manager at VanEck. “There is hope that President-elect Biden’s administration could help spur U.S. green finance and investment, including green bonds.”

The Demand for Green Bonds Is Heating Up

GRNB features a mix of corporate and sovereign debt and plenty of ex-US diversification, all of which are points to consider in the current environment.

Investors, including institutions, are clamoring for green bonds, a surefire sign that the space is growing and could continue to do so as more investors demand green initiatives in their investments. Private industries are also joining the fray, offering their own green bonds to address investors’ needs for environmentally friendly initiatives.

As just one example, Biden’s plan to bring the United States back into the Paris Climate Accord could be a boost for the U.S. green bond market.

“Biden has pledged to re-enter the Paris Agreement on day one of his presidency, which would open the door for increased global cooperation on climate plans and green finance,” notes Sokol. “The U.S. would join the European Union, China, Japan and South Korea in committing to aggressive emission reduction targets, and could take more of a leadership role in crafting global agreements going forward. Cooperation on global green finance standards—for example, by leveraging the planned E.U. green bond standards—could provide regulatory certainty to investors and issuers, and help to grow the U.S. green bond market.”

For more on multi-asset strategies, visit our Multi-Asset Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.